Known for its volatility, the digital currency market has always been exposed to both opportunities and risks. NEO, often called “China’s Ethereum,” has always been on this typical rollercoaster ride, experiencing sharp ups and downs. However, the cryptocurrency continues to attract attention in the crypto sphere, sparking lively discussions and varying Neo price predictions among enthusiasts and skeptics alike.

With its unique blockchain technology and vision to digitize assets using smart contracts, the NEO coin has been on the radar of investors and traders for its potential to carve out a niche in the decentralized financial landscape. Amidst the sea of predictions, some analysts are projecting a bullish future, foreseeing a significant rise from its previous positions and potentially reaching new heights in the coming years. Meanwhile, what does technical analysis point to? How do various factors in the crypto market influence the NEO price predictions?

This article features expert forecasts, technical analysis, and various factors that may influence the price of NEO in the future.

The article covers the following subjects:

Highlights and Key Points: Neo forecast 2023-2030

- The current cryptocurrency price of neo is $9.61.

- In October 2021, NEO was ranked 53rd by market cap, and by early March 2022 it dropped to 62nd place. In April 2024, it was down to 70th place. Thus, NEO is losing ground in the market.

- The NEO 3.0 update is expected to increase transaction speed and reduce gas fees. The update may become favorable for NEO’s price and usability.

- Experts predict that the price of NEO may post a slight increase or drop significantly. It is important to be cautious about predictions and use your own judgment.

- Implying a variety of technical tools and different time frames to identify trends and entry/exit points, technical analysis can help traders make decisions to buy or sell NEO.

- Recommended market entry levels. Short-term trading opportunity with upside potential.

- Forecasts for 2025–2030 indicate possible growth above $100. NEO can be a profitable investment in the long term.

- The crypto offers GAS dividends and has value growth opportunities. NEO is attractive for long-term investors.

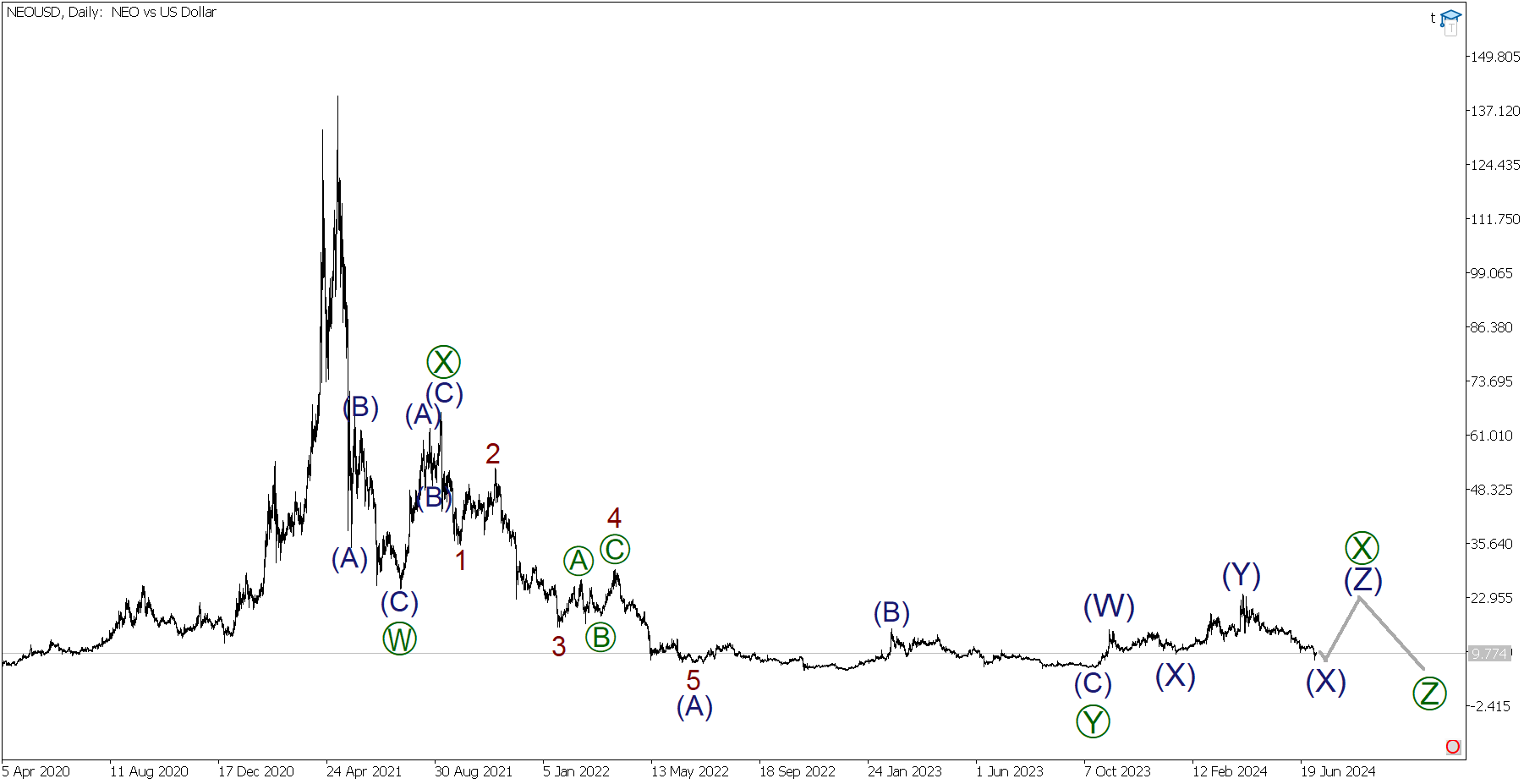

Weekly Elliott wave NEO analysis as of 08.07.2024

In the long term, the NEOUSD pair will continue to form a bearish correction as a triple zigzag [W]-[X]-[Y]-[X]-[Z]. The motive wave [Y] has been completed as a zigzag (A)-(B)-(C). After this, the initial part of the correction [X] started unfolding. There is a high probability that the linking wave [X] will take the shape of a triple zigzag (W)-(X)-(Y)-(X)-(Z), as shown on the chart. Let us analyze the situation on the H4 time frame.

The linking wave (X), a part of wave [X], continues to unfold as a double zigzag W-X-Y. The first two parts of the pattern have already finished taking shape. The last motive wave Y is in progress. The impulse wave [A] and correction [B] have ended within the wave Y. The price is moving in the impulse wave [C]. The wave is projected to complete near the low of 8.34, where the impulse sub-wave (3) finished to unfold. Against this backdrop, one can consider short trades on the instrument.

Weekly NEOUSD trading plan:

Sell 9.77, TP 8.34

NEOUSD wave analysis is presented by an independent analyst, Roman Onegin.

NEOUSD technical analysis

Technical analysis of the NEOUSD pair requires careful selection of time frames and instruments. For example, M15 or H1 time frames are suitable for short-term trading, where RSI and MACD indicators determine overbought and oversold levels. D1 or W1 time frames are better for long-term analysis, where moving averages and Fibonacci levels are used to identify trends and potential pivot points.

Indicators such as Bollinger Bands and a Stochastic Oscillator help identify volatility and momentum. Patterns such as Head-and-shoulders and Double bottoms can indicate possible trend reversals. Combining technical analysis with fundamental analysis is vital to get a complete picture of the market situation. It will allow you to make informed decisions based on comprehensive analysis.

Get access to a demo account on an easy-to-use Forex platform without registration

NEOUSD Rate Analysis for Three Months

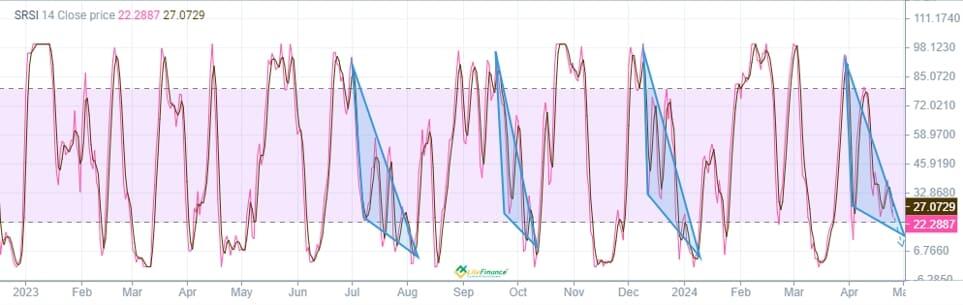

The RSI parameters should be set to:

- Period – 14;

- Overbought bound at 80%;

- Oversold bound at 20%.

MA should be tuned to the following settings:

- Period – 5;

- Number of previous bars – 12;

- Number of following bars – 4.

The RSI is approaching the oversold zone, narrowing into a Triangle. It signals that the entry into the oversold zone will be followed by a sharp upward trend. This is confirmed by the corresponding patterns.

In late April or early May, NEOUSD may experience a downtrend. After that, it will likely move sideways between $11.2 and $13.5 during the rest of the month.

How Will NEO Rate Perform in 2024 According to Technical Analysis?

Before conducting an analysis for 2024, let’s turn to the news background and data from leading analytical agencies. As a result, we have the following data:

- The minimum rate could be around $12.99.

- The average rate may be at $21.52.

- The maximum rate may reach $24.92.

Technical analysis:

- RSI. On the daily time frame, the indicator shows a bullish bias, standing at 52.36.

- Moving averages (MA). On the daily time frame, NEO does not show a clear trend as the 50-day MA is below the 200-day MA and the price is trading above both MAs.

- MACD (Moving Average Convergence/Divergence). The indicator is signaling an upcoming decline.

Long-term NEOUSD analysis for 2024

First, let’s identify the NEO/USD trend using the Ichimoku indicator to make a trading plan for 2024.

Current readings:

- Tenkan line (yellow): 18.31

- Kijun line (purple): 16.80

- Senkou Span A line (green): 17.55, and Senkou Span B line (red): 15.09

- Chikou Span line (orange): 18.34

Analysis:

- The Tenkan-sen line is above the Kijun-sen line. Both lines are moving up. The Ichimoku cloud has turned green, confirming a bullish trend.

Conclusion:

- Taking into account the three-month analysis, as well as the current upward trend in cryptocurrencies, here is the table with maximum and minimum prices that can be used as signals during the next three quarters.

| Month | NEOUSD Projected Values | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| June 2024 | 14.2 | 19.1 |

| July 2024 | 16.4 | 25.1 |

| August 2024 | 19 | 27 |

| September 2024 | 18 | 26 |

| October 2024 | 21 | 28 |

| November 2024 | 24 | 30 |

| December 2024 | 25 | 29 |

Long-Term Trading Plan for NEOUSD

Price targets for three months:

- May – June: A sideways movement is anticipated with targets at a low of $13.8 and a high of $19.1.

Price targets for 2024:

- July – December: An uptrend is forecast with the following key levels:

- Minimum: $16.4 in July, gradually increasing to $25 in December.

- Maximum: $25.1 in July, touching $30 in November.

Indicators:

- RSI: If the indicator approaches the oversold zone, it could signal a sharp uptrend.

- MA: Monitor narrowing MAs forming a Triangle and the corresponding reversal patterns.

Trading signals:

- Buy signal: When RSI approaches 20%, and the MA and MACD confirm the uptrend.

- Sell signal: When RSI nears 80%, and MA and MACD point to a decline.

Note: This trading plan is based on current technical analysis and is subject to change depending on market conditions. Always consider the overall market context and news background before making trading decisions. Cryptocurrency trading involves high risk.

Neo price prediction for 2024 by Crypto Experts

Predicting the future of digital assets always involves a bit of uncertainty, and NEO is no exception. Some experts predict that NEO could reach $21.52 by the end of 2024, while others see the potential to rise to $67.47 by 2030. Notably, the cryptocurrency market is extremely volatile, and investors should be cautious due to its inherent risks.

Experts and analytical agencies provide various forecasts based on technical analysis, historical data, and current market trends. Here are some of them.

Binance

Based on user data, Binance suggests that the price of NEO could be around $15.22 in 2024. This projection is not official but rather an average of predictions from the platform’s users.

LongForecast

In 2024, NEO is projected to experience volatility within an upward trend. The price is expected to rise from $16.16 in April to a high of $48.18 in December. Throughout the year, the cryptocurrency may decline to $25–$30 in August, eventually returning to $45–$50. The overall bullish trend mirrors optimism for NEO in 2024, inviting investors to exercise caution and vigilance in their investment strategies.

NEO Price Prediction for 2025 by Crypto Experts

Let’s take a look at the predictions of leading cryptocurrency analysts. Most of them believe that NEO can reach above $48, settling above this level by the end of 2025. The lowest expected price will fluctuate between $35 and $40, while the most likely price will stand near $45 by the end of 2025. Experts make the following assumptions based on analysis of current trends and historical data.

TechNewsLeader

The minimum and maximum prices of NEO are expected to be around $29.95 and $35.68, respectively, reflecting the confidence in the stable growth of NEO based on improving the technology base and network expansion. NEO may see increased demand as the market focuses on investing in this cryptocurrency. NEO’s strengthening position in the blockchain industry may contribute to this trend. By 2025, the price of NEO could hit $132.39. This optimistic forecast assumes that NEO will continue to develop as a key platform for decentralized applications

WalletInvestor

WalletInvestor predicts that the NEO price may plunge to $9,197 due to potential market corrections and changes in cryptocurrency regulation. NEO may not perform well in the long run. However, possible innovations and updates could change this trend. No specific data was provided for 2025. Notably, forecasts are subject to change, and investors should follow the latest news and conduct analysis before making trading decisions.

Traders Union

The price of NEO is anticipated to reach $20.59, reflecting moderate optimism about NEO’s future. The crypto may post gains against favorable market conditions, development of technology and an increased number of users. The price may reach $31.76, suggesting that NEO will continue to play an important role in the blockchain and smart economy ecosystem.

| Month | Minimum Price | Maximum Price | Average price |

|---|---|---|---|

| January 2025 | 15.010177 | 18.345773 | 16.677975 |

| February 2025 | 15.1903 | 18.565922 | 16.878111 |

| March 2025 | 15.372583 | 18.788713 | 17.080648 |

| April 2025 | 15.557054 | 19.014178 | 17.285616 |

| May 2025 | 15.743739 | 19.242347 | 17.493043 |

| June 2025 | 15.932664 | 19.473256 | 17.70296 |

| July 2025 | 16.123856 | 19.706936 | 17.915396 |

| August 2025 | 16.317343 | 19.943419 | 18.130381 |

| September 2025 | 16.513151 | 20.182741 | 18.347946 |

| October 2025 | 16.711309 | 20.424933 | 18.568121 |

| November 2025 | 16.911844 | 20.670032 | 18.790938 |

| December 2025 | 17.114786 | 20.918072 | 19.016429 |

How Did the NEO Price Change Over Time?

The cryptoverse is no stranger to volatility, with NEO exemplifying this trait through its price movements over time. A dive into historical data paints a clearer picture of NEO’s trajectory, aiding in forecasting its potential price.

In 2020, NEO commenced below the $10 mark, plummeting to its yearly bottom of $4 on March 13 (as per Bitfinex). However, it rebounded, touching $25.90 by September 18, only to retreat near $14 as the year concluded.

The NEO/USD pair often mirrors the BTC/USD pair, with the latter’s trends casting a long shadow on the former. March 2020’s financial upheaval due to the pandemic saw both Bitcoin and NEO tumble. Yet, unique developments created divergent price pathways. NEO’s alliance with the Blockchain-based Services Network (BSN) in late July is noteworthy, propelling its value as BSN’s cost-effective platform for blockchain endeavors augments the digital economy.

2021 was a rollercoaster, with NEO inaugurating at $14.25. Mid-April saw a bullish sprint, thanks to Bitcoin’s strides and the unveiling of an updated Go node for N3. This new rendition addressed bottlenecks, notably enhancing the notary service and key management. China’s evolving crypto stance, underscored by the People’s Bank of China’s endorsement of cryptocurrencies as “investment tools” on April 19, further catalyzed NEO’s ascent.

The bull run persisted till May 7, with NEO reaching a year-to-date high of $140.77, only to plunge to $25.03 by July 20 (Bitfinex). Bitcoin’s May decline played a role in this descent.

NEO embarked on a recovery, rising from $25.03 on July 20 to a commendable $62.97 by August 24, a magnificent over 151% upswing within a month. September saw it surpass the $60 threshold, although a price correction ensued, inaugurating a long-term bearish trend until early March 2022, with NEO hovering around $20.

Several contemporary developments hold promise for NEO’s valuation. The integration of the NEO-backed Jiuquan Chain into the ten chains constituting the Chinese mainnet is pivotal, facilitating the Chinese citizenry’s ingress into NFT markets via the BSN Open Permissioned Blockchain in compliance with local regulations.

It was also crucial to ensure a smooth transition of assets from N2 to N3 following the launch of N3 on August 2, 2021. This meticulous asset transfer mitigated bug risks, ensuring a seamless migration.

The advent of N3, NEO’s avant-garde blockchain version, and the inception of myriad NFT projects and DeFi protocols on N3 bodes well for NEO’s potential uplift.

NEO’s historical maximum of ($198.6) was recorded on 2018-01-15. While current valuations are distant from such peaks, analysts anticipate NEO to orbit around $20 in 2023. The migration to N3 and the surge in NFT and DeFi projects on the platform are anticipated to determine NEO’s price trajectory.

The average price of NEO, its minimum price, and how the coin is expected to perform depends on multifaceted factors, including regulatory landscapes, technological advancements, and the broader crypto market dynamics. As of the latest data, the NEOUSD rate stands at $9.61.

Long-term NEO Price Prediction for 2026–2030 and Beyond by Crypto Experts

Long-term forecasts of cryptocurrency prices are very imprecise and are of an estimation nature. The market situation can change at any time.

Traders Union

According to Traders Union, the NEO cryptocurrency will exhibit a promising upward trajectory. By 2024, the price is anticipated to stand near $20.59, soaring to $24.61 by the end of 2025 due to the continuous development of the NEO ecosystem and growing investor interest. By 2030, NEO is projected to hit $60.11, mirroring widespread adoption of the technology and increased demand for smart contracts and decentralized applications.

This bullish trend signals prospective growth, underpinned by the digital asset’s robust technological framework and its potential to foster a smart economy by facilitating the creation of digital assets and smart contracts. Investors and stakeholders should closely monitor the regulatory landscape and technological advancements, as these could serve as pivotal factors influencing NEO’s market dynamics and its long-term viability in the volatile cryptocurrency domain.

According to forecasts from Traders Union, the NEO cryptocurrency exhibits a promising upward trajectory from 2026 to 2030. Positioned as a progressive digital asset, NEO is projected to appreciate notably during this period. The price is anticipated to escalate from its valuation of approximately $10.58 in 2026 to an estimated $16.42 by 2030.

This bullish trend signals prospective growth, underpinned by the digital asset’s robust technological framework and its potential to foster a smart economy by facilitating the creation of digital assets and smart contracts. Investors and stakeholders should closely monitor the regulatory landscape and technological advancements, as these could serve as pivotal factors influencing NEO’s market dynamics and its long-term viability in the volatile cryptocurrency domain.

| Year | Average price | Year-End |

|---|---|---|

| 2026 | $26.94 | $29.28 |

| 2027 | $31.83 | $34.6 |

| 2028 | $37.6 | $40.87 |

| 2029 | $44.42 | $48.29 |

| 2030 | $52.5 | $57.09 |

Conclusion: Is NEO Coin Good Investments?

In 2024, the price is expected to range from $17.31 to $18.55. By 2025, it is predicted that the minimum NEO price will be around $30.74, the maximum could reach $37.23, and the average trading price will be around $31.83. By 2030, forecasts vary, but one agency suggests that the NEO price could reach $835.46.

Nevertheless, investors should proceed cautiously and closely monitor the regulatory environment and technological advancements that could significantly impact NEO’s market capitalization and overall stability in the volatile cryptocurrency market. While the general trend suggests an optimistic future for the coin, various forecasts emphasize that a comprehensive analysis should be conducted when trading in the cryptocurrency market.

FAQs on NEOUSD price prediction

On 08.07.2024, the NEO price is $9.61.

Predictions vary widely. However, if we consider all estimates of experts and investors, the NEO price may stand within the $70–$115 range.

NEO has growth potential due to its technological features such as low energy costs for mining, high transaction speed, and smart contracts.

With the current year’s setup, the price will rise and hit new all-time highs by the end of the year.

The NEO cryptocurrency is not “dead”. It is widely traded in the market and has a significant market cap.

Against Bitcoin’s rate appreciation, large investors started buying NEO, thereby increasing the value of the coin.

Price chart of NEOUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.