Dash, a cryptocurrency that has captured the attention of investors across various crypto exchanges, has been on a fascinating journey since its inception. Originally named XCoin, Dash has set itself apart from other digital currencies through its innovative two-tier network architecture, which utilizes controller nodes to enable instant transactions. This unique feature has intrigued investors and sparked comparisons between Dash and other cryptocurrencies like Litecoin.

Despite the recent downward trend in Dash’s price, long-term investors may have a promising opportunity. Dash’s robust transaction history and technical indicators suggest that the current market conditions could present a favorable entry point for those willing to hold onto their investments. However, it is crucial to exercise caution and conduct thorough analysis before making any investment decisions, especially considering the current greed index, which indicates a high level of market exuberance.

The article covers the following subjects:

Highlights and Key Points: DSHUSD Price Prediction 2024-2030

- As of 01.08.2024, the price of a DASH coin is $25.8.

- Some analytical agencies foresee high volatility of the asset in 2024. The price may surge to $194.43, otherwise decline to $22.09;

- The price prediction for Dash in 2025: some analysts suggest significant growth, with forecasts indicating a range from $268 to $276, the others predict that the price will be estimated within $35.37 – $66.48;

- The predictions for 2030 vary: some analysts foresee the token to breach $1 000, the others see it falling below $4;

- Technological innovations and Dash’s unique market position are critical drivers for its future adoption and value appreciation;

- The volatility of the cryptocurrency market and economic factors play significant roles in influencing Dash’s price movements.

Dash Price Today Coming Days and Week

When forecasting DASH’s price, monitor cryptocurrency market trends, as movements in major coins often affect altcoins. Stay updated on regulatory changes in key markets, which can impact prices significantly. Also, watch for any technological updates or enhancements to DASH, which can boost investor interest. Analyze changes in trading volume and liquidity as these indicate potential price movements. Employ technical analysis tools like Moving Averages, RSI, and MACD to track trends and reversals. Understanding these factors provides insights into DASH’s short-term price behavior.

Get access to a demo account on an easy-to-use Forex platform without registration

Analysts’ Dash Price Projections for 2024

The projected trajectory of the Dash price in 2024 has garnered considerable interest from investors, given the dynamic nature of the cryptocurrency landscape. The Dash price forecast for 2024 is based on the insights of leading crypto analysts and incorporates a range of intricate details.

CoinCodex

Price Range for 2024: $24.56 – $35.37 (as of August 1, 2024)

The CoinCodex forecast anticipates elevated volatility for the remainder of 2024. In October, the price is projected to reach its highest point in the year’s second half at $35.37. However, it is expected to decline to $24.56 in December. The outlook for Dash is unfavorable, with experts maintaining a bearish stance.

| Year | Minimum, $ | Maximum, $ |

|---|---|---|

| 2024 | 24.56 | 35.37 |

CoinPedia

Price range in 2024: $100.5 – $185.7 (as of August 1, 2024)

According to CoinPedia, the altcoin’s price could rise up to $185.7 by the year-end. The possible low level is expected at $100.5. The average target price of 2024 is $139.4.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2024 | 100.5 | 139.4 | 185.7 |

CoinMarketCap

Price range in 2024: $165.08 – $194.43 (as of August 1, 2024)

As CoinMarketCap states, Dash’s 2024 appears to be bullish, as the global DSH adoption increases due to the introduction of more Dash-related financial services. An average price level is projected at $176.08 while maximum and minimum price will hit $194.43 and $165.08, respectively.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2024 | 165.08 | 176.08 | 194.43 |

PricePrediction

Price range in 2024: $28.11 – $35.46 (as of August 1, 2024)

PricePrediction estimates that DSH will rise to an average of $33.27 by the end of 2024, with a price high of $36.55 to be reached in December.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| August | 28.11 | 29.19 | 30.29 |

| September | 28.43 | 29.78 | 31.45 |

| October | 29.62 | 30.97 | 32.64 |

| November | 30.51 | 31.59 | 34.19 |

| December | 31.77 | 32.85 | 35.46 |

DigitalCoinPrice

Price range in 2024: $22.09 – $56.51 (as of August 1, 2024)

DigitalCoinPrice projects that the DSHUSD pair will trade sideways. The price will increase in September, followed by a high volatility. The projected price range for December is $22.11 to $54.43.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| August | 25.91 | 25.91 | 25.91 |

| September | 23.19 | 42.93 | 54.60 |

| October | 22.09 | 35.05 | 55.27 |

| November | 22.40 | 26.72 | 56.51 |

| December | 22.11 | 50.05 | 54.43 |

Dash Technical Analysis

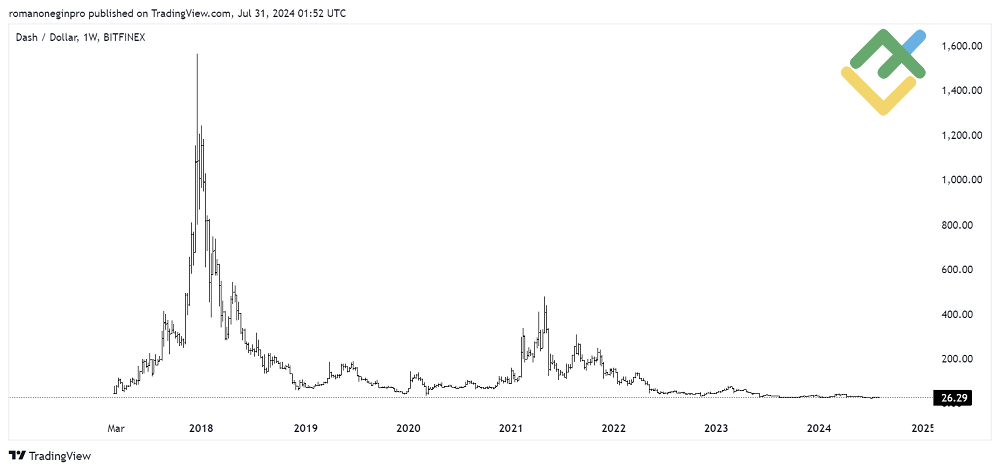

DASH is not only a digital currency, but also a decentralized payment system. The complete history of the cryptocurrency movement can be seen on the weekly time frame.

The chart illustrates two primary trends: an upward trajectory and a downward one. A downward corrective pattern has been forming since the beginning of 2018. Based on the most recent chart section, which shows a horizontal price movement, it can be assumed that bears are losing strength and that the trend may change direction soon.

Let’s assess the price movement on the daily and 4-hour charts to conduct a comprehensive technical analysis. The use of additional tools and indicators will enhance the precision of the forecast.

- The Elliott Wave theory can help identify emerging patterns and predict future price movements.

- Trend lines offer insight into the prevailing price direction.

- Fibonacci retracement levels can determine potential pivot points.

- Candlestick patterns are useful in assessing market behavior and psychology, as well as in identifying potential price targets.

blog

Promo code

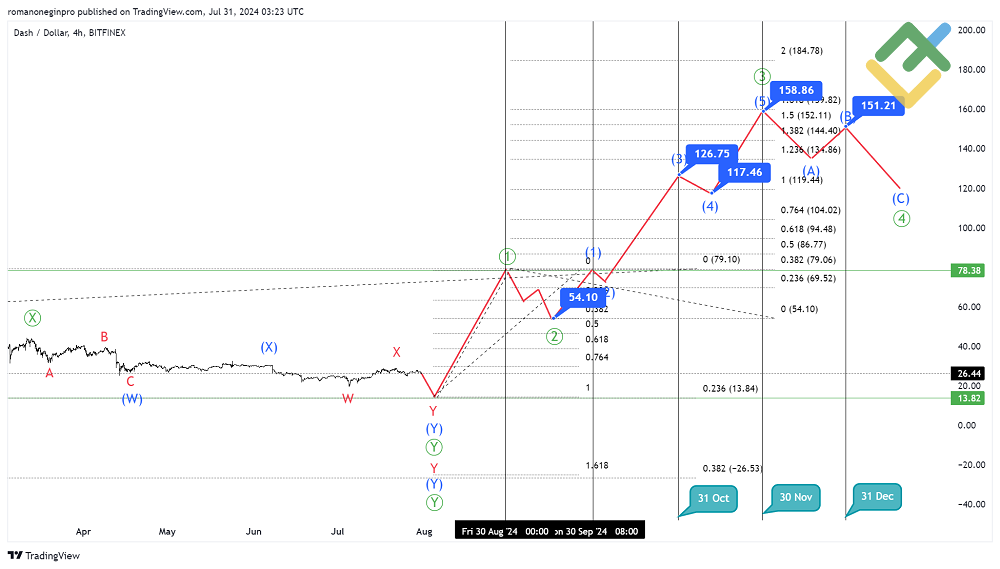

DSHUSD Analysis For Next Three Months

Let’s examine the daily chart to develop a potential scenario for three months.

According to the Elliott Wave theory, a global corrective pattern has been developing on the DSHUSD cryptocurrency over the past five years. This pattern takes the form of a double zigzag [W]-[X]-[Y]. It is likely that the motive wave [W] and the ascending linking wave [X] have already been completed. Each of these sub-waves has taken the form of a double zigzag of a lower degree.

Since the spring of 2021, the price has declined within the final motive wave [Y], as was the case with the previous two waves. It appears to be a double zigzag (W)-(X)-(Y). Let’s consider the final active sub-wave (Y), which is underway and may end soon.

The wave (Y) may unfold as a double zigzag W-X-Y, which necessitates the completion of the final sub-wave Y. Most likely, the wave Y, comprising sub-waves [W]-[X]-[Y], will conclude near 13.82. According to the Fibonacci extension, the wave Y will retrace 23.6% of the wave W at this mark.

The price may reach the level of 13.82 within the next two weeks. Following this, the cryptocurrency’s price will likely reverse and start a new bullish wave. It is possible that the price will surge within an impulse pattern after a prolonged bearish period. Consequently, over the next two months, the initial phase of a new bullish impulse may unfold. Below you will find a more detailed markup and key price levels.

Long-Term Dash Technical Analysis for 2024

Let’s examine the chart markup on the 4-hour time frame.

As previously indicated, the descending wave Y, which assumes the form of a double zigzag, may conclude within the next two weeks. It is probable that, having reached the level of 13.82, the price will reverse. As previously stated, there is a strong possibility that a new upward trend will emerge, potentially taking the form of an impulse.

The chart illustrates the potential future structure of the anticipated impulse, as indicated by the trend lines. The horizontal lines show the last days of each month. We will now analyze each month in detail.

In August, we can see a trend reversal and the first part of the bullish impulse as a sub-wave [1]. The sub-wave [1] may end near the previous high of 78.38, which was marked by sub-wave X (see the daily time frame).

In September, the price will likely maintain a slight downward correction [2]. The Fibonacci levels indicate that the correction will retrace 50% of the sub-wave [1], dragging the price to the area of 54.10. In addition, the sub-wave (1), the initial phase of the impulse wave [3], may terminate in September. The price is expected to soar to the high of 78.38 within the sub-wave (1).

In October, Dash may climb to 126.75 in the impulse wave (3). In November, the market is expected to experience a pullback in correction (4), reaching approximately 117.46, before embarking on a growth trajectory in the final sub-wave (5) towards 158.86. At this level, the impulse wave [3] will retrace 150% of the sub-wave [1].

In December, a bearish zigzag correction [4] may emerge. It is likely that its first half will be formed, and the price will fall to 151.21.

| Month | DSHUSD Projected Values | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| August | 13.82 | 78.38 |

| September | 54.10 | 78.38 |

| October | 72.85 | 126.75 |

| November | 117.46 | 158.86 |

| December | 134.62 | 158.86 |

Long-Term Trading Plan for DSHUSD

Based on the projected price movements during the current year, the trading plan is as follows:

- In light of the imminent trend reversal, it may be profitable to consider long trades at the current level with a target of 78.38, where the sub-wave [1] is anticipated to end.

- In the first half of September, bearish correction within the wave [2] is projected to occur. Thus, short trades can be considered with a target of 54.10. At the conclusion of the correction, long trades can be opened with a target of 78.38, as the minor sub-wave (1) is expected to unfold.

- In November, long trades can be initiated as the price may soar in an impulse sub-wave (3).

In the long term, one may buy the asset at the current level with the target of 158.86. It is possible that a large impulse sub-wave [3] will be completed at this level.

(DASH) Dash Price Prediction for 2025

The Dash price prediction for 2025 points towards potential growth, underscored by its technological innovations and market position. Dash’s unique features might drive broader adoption and enhance its value amid expected market fluctuations. Analysts remain cautiously optimistic, suggesting a year of opportunities and challenges for Dash as it navigates the evolving cryptocurrency landscape.

CoinCodex

Price Range for 2025: $22.64 – $35.37 (as of August 1, 2024)

CoinCodex anticipates a sideways trend for 2025. There will be a slight increase in volatility, while the price maximum will remain at the 2024 level. Experts’ outlook is ‘Hold.’

| Year | Minimum, $ | Maximum, $ |

|---|---|---|

| 2025 | 22.64 | 35.37 |

CoinPedia

Price Range for 2025: $151.43 – $275.78 (as of August 1, 2024)

CoinPedia analysts expect that Dash network will attract more payment processors and merchants and therefore the price of the altcoin could rise significantly, making Dash one of the most valuable cryptos out there. On the contrary, there is a possibility of DSH facing competition from the rival assets emerging, which may result in lowering the price. With that being said, an average price target in 2025 is projected at $213.8 while the min-max range could be $151.43 – $275.78.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2025 | 151.43 | 213.8 | 275.78 |

CoinMarketCap

Price range in 2025: $234.78 – $267.80 (as of August 1, 2024)

The analysts at CoinMarketCap also predict the bullish trend for DSH in 2025, with min-max levels surging to the range of $234.78 – $267.80, which places the average target at $251.65.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2025 | 234.78 | 251.65 | 267.8 |

PricePrediction

Price range in 2025: $31.54 – $56.17 (as of August 1, 2024)

PricePrediction is extremely optimistic in its forecasts. The average price of the DSH token will rise steadily to $47.27 from $34.49 in 2025, without encountering any corrections along the way. In December, the price is expected to rise to a yearly high of $56.17 from $45.96.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| January | 31.54 | 34.49 | 35.48 |

| February | 34.23 | 35.87 | 37.20 |

| March | 35.63 | 36.95 | 39.00 |

| April | 36.37 | 37.69 | 40.84 |

| May | 36.80 | 38.44 | 42.73 |

| June | 37.95 | 39.60 | 44.65 |

| July | 39.86 | 41.18 | 46.23 |

| August | 40.36 | 42.00 | 48.29 |

| September | 41.20 | 42.84 | 50.39 |

| October | 42.81 | 44.13 | 52.11 |

| November | 44.25 | 45.89 | 53.87 |

| December | 45.96 | 47.27 | 56.17 |

DigitalCoinPrice

Price range in 2025: $54.40 – $66.48 (as of August 1, 2024)

DigitalCoinPrice also expects growth, but corrections are possible along the way. Nevertheless, they estimate that the DSH token may reach higher values. By the end of 2025, the average price will almost reach the $60 mark. The minimum and maximum prices will be $55.24 and $61.10 respectively.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| January | 54.76 | 56.08 | 61.05 |

| February | 55.66 | 57.22 | 61.20 |

| March | 54.43 | 55.33 | 63.04 |

| April | 55.16 | 58.51 | 66.48 |

| May | 54.53 | 58.68 | 61.88 |

| June | 54.40 | 58.53 | 59.89 |

| July | 55.01 | 59.49 | 62.68 |

| August | 55.44 | 63.44 | 66.17 |

| September | 54.41 | 56.21 | 58.95 |

| October | 55.59 | 57.59 | 64.10 |

| November | 55.36 | 57.72 | 62.19 |

| December | 55.24 | 57.84 | 61.10 |

(DASH) Dash Price Prediction for 2026

Dash has consistently demonstrated a strong potential for growth in cryptocurrency, underpinned by its solid technical infrastructure and real-world applications. As we gaze into the future, Dash’s trajectory appears increasingly promising.

CoinCodex

Price Range for 2026: $19.54 – $23.93 (as of August 1, 2024)

The 2026 forecast for Dash, as reported by CoinCodex, does not promise a rosy future for the cryptocurrency. The price is anticipated to fall within a range of $19.54 – $23.93, with little possibility of a correction.

| Year | Minimum, $ | Maximum, $ |

|---|---|---|

| 2026 | 19.54 | 23.93 |

CoinPedia

Price Range for 2026: $220.50 – $396.14 (as of August 1, 2024)

In contrast, CoinPedia analysts expect that the coin will demonstrate growth. The projected average price in 2026 is $316.50, suggesting the continuation of the bullish trend observed in 2025.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2026 | 220.5 | 316.50 | 396.14 |

CoinMarketCap

Price range in 2026: $304.48 – $337.50 (as of August 1, 2024)

CoinMarketCap Dash price prediction for 2026 is also bullish, with a projected average price at $324.29. Experts foresee the altcoin to trade within $304.48 – $337.50 during 2026.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2026 | 304.48 | 324.29 | 337.5 |

PricePrediction

Price range in 2026: $44.52 – $77.28 (as of August 1, 2024)

Similarly, PricePrediction‘s forecast reflects a bullish outlook. In December, the range is projected to be $65.01 – $79.04, with the yearly average surging to $67.37 from $49.63.This suggests the continuation of the bullish trend observed in previous years and investor confidence in Dash.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| January | 45.38 | 49.63 | 51.05 |

| February | 48.76 | 51.12 | 53.53 |

| March | 49.78 | 52.14 | 55.58 |

| April | 51.35 | 53.71 | 57.66 |

| May | 52.89 | 54.78 | 60.35 |

| June | 54.54 | 56.43 | 63.09 |

| July | 56.23 | 58.12 | 65.35 |

| August | 57.50 | 59.86 | 67.67 |

| September | 60.37 | 62.26 | 70.06 |

| October | 61.76 | 64.13 | 73.18 |

| November | 64.16 | 66.05 | 75.74 |

| December | 65.01 | 67.37 | 79.04 |

DigitalCoinPrice

Price range in 2026: $75.24 – $94.34 (as of August 1, 2024)

DigitalCoinPrice offers a more modest forecast for the Dash price in 2026. The altcoin is forecast to trade flat in 2026, with significant fluctuations anticipated during the year. For instance, the price is projected to reach $86.09 in March and $94.34 in August, but is expected to decline considerably in June and September. In December, Dash is likely to showcase less volatility, but the forecast does not promise a bullish trajectory.

| Month | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| January | 76.07 | 78.66 | 93.73 |

| February | 76.02 | 77.97 | 89.97 |

| March | 76.41 | 84.51 | 86.09 |

| April | 75.24 | 82.40 | 91.73 |

| May | 76.06 | 79.47 | 91.55 |

| June | 75.61 | 77.30 | 88.21 |

| July | 75.49 | 81.49 | 90.66 |

| August | 76.32 | 90.92 | 94.34 |

| September | 75.25 | 76.08 | 88.68 |

| October | 75.85 | 87.43 | 88.88 |

| November | 75.84 | 81.50 | 86.06 |

| December | 76.41 | 77.20 | 86.20 |

Recent Price History of the Dash Coin

Dash’s price history from 2019 to 2023 reflects the cryptocurrency’s journey through the market’s volatility and resilience. In 2019, Dash stood firm at $89.78, showcasing its potential amidst a hopeful crypto community. By 2020, amidst global uncertainties, its price slightly dipped to $67.75, mirroring the cautious sentiment across financial markets. However, 2021 marked a significant upturn for Dash, with its price soaring to $189.21, riding the growing interest in cryptocurrencies as both investment and alternative financial systems.

The subsequent years, though, saw a correction in Dash’s trajectory. By 2022, the price will be adjusted to $126.37, reflecting broader market trends and regulatory impacts on investor sentiment. By March 2023, the price further contracted to $58.60, highlighting the unpredictable nature of the crypto market and external economic factors influencing its performance.

Throughout this period, Dash’s ability to adapt to market dynamics and maintain its presence in the digital currency landscape underscores its resilience. Each year’s price movements encapsulate the challenges and opportunities faced by Dash, marking its enduring relevance in the ever-evolving cryptocurrency ecosystem.

Long-Term Dash Price Prediction for 2027-2030

Analysts have provided a range of forecasts for the last four years of the current decade. Some anticipate a significant decline, while others foresee a period of rapid growth. Given the inherent volatility of cryptocurrencies, it is challenging to make a definitive prediction about the value of the coin over such an extended period. Therefore, the forecasts presented below are intended to provide a general insight rather than a precise projection.

CoinCodex

The long-term forecast for Dash from CoinCodex is highly pessimistic. In 2027-2029, the coin will experience a period of significant volatility, with yearly lows declining and highs rising. This will eventually result in a substantial decline to the $3.33 – $12.92 range in 2030.

| Year | Minimum, $ | Maximum, $ |

|---|---|---|

| 2027 | 18.94 | 20.93 |

| 2028 | 18.78 | 21.50 |

| 2029 | 10.16 | 37.50 |

| 2030 | 3.33 | 12.92 |

CoinPedia

CoinPedia expects the DSHUSD exchange rate to start hitting new peaks. Before the end of the decade, the price may exceed the $1 000 mark. In 2030, the average price will stand above $1,500, and the maximum price will be $1 686.50.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2027 | 321.06 | 468.53 | 569.03 |

| 2028 | 467.49 | 693.58 | 817.37 |

| 2029 | 680.71 | 1026.74 | 1174.09 |

| 2030 | 991.18 | 1519.92 | 1686.50 |

PricePrediction

A more conservative forecast is presented by PricePrediction. Based on expert analysis, the price of the coin is expected to exceed $300, reaching a maximum of $343.25, while an average would be on $286.07.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2027 | 97.11 | 99.80 | 114.50 |

| 2028 | 138.62 | 143.61 | 166.76 |

| 2029 | 193.55 | 200.74 | 241.82 |

| 2030 | 276.03 | 286.07 | 343.25 |

DigitalCoinPrice

According to DigitalCoinPrice analysts, Dash will trade flat in 2027-2028. In 2029, a new growth phase will begin. In 2030, the price will almost reach the $200 level.

| Year | Minimum, $ | Average Price, $ | Maximum, $ |

|---|---|---|---|

| 2027 | 99.71 | 115.80 | 118.05 |

| 2028 | 99.71 | 115.80 | 118.05 |

| 2029 | 122.99 | 135.11 | 142.16 |

| 2030 | 174.73 | 189.75 | 193.88 |

Which Factors Impact Dash Price?

The price of Dash (DASH) is influenced by various factors, from market dynamics to its unique technological features. Key influences include:

- Project Developments: Updates, new features, or partnerships within the Dash ecosystem can significantly impact its price.

- Market Dynamics: The trading volume on exchanges and overall asset flow affect DASH’s supply and demand, influencing its price.

- Public Sentiment: News coverage and social media discussions can sway investor sentiment, affecting the cryptocurrency’s market value.

- Economic Trends: Broader trends in the global economy and the cryptocurrency market at large can impact DASH’s price.

- DASH’s scarcity plays a crucial role in its valuation due to its capped supply of approximately 18.9 million coins, potentially less if treasury funds are unallocated. This limited supply mechanism supports its price.

- The adoption level. More businesses using Dash boosts its utility and demand. The upcoming DashPay Wallet, aimed at improving user experience, is expected to drive adoption further and, by extension, DASH’s price.

Is It Worth Investing in Dash?

The Dash price prediction journey, stretching into 2024 and beyond, paints a picture of volatility coupled with promise. Forecasts suggest that the price of Dash will experience significant movements, pointing to a landscape ripe with both challenges and opportunities. As we venture towards 2025 and 2026, the momentum leans towards growth, underpinned by Dash’s robust technical infrastructure and appeal within the crypto community. Analysts express a cautiously optimistic stance for Dash’s trajectory to 2030, emphasizing its potential to stand out in a crowded cryptocurrency market.

FAQs on Dash Price Prediction

As for 01.08.2024, Dash is trading at $25.8.

Dash’s price is expected to grow, especially in 2025, underscored by its technological innovations and market position, but the outlook for 2026 is cautiously optimistic.

DASH could see significant growth in five years, given its bullish trends. However, due to the volatile nature of cryptocurrency markets, precise long-term predictions are inherently challenging.

CoinPedia experts think that it’s possible — they suppose that the token will reach $1,000 in 2029 and in 2030 it will exceed $1,500. But the other evaluations are either more modest or completely opposed.

The analysts recommend holding your horses. Under the current circumstances the market sentiment varies from neutral to bearish, but, according to some forecasts, DSH will see significant growth in the coming years. All depends on your investment goals and risk tolerance.

DASH’s future seems promising, backed by its solid technical infrastructure and real-world applications. This indicates a strong potential for growth, especially from 2026 to 2030.

Reaching $10,000 would require significant market adoption and a drastic change in the cryptocurrency landscape. Such a milestone is speculative and would depend on numerous factors beyond current market trends and technological developments.

Whether Dash is better than Bitcoin depends on the criteria used for comparison. Dash offers faster transaction times and privacy features, making it appealing for specific uses. However, Bitcoin’s broader adoption and recognition as a store of value give it advantages in other areas.

Price chart of DSHUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.