The AUDUSD pair is facing challenges not only from developments in China and the US but also from Australia. The deceleration in inflationary pressure may cancel the RBA’s next cash rate hike. What impact will this have on the Australian dollar? Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Slowing inflation in Australia deprives the AUDUSD pair of its advantages.

- China’s economy is experiencing a downturn.

- Deteriorating global risk appetite is weighing on the aussie.

- Short trades can be opened if the pair rebounds from the resistance levels of 0.6505-0.6515 and 0.655.

Weekly Australian dollar fundamental forecast

Following a period of strong performance, the AUDUSD pair saw a significant decline as market participants adjusted their expectations for the pace of economic growth in China and the Reserve Bank of Australia’s key interest rate. The correction of US stock indices and the mass liquidation of positions by carry traders, occurring against the backdrop of improving global risk appetite and the strengthening of the yen, exacerbated the situation.

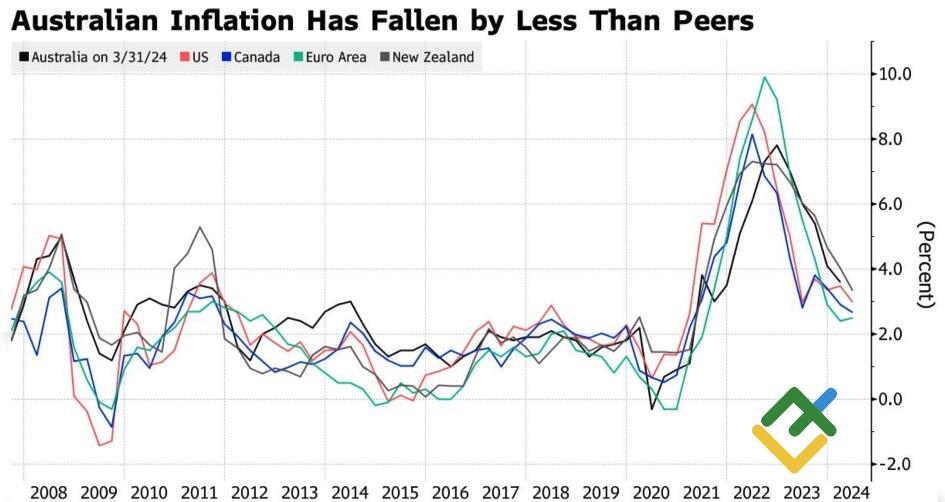

The rapid collapse of the AUDUSD pair has not been observed for an extended period. The pair has been in decline for 11 of the last 13 trading days in the Forex market, with the release of Australian consumer price data accelerating the process. The average inflation indicator slowed to 3.9% in the second quarter, a positive outcome for the RBA. The central bank has been criticized for not acting quickly or strongly enough on monetary policy, which has kept CPI high for longer than in other developed economies. However, the latest statistics are a reason to celebrate.

Inflation rate in Australia and other countries

Source: Bloomberg.

The Reserve Bank’s victory over inflation is a negative development for the AUDUSD exchange rate. If the regulator previously indicated that a cash rate hike was not off the table and the derivatives market highlighted the potential for monetary restriction as early as August, the second-quarter CPI data prompted a shift in perspective. The derivatives market is forecasting a key rate cut by December with a 67% probability. As a result, Australian bond yields collapsed, hurting the Australian dollar.

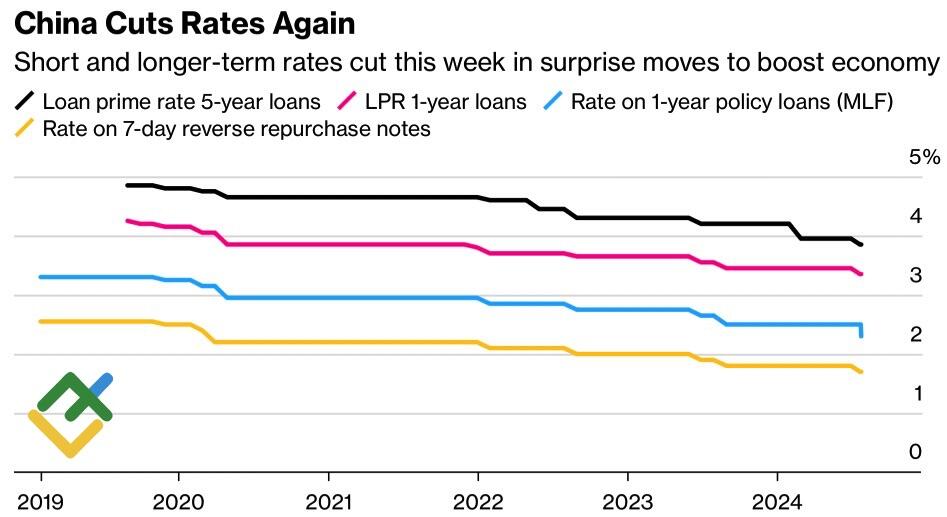

The news that the Reserve Bank will not be an exception and will follow the lead of other central banks in loosening monetary policy was not the only disappointment for the AUDUSD pair. The Chinese economy continues to pose challenges, with both the slowdown in manufacturing activity for the third consecutive month and the sharp cut in the loan prime rate by the People’s Bank of China. This move is perceived as a sign of panic.

PBoC’s interest rate

Source: Bloomberg.

China represents not only the primary market for Australian goods but also the largest commodity consumer in the market. The primary concern regarding Donald Trump’s return to power in the US is that it will have a significant adverse impact on the economy. Thus, the Bloomberg Commodity Index declined by 6% in July, reaching its lowest level since the beginning of the year. The Australian dollar is a commodity currency. Therefore, it is sensitive to fluctuations in the commodity market.

Weekly AUDUSD trading plan

The Australian currency also reacts to the deteriorating global risk appetite, as reflected in the decline in US stock indices, and the reduction of carry traders’ transactions due to the strengthening of the yen, the main funding currency. The outlook for the AUDUSD pair is so unfavorable that the dovish signals from the Fed can only delay the decline. Concurrently, short trades can be opened if the quotes rebound from the resistance levels of 0.6505-0.6515 and 0.655, adding them to the ones initiated below 0.665.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.