What could potentially impact the bullish outlook on gold? Could it be a robust US labor market in August or modest forecasts of the FOMC on the federal funds rate in September? Let’s discuss these factors and make a trading plan for the XAUUSD.

The article covers the following subjects:

Highlights and key points

- Gold hit record highs thanks to geopolitics.

- The precious metal’s rally potential is not exhausted due to the tailwind.

- The XAUUSD may decline on labor market statistics or Fed forecasts.

- The level of $2,515 per ounce is the line in the sand for the XAUUSD.

Weekly fundamental forecast for gold

Central banks are purchasing gold, and it is a sound investment strategy. Bank of America is making such an appeal to investors, and other financial institutions are following suit. Goldman Sachs predicted in April that the precious metal would reach $2,700 per ounce, while TD expects to see it in the coming months. Citigroup anticipates a figure of $3,000 by mid-2025, contingent on a significant capital inflow into gold exchange-traded funds. The question now is not where the XAUUSD is headed but whether there will be a pullback to buy the asset at a lower price.

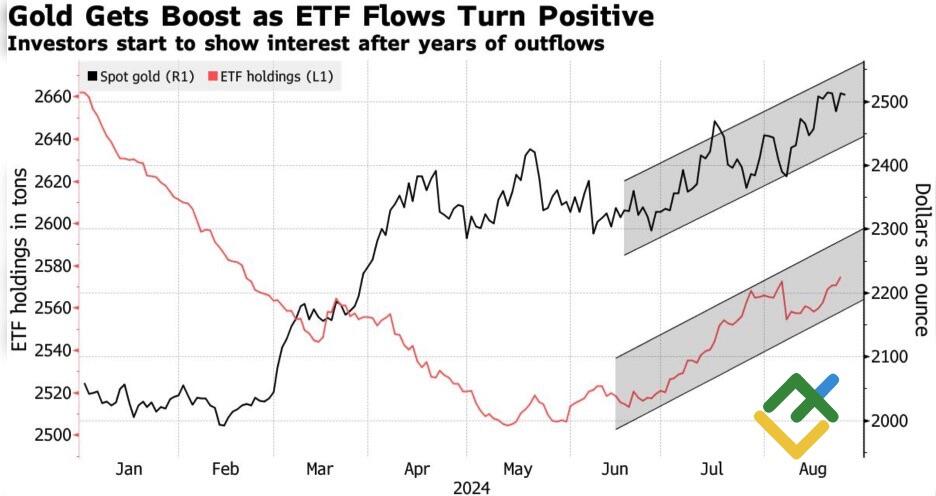

Gold price and gold ETF holdings

Source: Bloomberg.

Central banks have indicated that their decision to purchase gold is driven by concerns that inflationary pressures may persist at elevated levels for an extended period. This is not a positive development, as the role of central banks is to maintain price stability at or near their target levels. It is probable that the regulators’ activity is a consequence of unfavorable market conditions. Demand for the precious metal has remained consistent since the onset of the conflict in Eastern Europe. The situation in the Middle East has contributed to an intensification of the issue. Furthermore, these risks remain present in other areas.

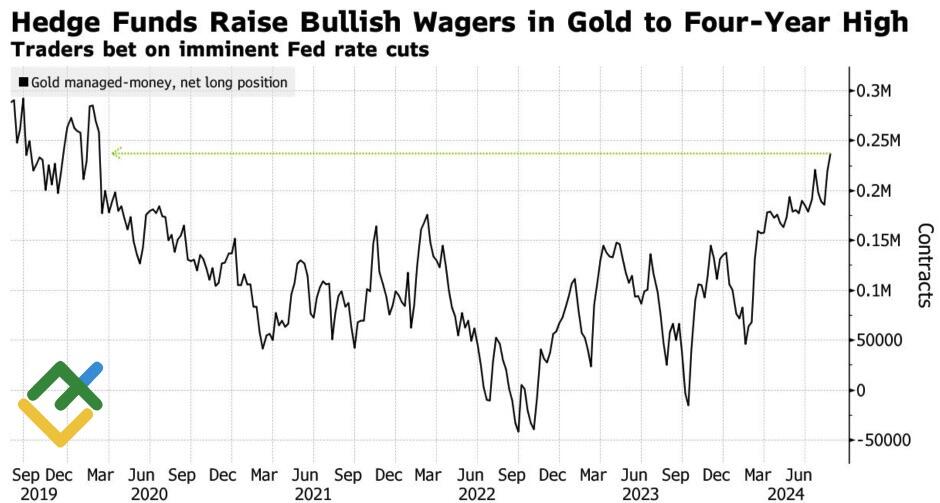

Since October 2022, XAUUSD quotes have grown by 55% despite the Federal Reserve’s aggressive tightening of monetary policy, the growth of US Treasury yields, and the strengthening of the US dollar. Gold was actively purchased despite market headwinds, and its shift to a tailwind indicates significant growth potential for the precious metal. It is not surprising that asset managers increased net longs on gold in the futures market to the highest levels in four years. The SPDR Gold Shares, the largest gold-focused ETF, saw its eighth consecutive week of inflows, marking the longest period of growth in the stock since mid-2020.

Asset managers’ positions in gold

Source: Bloomberg.

In theory, an overabundance of speculative long positions could potentially lead to a correction in the market. If bulls become overly concerned about a particular development, it could trigger a domino effect that could have broader implications. What could cause XAUUSD buyers to become cautious? For example, a potential trigger could be a robust US employment report for August, which might reassure investors that the US economy is not heading for a recession. Alternatively, it could be revised forecasts from the FOMC rate forecasts, which provide for only one act of monetary expansion of 25 bps after September in 2024. Currently, the derivatives market anticipates two or three interest rate hikes in 2024.

Weekly trading plan for gold

The pullback may also be of a technical nature, when gold’s inability to maintain its position above the key level of $2,515 per ounce may prompt some investors to take profits and start selling the precious metal. However, the long-term forecast of $2,800 remains in place, so any corrections should be viewed as an opportunity to buy the XAUUSD at attractive prices.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.