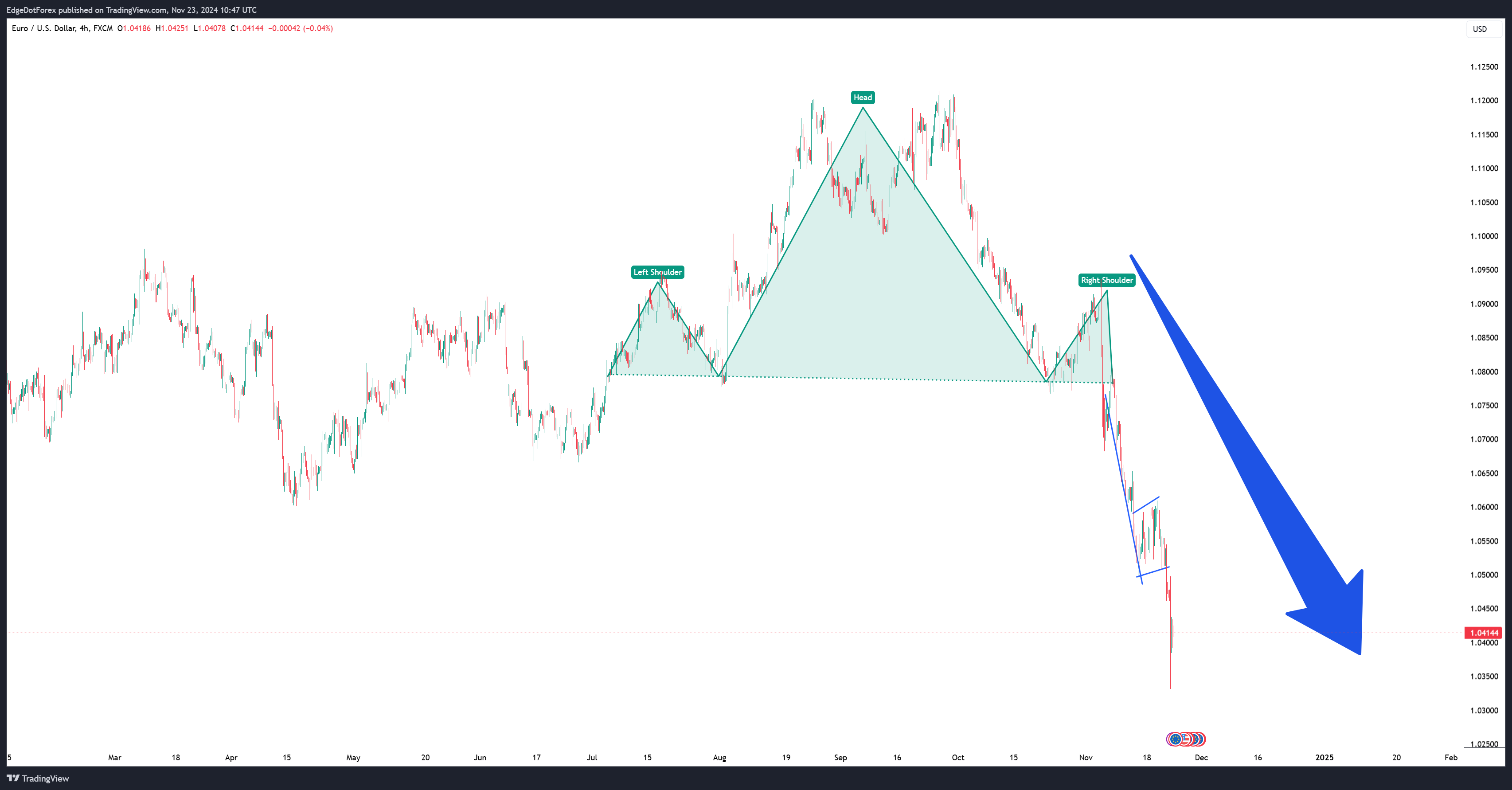

Financial experts from ING discussed the current state of the U.S. dollar, suggesting that it is undergoing a phase of bearish consolidation rather than a significant decline.

This observation comes after the dollar experienced a sharp 5% drop since the beginning of July. Market expectations have factored in 100 basis points of Federal Reserve rate cuts by the end of the year, with a terminal rate priced at 3.00%.

ING analysts believe that these expectations have set the stage for the dollar’s value to stabilize without substantial further decline or rally.

The dollar’s recent price action is being viewed as part of a broader downward trend, evidenced by the participation of typically lagging Asian currencies, including the Korean won.

Notably, the options market is currently showing a preference for Korean won call options, a trend not seen since 2007. This shift could be attributed to either investors rebalancing portfolios or Asian exporters engaging in overdue dollar hedging.

To see the dollar’s bear trend resume, ING suggests that more negative surprises in U.S. activity data would be necessary. However, the immediate economic calendar, highlighting revisions to second-quarter GDP and weekly initial claims, may not provide such catalysts. Initial claims have been consistently near the 235,000 mark, with broad job layoffs not yet materializing.

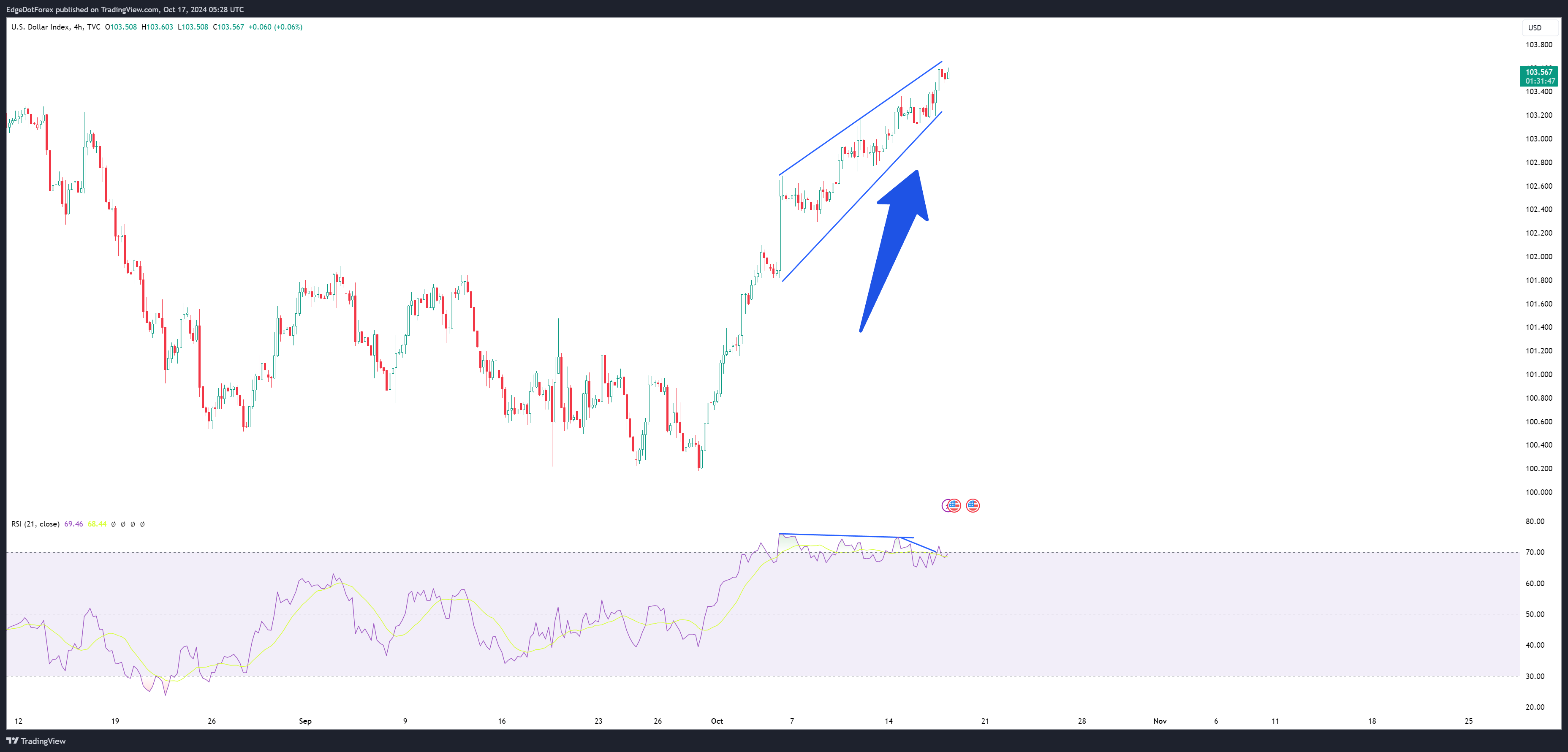

Federal Reserve Chair Jerome Powell’s recent speech indicated some concern over the rapid deterioration of the labor market, hinting at potential future increases in jobless claims. Despite this, ING expects the Dollar Index (DXY) to remain relatively stable within its current range. Analysts believe that only a move above the 101.60/65 threshold would indicate a shift beyond what is currently seen as bearish consolidation for the dollar.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

This post is originally published on INVESTING.