The recent China economic slowdown has raised concerns across global markets. Traders are now wary of a potential repeat of the 2015 crisis. The slowdown’s impact on commodity prices and the Chinese stock market has been significant. Industrial metals, oil, and other commodities have seen price declines. The People’s Bank of China has intervened with policy changes, yet concerns remain.

A Faltering Chinese Economy

China’s domestic consumption engine seems to be faltering. Real estate interest is plummeting, and online sales need constant discounting to sustain values. A downturn in cotton and cosmetics imports indicates potential barriers to further sales among affluent population segments. These trends suggest that the China economic slowdown is deeply affecting various sectors.

Commodity Prices on the Decline

Source: MarketWatch

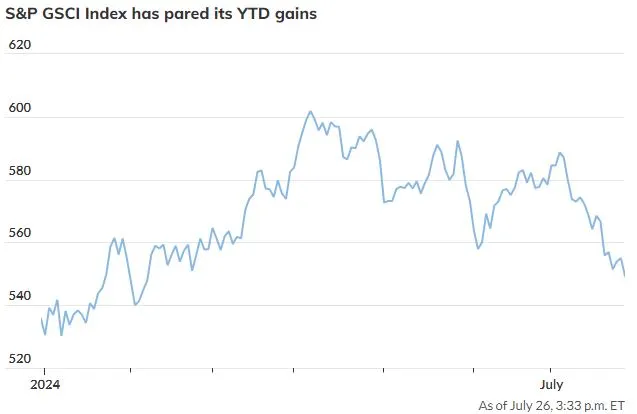

Commodity prices have nearly fizzled out after an early-year rally. Weakness in China’s economy is the main driver behind this trend. For example, the S&P GSCI index, which tracks global commodity prices, saw significant gains early in the year. However, as of recent data, it has only increased by 3.6%, down from its peak of 12.4% in April. Industrial metals, a key indicator, are struggling. The S&P GSCI’s industrial metals sub-index is up a mere 0.6% year to date. This trend highlights the broader impact of the China economic slowdown.

The Role of the People’s Bank of China

In response to the slowing economy, the People’s Bank of China (PBOC) has made several policy adjustments. They reduced a key policy interest rate unexpectedly, cutting the 7-day reverse repo rate to 1.70% from 1.80%. They also cut the rate on their medium-term lending facility to 2.3% from 2.5%. These actions aim to stimulate spending. However, average Chinese consumers seem more inclined to save, dampening the intended effects of these rate cuts.

Comparing to the 2015 Crash

Current weaknesses in China’s economic indicators recall the 2015 crisis. During that period, a global slump in commodity prices coincided with a slowdown in China’s economy and steep losses in the Chinese stock market. The U.S.-China Economic and Security Review Commission described it as an “extraordinary fall.” The China economic slowdown today finds parallels in the lead-up to that crash. The CSI 300 stock index, considered conservative, has fallen 7.6% since May 20. Meanwhile, the more sensitive Hang Seng Index has dropped 13.3% from its peak this year.

Global Impact and Strategic Vulnerabilities

The China economic slowdown has implications beyond its borders. The Western Hemisphere is reducing consumption volumes. China’s export engine faces competition from countries like India and Vietnam. Provincial governments in China are struggling to raise tax revenue, affecting infrastructure development. Moreover, domestic consumer reluctance to spend weighs heavily on the economy. Despite these challenges, there are multiple avenues for commodities to find support. For instance, India’s domestic consumption continues to rise, as does consumption in parts of Southeast Asia and Latin America.

Industrial Metals and Commodity Resilience

Source: MarketWatch

While the China economic slowdown has pressured commodity prices, precious metals have shown resilience. During the 2015 pullback, gold and silver were down, but they have outperformed industrial metals in recent months. Industrial metals like copper, nickel, aluminum, and steel have all seen price declines. On the other hand, gold and silver have maintained their status as safe havens. India’s recent reduction in import duties for gold and silver could further boost demand for these metals.

Signs of Economic Weakness

Recent signs of economic weakness in China include a collapse in the copper premium. This figure, which leads Chinese copper imports by four months, foreshadows weak imports in the coming months. Oil imports are also shrinking, and forward-looking indicators based on credit and fiscal spending suggest underwhelming economic growth. This trend is negative for industrial and energy commodities. China’s economy might stagnate at a low level or worsen further, both scenarios bearish for industrial metals like copper, steel, iron ore, aluminum, and nickel.

Long-term Outlook

Looking ahead, the China economic slowdown will likely continue to influence global markets. The PBOC’s purchases of gold to diversify its international reserves away from the U.S. dollar is a multi-year theme. This move supports a bullish outlook for gold over the long term. While industrial metals face short-term challenges, other regions’ rising consumption could provide some support. Nevertheless, the global economy remains closely tied to China’s economic health.

In conclusion, the China economic slowdown has sparked fears across commodity markets. Its impact on commodity prices and the Chinese stock market is evident. Despite efforts by the People’s Bank of China, concerns about future economic growth persist. Traders and investors will continue to watch China’s economic indicators closely. The slowdown’s ripple effects will likely influence global markets for the foreseeable future.

Click here to read our latest article Inflation Gauge Signals Relief

This post is originally published on EDGE-FOREX.