While silver’s bullish market will be buoyed by its industrial use and the automobile revolution in the long term, the XAGUSD pair has other drivers on the medium-term investment horizon. Let’s discuss them and make a trading plan.

The article covers the following subjects:

Highlights and key points

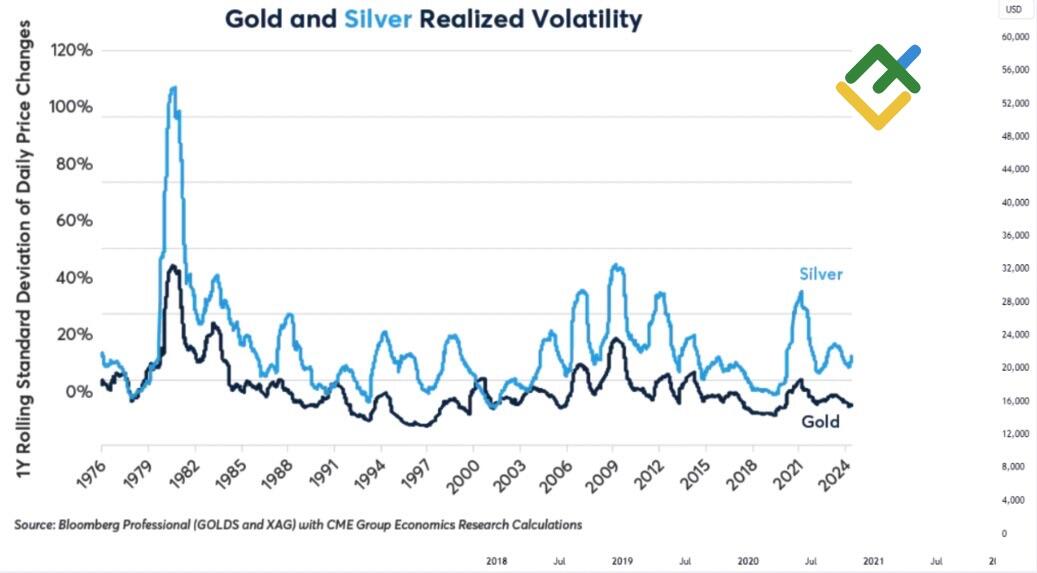

- Silver shows higher volatility than gold.

- Solar panels and electric cars will allow XAGUSD to grow in the long term.

- The Fed’s signals about rate cuts are a reason to buy the precious metal.

- Silver can reach $34.2 and $36.4 per ounce.

Monthly fundamental forecast for silver

History shows that silver outperforms gold in bull markets and vice versa. Since the beginning of the year, the XAUUSD has increased by 14%, while the XAGUSD has added more than 30%. The white metal is more volatile; it often benefits from the same growth drivers as its more expensive counterpart. However, the automotive revolution may become a more significant growth driver than de-dollarization.

Gold and silver volatility

Source: Kitco.

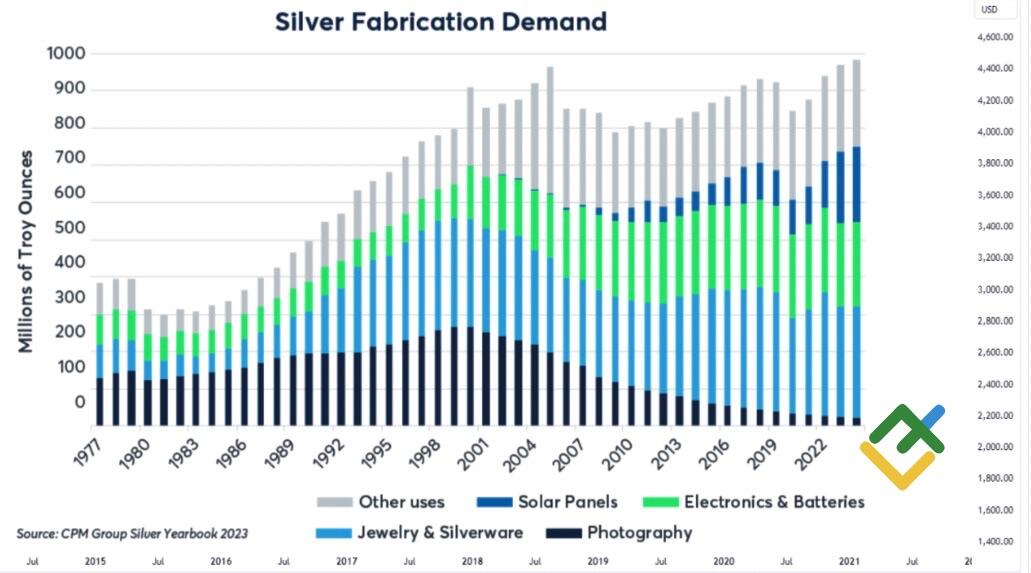

Unlike gold, which hit new record highs in 2024, silver reached its record highs in 2011. At the end of the last century, the share of the metal used in the photography industry amounted to 36.6% of the annual supply, and by 2023 it was reduced to 2.3%. The imbalance in the market is not so significant that we can count on a new all-time high, but the situation will change in the coming years.

Silver’s share in solar panel production has increased from almost zero in 1999 to 20% in 2023. Coupled with the revolution in the automotive industry, this allows the white metal market to be in a state of permanent scarcity, pushing prices higher. Bank of America predicts that silver will reach $35 per ounce within the next two years, partly due to increased investment demand.

While conventional gasoline or diesel cars use an average of 15-28 grams of silver, electric vehicles use 25-50 grams. Industry forecasts predict that sales of the latter will exceed 50% of total sales over the next decade. The growing demand for the white metal is a strong argument in favor of buying it for the long term.

Silver demand breakdown

Source: Kitco.

In the medium term, the main driver of the XAGUSD rally is expected to be the beginning of the Fed’s monetary expansion cycle. The latest FOMC forecasts call for 1-2 rate cuts in 2024 and as many as four in 2025. Donald Trump’s victory in the presidential election will likely accelerate inflation and force the Fed to slow down. Still, Trump will do everything possible to make the central bank act faster. Against this backdrop, Jerome Powell’s resignation cannot be ruled out.

Aggressive monetary easing in 2025 is a direct way to reduce Treasury yields and the fall of the US dollar. As a result, the headwind for the precious metals sector will turn into a tailwind, and silver will outperform gold in a bull market.

Monthly trading plan for silver

Once the Fed starts signaling the beginning of monetary expansion or inflation data will do it for the regulator, XAGUSD bulls will trigger a rally. Jerome Powell’s dovish rhetoric before Congress and the slowdown in the US CPI may prompt investors to open more long trades, adding more to those initiated in early May near $26 an ounce. The bullish targets remain unchanged at $34.2 and $36.4.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.