A recent survey of Bloomberg experts revealed that only 30% anticipate a rate increase from the Bank of Japan in July. Most respondents expected a modest reduction in quantitative easing (QE). However, the evolving dynamics of inflation and wage rates are prompting the BoJ to consider more decisive action. Let’s discuss this topic and make a trading plan for the USDJPY pair.

The article covers the following subjects:

Highlights and key points

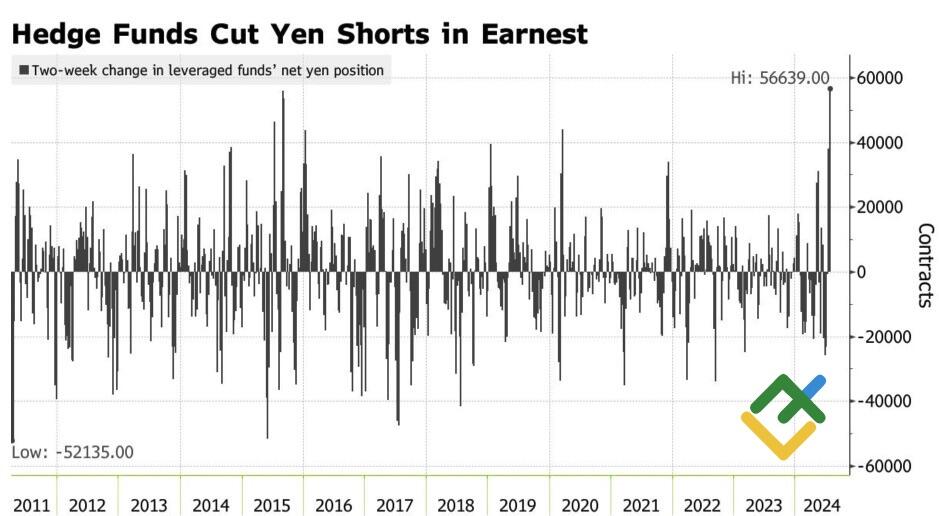

- Hedge funds are buying the yen at the fastest pace since 2011.

- Experts and the derivatives market do not believe in the normalization of the BoJ policy in July.

- The reduction of the bond yield differential pushes the USDJPY down.

- The US dollar risks slipping to ¥149.6 and ¥147.4.

Weekly fundamental forecast for Japanese yen

Markets are speculating whether there is a link between the sell-off in technology stocks and the strengthening of the yen. Since reaching its high on July 11, the Nasdaq 100 index has sagged by 8%, while the USDJPY has plunged by 5%. Although these moves seem to have different fundamental reasons, buying tech stocks and selling the yen have been the most popular trades for hedge funds. Will they close them now?

In the two weeks leading up to July 23, leveraged investors liquidated USD/JPY at the fastest pace since 2011. Rumors of an overnight rate hike and QE reduction at the BoJ meeting boosted downward momentum, which began with the release of US inflation data for June and BoJ currency interventions. Further events developed rapidly.

Hedge fund positions on the yen

Source: Bloomberg.

A recent survey of Bloomberg experts revealed that only 30% anticipate that on July 31, Kazuo Ueda and his colleagues will take a second step to normalizing monetary policy, raising the overnight rate to 25 bps by 15 bps. At the same time, 90% of respondents view such an action as a significant risk. The derivatives market has increased estimates of monetary restriction since the previous Governing Council meeting to 45% from 25%. This is a justified and expected outcome.

Consumer prices in Tokyo, a leading indicator for national inflation, accelerated in July to 2.2% for the third consecutive month. Thus, indicators may consolidate above the 2% target, underscoring the need to continue the BoJ’s monetary policy normalization cycle.

Tokyo inflation rate

Source: Bloomberg.

Japan’s labor ministry has proposed a record fourth consecutive year of minimum wage hikes of 5%, following a 4.3% increase in the previous fiscal year. This is intended to support low-income households in the context of high price increases. The BoJ has stated that it monitors wage rates in order to make informed decisions regarding interest rates.

Meanwhile, Kazuo Ueda and his colleagues will deliver their verdict on the QE. The consensus forecast by Bloomberg experts is for a reduction in asset purchases from ¥6 trillion to ¥5 trillion, followed by a further decline to ¥3 trillion over two years. Should the final figures be even smaller and the overnight rate be raised, the USDJPY‘s decline risks accelerating.

Weekly USDJPY trading plan

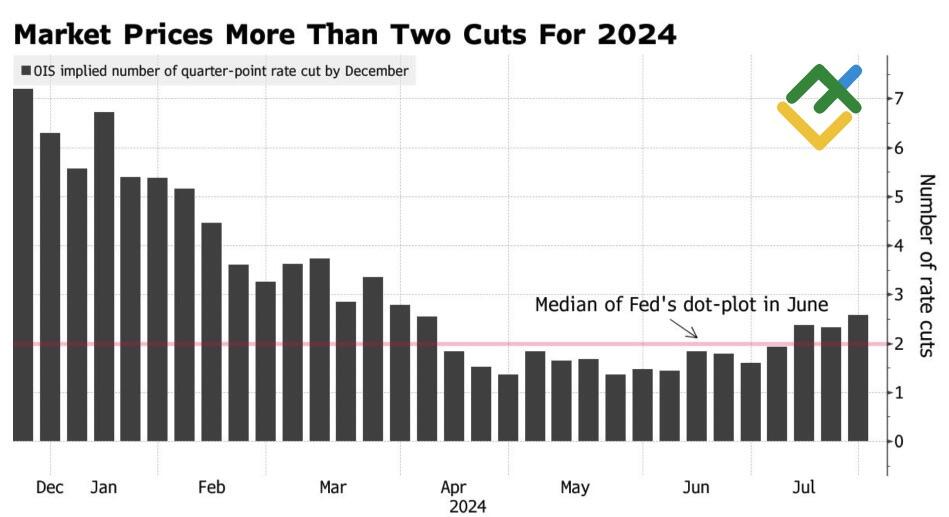

While a 15 bp increase in borrowing costs is unlikely to narrow the differential between US and Japanese bond yields significantly, investors anticipate that the Federal Reserve will cut the federal funds rate three times in 2024. This creates pressure on the US dollar, and when coupled with the closure of positions by carry traders and hedge funds, there is an increased risk of the USDJPY pair continuing to slide towards 149.6 and 147.4. Should the Bank of Japan announce favorable news regarding the yen, one can open short trades, adding them to the ones formed at 160.25.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.