The retreat of the Trump trade was a contributing factor to the EURUSD rally in August. However, it was employed prematurely. The optimal time to make trading decisions amid the upcoming US presidential election will be in September. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The US economy accelerated in the second quarter to 3%.

- German inflation fell below 2% for the first time since 2021.

- Trading on the back of the US presidential election will strengthen demand for the US dollar.

- The EURUSD risks to return to 1.1 and 1.0945.

Monthly US dollar fundamental forecast

If the advantages become ineffective, it is necessary to retreat. The EURUSD exchange rate demonstrated a consistent upward trajectory throughout most of August, driven by investor concerns surrounding a potential economic slowdown in the US and the perception that the European Central Bank (ECB) would be highly reluctant to ease its monetary policy stance. As a result, the major currency pair showcased its best monthly performance since December, when the Fed made a dovish reversal. However, the US dollar may have already staged a comeback in September as it did in January.

The situation is not as unfavorable as it may appear. The second estimate of US GDP for the April-June period indicated a more rapid expansion of 3%, exceeding the initial estimate. The increase in consumer spending was not 2.3%, as previously estimated, but 2.9%. Thus, there is no recession in the US. In light of the robust economic performance, market expectations of a 100-basis-point monetary expansion by the Fed in 2024 appear to be unduly optimistic. At the same time, inflation may hit a new peak, and the Fed will have to raise the key rates following a rate cut.

Conversely, the initial decline in German inflation below the 2% target from 2021, coupled with the fragility of the German and eurozone economies, present optimal circumstances for the ECB to continue its monetary expansion cycle in September. This is particularly relevant given Chief Economist Philip Lane’s assertion that wage growth will decelerate considerably in 2025-2026, and the Spanish CPI declined to its lowest level in a year.

Inflation rate in Spain and Germany

Source: Bloomberg.

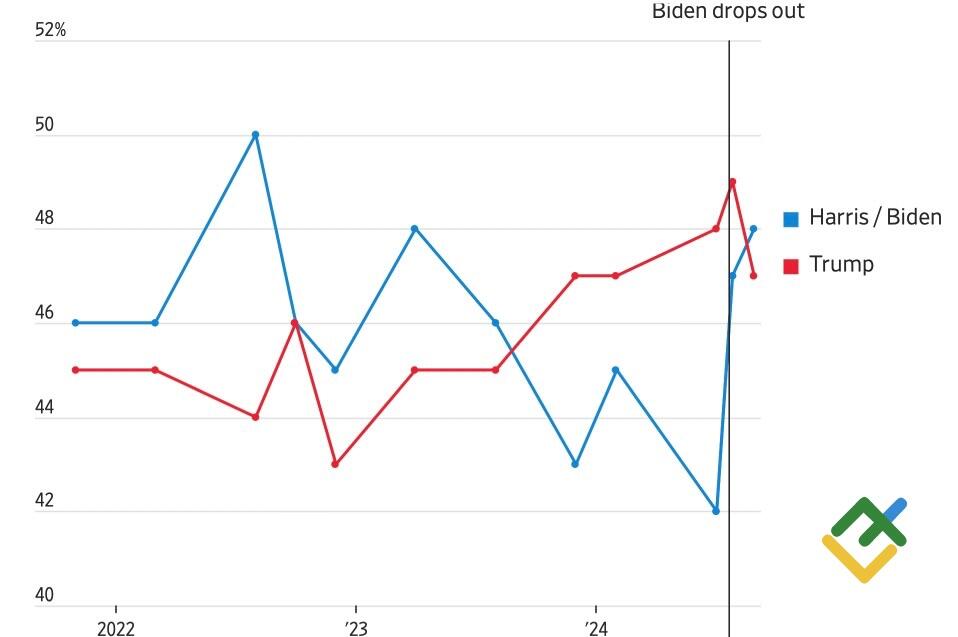

One of the key factors behind the EURUSD rally in August was the retreat of the Trump trade following Kamala Harris emerging as a prominent figure in the US political landscape, eclipsing Joe Biden. For the first time since last April, the Wall Street Journal polls have the Democratic candidate’s rating higher than that of the Republican candidate.

Ratings of presidential candidates

Source: Wall Street Journal.

Notably, every situation has a specific timeframe for optimal results. The Trump trade strategy was initiated prematurely due to the Republican Party’s evident advantage over the Democratic Party, particularly in light of the latter’s candidate, Joe Biden. According to Citigroup, the period when the US presidential election factor becomes tradable is September. Regardless of the outcome of the election, rising uncertainty will support the US dollar as a safe-haven currency.

The advantage that Kamala Harris holds over Donald Trump is minimal. In 2016, the Republican candidate also trailed behind Hillary Clinton in the polls yet ultimately emerged victorious. His pro-inflation and protectionist policies create the optimal conditions for the US dollar to appreciate. The implementation of this strategy will result in accelerated inflation in the US and a deceleration of global economic growth.

Monthly EURUSD trading plan

The evidence of a slowdown in the US economy and a sharp cooling of the labor market is inconclusive, and expectations of a Fed rate cut are overstated. The intensification of trading ahead of the US presidential election, combined with these factors, creates the necessary conditions for the EURUSD pair to continue to slump towards 1.1 and 1.0945. Therefore, one may keep their short trades formed at 1.118 open, initiating more during pullbacks.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.