The British pound, once under the spotlight, is falling now. The global economy and rumors that the Bank of England will cut interest rates are to blame. The Chancellor of the Exchequer’s speech may also have a negative impact on the GBPUSD. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The global economic slowdown is pushing the GBPUSD down.

- Chances of a repo rate cut in August have risen sharply.

- Labor’s tax hike will destroy the British pound.

- The GBPUSD risks falling to 1.27.

Daily fundamental forecast for pound sterling

Everything changes, but when it comes to Forex, things change at a rapid pace. Just a few weeks ago, the British pound was in the spotlight thanks to an accelerating economy, a dovish stance of the Bank of England, and Labor’s convincing victory in the parliamentary elections. However, in early August, it became clear that each of the sterling’s trump cards could be easily beaten. The GBPUSD‘s weakness caused the asset to collapse.

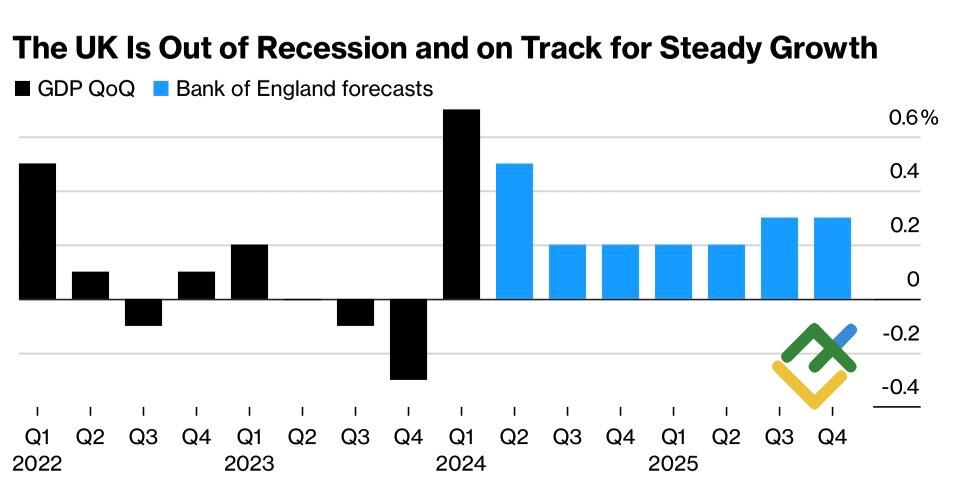

The British economy continues to demonstrate resilience following a period of robust growth in the first quarter, as evidenced by the positivity in business activity data. However, the US and the eurozone are showing signs of weakness, and investors are questioning whether Britain can maintain its momentum. Britain cannot stay isolated if its major trading partners are struggling, as there is a risk of a similar downturn spreading around the world.

The UK GDP figures and forecasts

Source: Bloomberg.

This situation may prove pivotal at the Bank of England meeting on August 1. Previously, the centrists highlighted the elevated growth rates of service prices and wages, along with the economy’s resilience, emphasizing the necessity to maintain the repo rate at the current 5.5% level. Those in favor of a dovish policy stance maintained that CPI should decline to the 2% target for two consecutive months and that there should be a notable disinflationary trend. However, given that the global GDP slowdown is having a negative impact on Britain, it is now time to take action.

Not surprisingly, most Bloomberg experts forecast a 25 bp cut in the repo rate to 5.25%. The derivatives market has raised the odds of such an outcome from 40% in early July to the current 66%. After the MPC vote regarding keeping borrowing costs on a plateau split 7-2 at the previous meeting, doves are expected to win 5-4 this time.

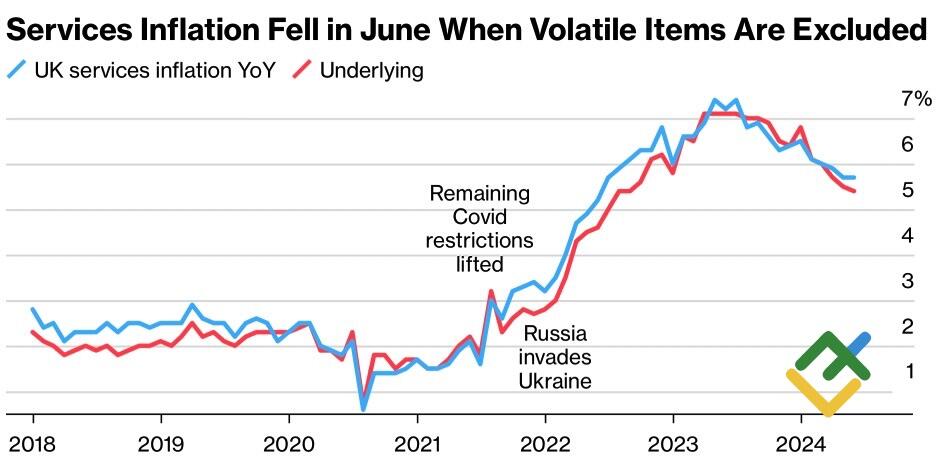

Furthermore, recent Bloomberg research indicates that prices for services excluding volatile items are decelerating at a faster rate than the official figure.

UK services inflation rate

Источник: Bloomberg.

Thus, the second trump card of the GBPUSD bulls is no longer working. The sharp transition from holding the Repo rate on a plateau to its most likely cut was a real blow to the pound sterling.

As for the Labour victory in the elections, not everything is smooth here either. Chancellor of the Exchequer Rachel Reeves will give a speech following the BoE’s head Andrew Bailey. She is expected to severely criticize the Conservatives, who left a £20 billion deficit in public finances. Radical measures will be needed to close the budget hole. If raising taxes is discussed, the GBPUSD’s collapse will most likely accelerate.

Daily GBPUSD trading plan

So, the pound has turned from a beautiful swan into an ugly duckling before our eyes, and its future depends on the BoE’s and Exchequer’s verdicts. A Repo rate cut and a tax hike are the worst scenarios that can drop the GBPUSD quotes to 1.27. Conversely, keeping borrowing costs on a plateau of 5.5% will be a reason to go long.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.