The divergence in the monetary policies of the Fed and the Bank of Japan provides insight into the trajectory of the USDJPY pair. At the same time, expectations for a reduction in the federal funds rate may be overly optimistic. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Reuters experts project the Bank of Japan to raise the rate in 2024.

- The futures market expects the Fed rate cuts of 100 bp.

- Divergence in monetary policy helps the USDJPY to determine the trend.

- The pair may collapse to 139 and 133.5 in three months.

Quarterly fundamental forecast for Japanese yen

The Bank of Japan’s decision to raise the overnight rate again before the end of the year is unlikely to have a significant impact on USDJPY bears if the Fed plans to ease monetary policy. Furthermore, the derivatives market indicates that the US central bank will take an aggressive approach, with a 65% probability of a 100-basis point reduction in the federal funds rate in 2024. The yen has benefited from the divergence, which has served to enhance its appeal.

The latest Japanese inflation data gave rise to two distinct impressions. Consumer prices increased from 2.6% to 2.7% in July, marking 28 consecutive months above the target. At the same time, core inflation fell below 2% for the first time since 2022, prompting centrists and Governing Council doves to advocate caution. Kazuo Ueda asserts that if the economic and inflation outlook aligns with the BoJ’s projections, the monetary policy adjustment will persist.

Japan CPI change

Source: Bloomberg.

According to a recent survey conducted by Reuters, 31 out of 54 experts, or 57%, predicted that the Bank of Japan would raise the overnight rate by 25 basis points to 0.5% in 2024. Two-thirds of respondents anticipate this will occur in December, with approximately a third of experts indicating October as a potential timeframe. According to Jupiter Asset Management, the cost of borrowing in Japan will reach 1% by 2025, the differential with the US will narrow, and the USDJPY pair will decline to 130.

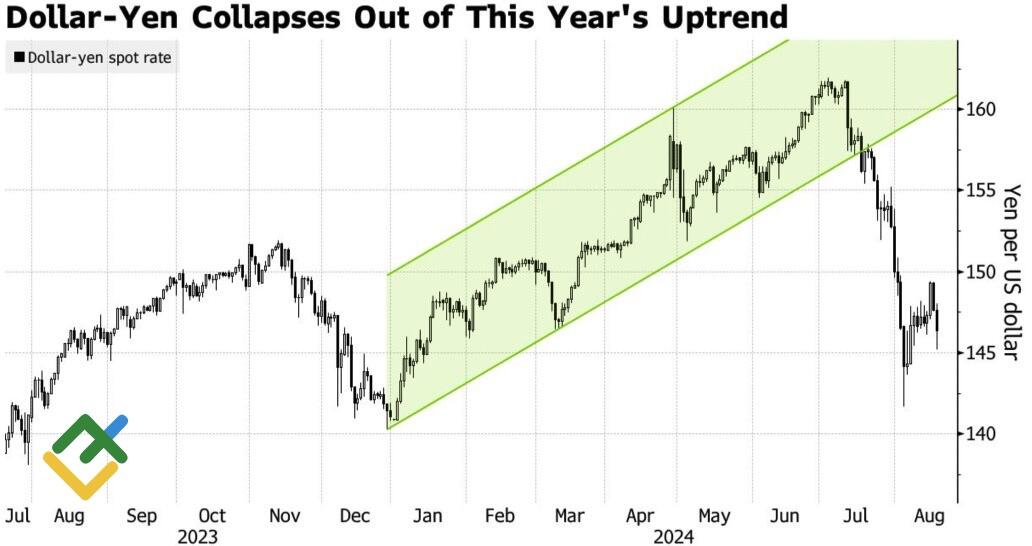

US dollar against Japanese yen rate

Source: Bloomberg.

This forecast is in line with market expectations of a 100 bp cut in the federal funds rate in 2024 and another 120 bp cut in 2025. In a recent statement, Fed Chief Jerome Powell indicated that the central bank was not in favor of further cooling of the labor market and that it was time to adjust monetary policy.

Meanwhile, USDJPY bulls receive no support from the rapid rally of the US stock indices. This is typically seen as an improvement in global risk appetite, leading to the selling of the yen as a funding currency in carry trade operations. However, following the events of Black Monday, speculators will likely exercise caution before divesting the currency of Japan. According to Citi, the US dollar has assumed a more prominent role in the global carry trade landscape, with the yen currently being sold against the currencies of developing countries.

Quarterly USDJPY trading plan

Market expectations of a federal funds rate cut in 2024 are overstated. Such aggressive monetary expansion by the Fed would require a recession in the US economy, which is unlikely to occur. A gradual change in the market outlook will lead to a return of interest in the greenback. At the same time, the USDJPY downtrend persists, so pullbacks should be used to build up short trades, adding them to the ones opened at 147.2. The targets are located at 139 and 133.5.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.