If it weren’t for the Trump trade, EURUSD quotes would have soared above 1.1. The derivatives market is fully confident of a Fed rate cut in September and is counting on three acts of monetary expansion in 2024. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The ECB may put the brakes on rate cuts because of France.

- The Fed risks loosening monetary policy three times in 2024.

- The EURUSD pair would soar above 1.1 if the Trump trade were absent.

- Swings in politics and the economy increase consolidation risks.

Weekly US dollar fundamental forecast

What does not kill us makes us stronger. The French election, which could collapse the euro, is now seen as support for EURUSD. ECB officials fear that the new government’s excessive fiscal profligacy could accelerate inflation. It is hard to get small countries to abide by EU rules if giants like France and Italy do not adhere to them. As a result, the European Central Bank will likely not signal monetary easing at its July meeting. All the better for the regional currency.

In the Forex market, currecties are fluctuating constantly. In June, traders were choosing between the French political drama and a slowing US economy. In July, the scenery changed. This time markets have to pick between the Fed easing monetary policy and the Trump trade. The futures market is confident in the start of monetary expansion in September and gives a 12% chance that the federal funds rate will shrink by 50 bps rather than 25 bps.

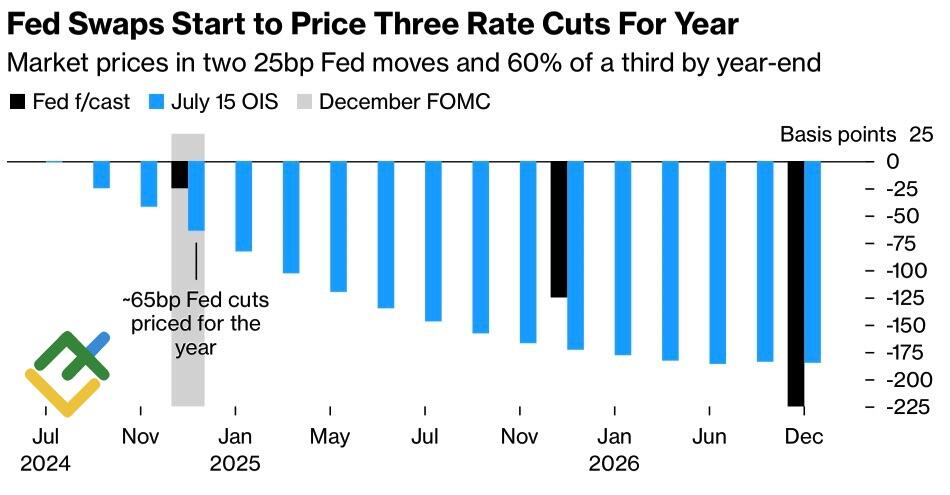

Moreover, after Goldman Sachs’ statement that the conditions for lowering borrowing costs were already in place in July, derivatives are giving a 60% chance of three acts of monetary policy easing by the Federal Reserve – in September, November, and December.

Fed federal funds rate expectations

Source: Bloomberg.

Comments from Jerome Powell and San Francisco Fed President Mary Daly that recent reports have increased the central bank’s confidence in achieving its 2% inflation target helped to shift the market’s outlook. However, investors were even more impressed by what Austan Goolsbee said. The Chicago Fed president said that monetary policy was tighter because inflation was down from 4% to 2.5%, and real interest rates had been on the rise. With the labor market and the economy cooling, this is not necessary. Monetary policy should be eased.

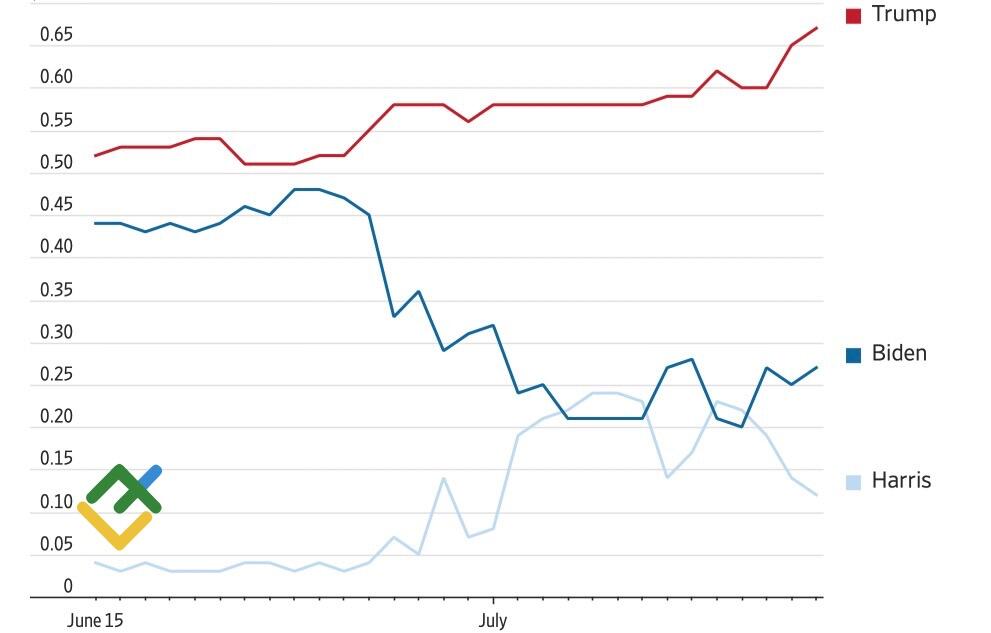

Such a market narrative could severely harm the US dollar, but the Trump trade is throwing it a lifeline. After the assassination attempt, the chances of the Republicans returning to the White House rose from 60% to 67%.

Ratings of presidential candidates

Source: Wall Street Journal.

Investors expect Donald Trump to cut taxes and raise interest rates. This combination risks fuelling inflation, forcing the Fed to slow monetary expansion and making the US dollar attractive again. Curiously, the decline in stock market volatility indicates confidence in Donald Trump’s victory. However, much will depend on Republican control of the House of Representatives. UBS sees a 45% chance of a red wave.

Weekly EURUSD trading plan

Thus, the swing between politics and the economy continues. If the EURUSD pair drops below the support of 1.0888, the risk of a pullback to the convergence zone of 1.0845-1.086 will intensify. The pullback will allow traders to open long trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.