The Reserve Bank of Australia has historically embraced the principle that consistent and gradual progress is often the most effective approach. However, it has recently encountered significant headwinds. High rates can severely damage the Australian economy, so they should be lowered. What are the implications of this for the AUDUSD pair? Let’s discuss this topic and make a trading plan.

Major Takeaways

- The RBA is ready to cut the key rate to 3.85%.

- The derivatives market expects three acts of monetary expansion in 2025.

- The base-case scenario assumes a hawkish cut.

- Long trades can be considered if the AUDUSD pair breaks through the resistance levels of 0.6435 and 0.646.

Weekly Fundamental Forecast for Australian Dollar

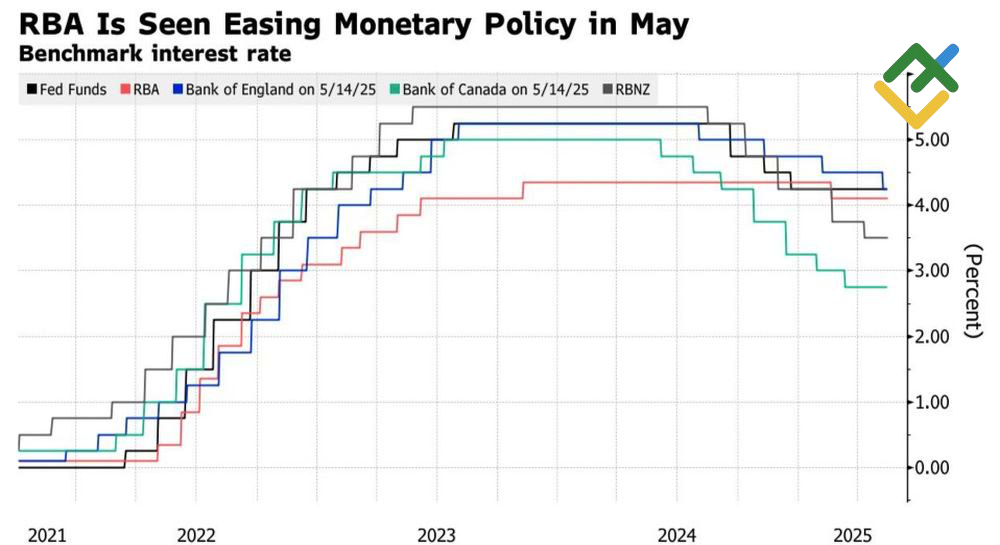

During the global monetary tightening cycle of 2022–2023, the Reserve Bank of Australia raised the interest rate extremely slowly compared to its counterparts, following the principle of “slow and steady wins the race.” Now that other regulators, led by the Fed, are pausing their monetary easing cycle, the RBA is forced to act aggressively. In Australia, the cash rate is higher than in Canada and New Zealand and roughly the same as in the US and the UK, which is bad news for the Australian economy.

Central Banks’ Interest Rates

Source: Bloomberg.

Investors anticipate a substantial 25-basis-point reduction in the cash rate to 3.85% at the upcoming May 20 meeting, as the current high cost of borrowing could damage GDP growth. In addition, core inflation has returned to the 2–3% range in the first quarter for the first time in three years. Meanwhile, the RBA is adopting a cautious stance, citing employment growth of 89,000 in April, a stagnant unemployment rate of 4.1%, and an acceleration in average wages from 3.2% to 3.4% in January–March 2025.

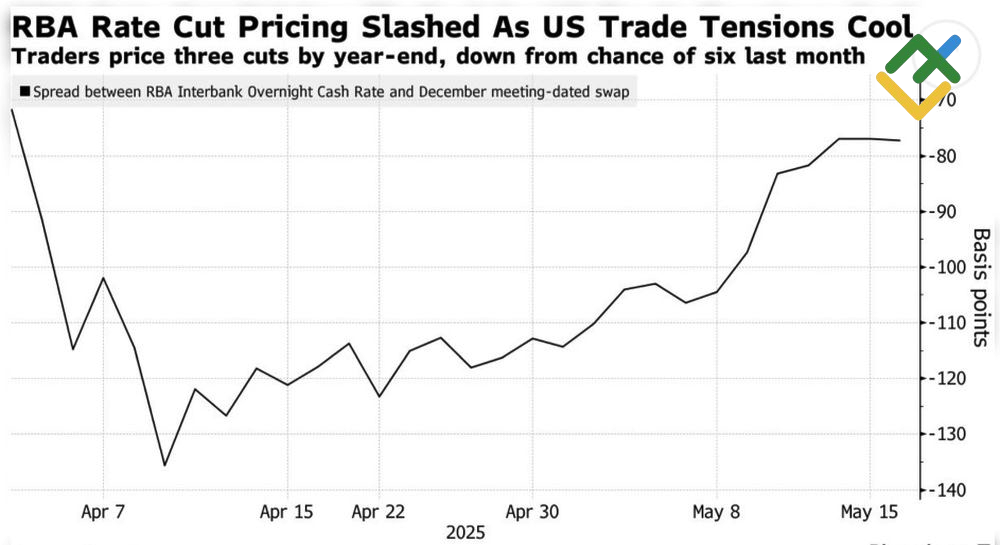

Michele Bullock will likely slash the cash rate, but the RBA will do everything possible to ensure that the derivatives market lowers its expectations for the scale of monetary expansion. Currently, the market bets on an 82 basis point decline in the key rate by the end of the year, which implies three acts of monetary expansion, with a possibility of a fourth.

Market Expectations on RBA Rate Cut

Source: Bloomberg.

On paper, this should support the AUDUSD pair. The Australian dollar will rise even more if the RBA follows the Fed’s lead and abandons the idea of lowering the cash rate, as Citi predicts. According to CIBC, the RBA is in a state of limbo, where it is difficult to make the right decision. Credit Agricole calls the current situation a Goldilocks scenario, requiring a hawkish cut.

The central bank’s decision in May is expected to trigger short-term increased volatility in the Australian dollar. The AUDUSD rate will continue to be driven by investor sentiment, with some investors previously reluctant to buy the US dollar now reevaluating their stance. The US administration is devising new reasons to fuel risk appetite. Still, sooner or later, the boundless imagination of the US government will cease to have the same effect on US stock indices.

Weekly AUDUSD Trading Plan

The main scenario suggests a continuation of capital outflows from North America to other regions, which should maintain the upward trend in the AUDUSD pair. In this regard, a cash rate cut followed by hawkish rhetoric from the RBA, or a so-called hawkish cut, will set the stage for buying the pair on a breakout of resistance levels of 0.6435 and 0.646, or if the price fails to fall below 0.64.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.