Decreasing political risks in Europe and growing interest in French assets deprive the franc of important growth drivers. Together with the SNB’s reluctance to intervene in the Forex market, these factors make the EURCHF bearish positions vulnerable. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The French political drama has come to an end.

- The franc was benefiting from the political turbulence.

- Now EURCHF bears are suffering.

- SNB may bring the pair to parity by cutting the rate.

Monthly fundamental forecast for franc

The victory of the New Popular Front in the French parliamentary elections has dealt a blow to the euro, forcing it to open with a gap against the world’s major currencies. The franc benefited the most. According to Thomas Jordan, the currency is a safe-haven asset, and the SNB must consider Europe’s political uncertainty. However, EURCHF bears’ excitement was short-lived, and the gap allowed traders to open more long trades, adding them to the ones initiated at 0.9615.

Thomas Jordan argues that the National Bank is comfortable with the current situation. The models show a decline in inflation to 1% by 2026, although consumer prices may accelerate in the third quarter of this year. The franc’s strength is among the main reasons. The currency gained against the political drama in France. As soon as the degree of political risks decreased, EURCHF quotes rose sharply.

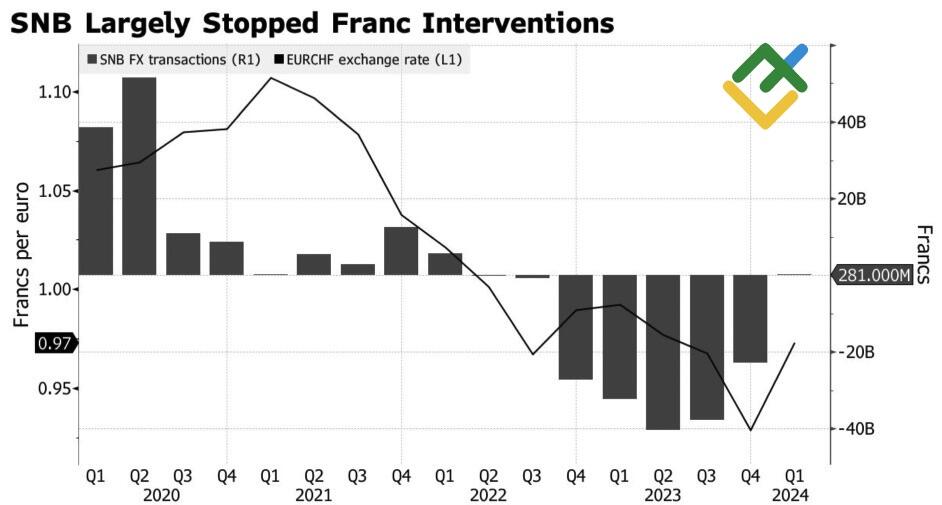

The SNB’s satisfaction with the franc’s rate is evidenced by the volume of its interventions in the Forex market. In October-December, the central bank sold foreign currency for 22 billion francs, and in January-March, it bought a modest 281 million francs.

SNB forex interventions

Source: Bloomberg.

In fact, the main reason for the EURCHF rally in January-May was the easing of the monetary policy by the National Bank. In March, the key rate was cut by 25 bps, which shocked investors. In June, Bloomberg experts were divided on whether the central bank should continue the cycle of monetary expansion, and it again reduced the cost of borrowing to 1.25%. As a result, the franc has joined the list of top outsiders among G10 currencies, and the imported inflation associated with its weakening allows the SNB to remain idle.

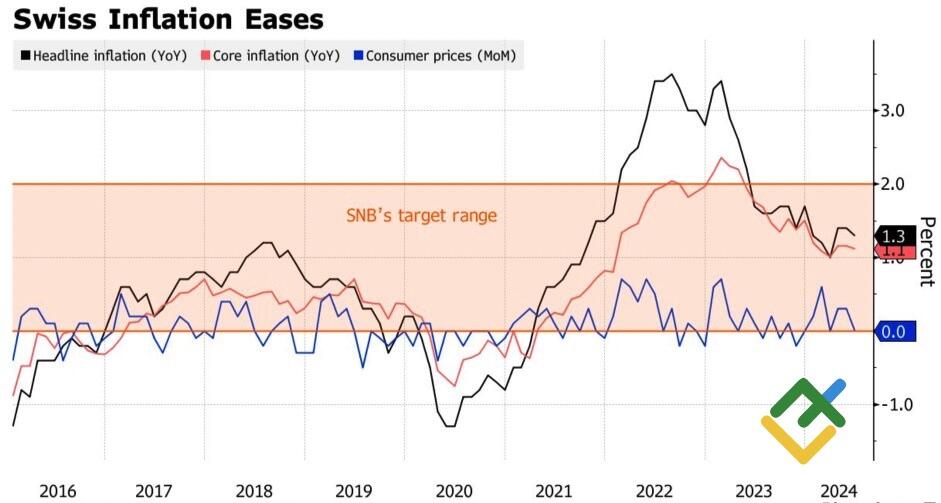

Indeed, Switzerland’s CPI accelerated from 1.3% to 1.4% y/y in May, the fastest pace of the indicator this year, driven mostly by import prices. Core inflation also exceeded the forecasts of Bloomberg experts, reaching 1.1%.

Switzerland’s inflation rate

Source: Bloomberg.

The indicators make the market bet on either one or two rate cuts before the end of 2024. The Swiss National Bank intends to do so at every meeting, given the forecast of a temporary acceleration in consumer prices in the third quarter, which will continue to put pressure on the Swiss franc.

Monthly trading plan for EURCHF

EURCHF purchases will be facilitated by the stabilization of the political situation in France, the growth of investors’ interest in this country’s undervalued assets due to the pre-election turbulence, and the ECB’s sluggishness in easing monetary policy. Therefore, long positions initiated at 0.9615 can be kept open. On pullbacks, one may open more long trades. The targets are at 0.99 and 1.002.

Price chart of EURCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.