The British pound’s advantages are still in place, but the recent correction in US stock indices and the Trump trade has triggered a pullback in the GBPUSD pair. It is unclear how long this trend will persist. The latest PMI data seem to have dragged the pound to the bottom. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The GBPUSD pullback was due to the Trump trade and the S&P 500 correction.

- Robust PMI data show that the pound still has upside potential.

- Political stability allows the Bank of England to take its time.

- The pound sterling may soar to $1.35.

Weekly fundamental forecast for pound sterling

The British pound is likely to continue its upward trajectory, although the speculative appetite could lead to sudden declines. For example, in the second half of July, GBPUSD quotes collapsed amid growing investor interest in the Trump trade and the correction of the US stock indices. However, might this be an optimal time to enter long positions?

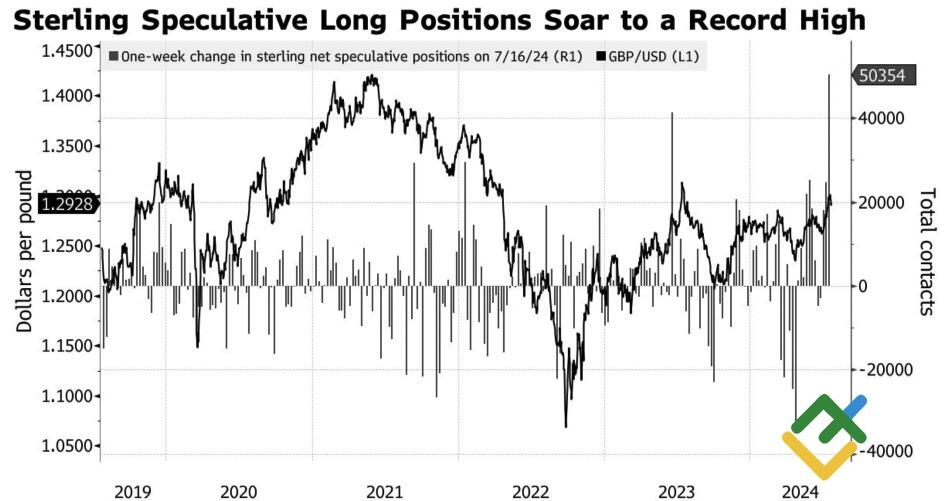

Net long positions on the pound have reached record highs, driven by asset managers, hedge funds, and other market participants. The pound has become a highly sought-after asset due to robust economic growth in the UK, the Bank of England’s cautious approach, and the low political risks following the Labour Party’s victory in the parliamentary elections. However, JP Morgan has cautioned that the current level of positioning makes the GBPUSD pair vulnerable to a pullback. Should a black swan loom on the horizon, it would have a detrimental impact on the value of sterling.

GBPUSD and change in net speculative positions

Source: Bloomberg.

Such unpleasant events were investors’ focus on the Trump trade after the presidential debate and the assassination attempt on the Republican candidate, which resulted in the growth of his ratings, as well as the correction of the S&P 500 due to disappointing corporate reports of the Magnificent Seven companies. However, the withdrawal of Joe Biden from the presidential race and the high popularity of Kamala Harris deprive the US dollar of an important advantage. These factors, along with the robust UK business activity statistics, allowed the GBPUSD pair to hit the bottom and rebound.

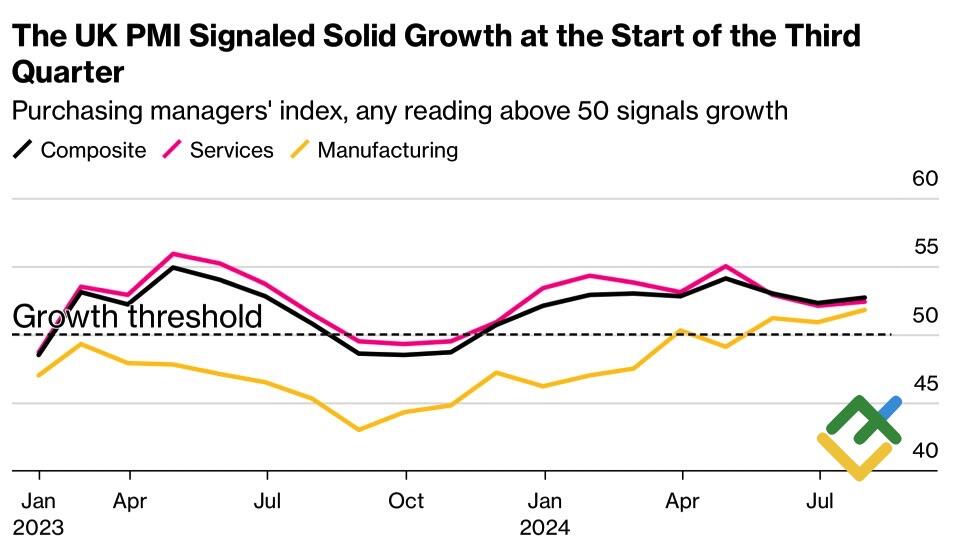

UK purchasing managers’ index

Source: Bloomberg.

The June purchasing managers’ indices surpassed the forecasts of Bloomberg experts, with the manufacturing sector recording its highest PMI value in two years and the fastest increase in orders since April 2023. The trends in the indicators point to a robust economic recovery, which increases the likelihood of the government achieving its goal of boosting GDP to 2.5%. Against this backdrop, one can purchase the GBPUSD pair. Amundi, Europe’s largest manager of $2.3 trillion in assets, believes that a prudent strategy would be to buy the dips. The company forecasts that the value of sterling will rise to $1.35.

The Labour Party’s victory and strong business activity data give the Bank of England the opportunity to postpone monetary policy loosening. Despite consumer prices falling to 2%, core inflation is still far from the target, and services prices and wage growth are too high. The futures market gives a 45% probability of a repo rate cut at the August 1 meeting.

Weekly GBPUSD trading plan

ING estimates that the pound will fall by the end of the year as the BoE loosens monetary policy three times. However, some argue such a scenario. The central bank has time to mull it over and would not act hastily. The GBPUSD‘s bullish targets remain at 1.312 and 1.323. The current pullback offers a great buying opportunity.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.