The UK does not experience political turbulence as France and the US, allowing the pound to soar to its 2-year high against the euro and a yearly high against the greenback. Let’s discuss this topic and make a trading plan for the GBPUSD.

The article covers the following subjects:

Highlights and key points

- The Labour Party will stabilize the UK economy.

- Money will flow into the country after the scandalous Conservative government.

- The Bank of England is unlikely to cut the repo rate in August.

- These factors may push the GBPUSD to 1.305.

Weekly fundamental forecast for pound sterling

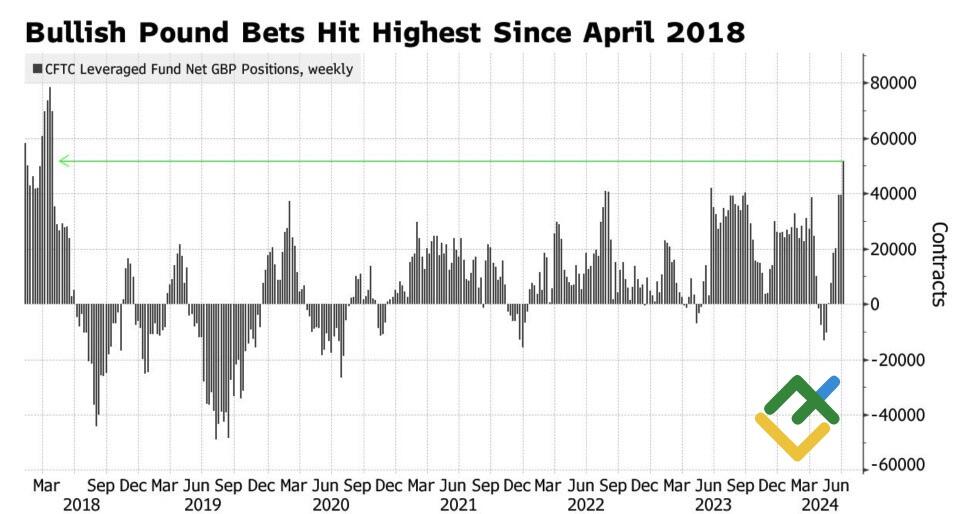

The Labour Party’s unconditional victory in the parliamentary elections allowed the British pound to bathe in applause. Two days before the vote, hedge funds increased their net-longs on the pound sterling to the highest level in more than six years and were rewarded. Thanks to investors’ confidence in the stability, competence, and consistency of the new government, GBPUSD quotes skyrocketed.

Net GBP positions change

Source: Bloomberg.

The 412 seats in the new parliament is an excellent result for the Labour Party. The Conservatives, who had ruled for the previous 14 years, paid the price for Brexit and endless scandals. Separation from the EU proved to be a mistake, and the subsequent pandemic, military conflict in Ukraine, and energy crisis have made the UK Europe’s sickest man.

The UK economy recorded the best growth among the G7 countries in the first quarter amid a recovery from recession, and the pound came on the heels of the US dollar in the G10 currency race. Thanks to Labour’s solid victory, the UK currency has overtaken the greenback and become the leader, building up a handicap.

The UK does not experience political turbulence as France and the US. Emmanuel Macron’s gamble ended with a hung parliament, and the risks of Donald Trump returning to the White House are increasing. The UK has become a safe-haven island in an ocean of political storms, attracting investors to buy British assets that have fallen in value since Brexit. Indeed, the GBPUSD pair was hovering near 1.5 before the vote on Brexit. Today, it cannot even reach 1.3.

The pair has room to grow, which it is doing amid Bank of England officials’ reluctance to vote to cut the repo rate in August. After the previous meeting, when Andrew Bailey described the decision to keep borrowing costs at 5.25% as finely balanced, the odds of the monetary expansion were 60-65% against consumer prices falling to 2%.

Inflation rate in different countries and regions

Source: Bloomberg.

However, Bank of England Chief Economist Huw Pill believes that monetary policy easing requires CPI and core inflation to move towards the regulator’s target. Meanwhile, Jonathan Haskel draws attention to rising services prices and wages at 6%, and Catherine Mann argues that consumer prices have only reached 2% and will accelerate in the future. None of the officials will vote for a rate cut, which has reduced the chances of an August cut to 50% and boosted the GBPUSD pair.

Weekly trading plan for GBPUSD

The GBPUSD rally will require efforts from both sides. Only a slower pace of US inflation in June than forecast by Bloomberg experts will allow the pair to reach the second of two previously set targets of 1.287 and 1.295 for long trades. The first target was reached a week later. If all goes according to this scenario, the GBPUSD pair’s target can shift to 1.305. Otherwise, it will be time to take profits.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.