I welcome my fellow traders! I have made a price forecast for the USCrude, XAUUSD, and EURUSD using a combination of margin zones methodology and technical analysis. Based on the market analysis, I suggest entry signals for intraday traders.

Oil’s short-term uptrend continued yesterday.

The article covers the following subjects:

Major Takeaways

- USCrude: Oil prices are rising, testing the Target Zone 63.61 – 62.83.

- XAUUSD: Gold is declining within a short-term downtrend.

- EURUSD: The euro pulled back to resistance (А) 1.1214 – 1.1201 as part of a correction.

Oil Price Forecast for Today: USCrude Analysis

Oil’s short-term uptrend continued yesterday, and market participants pushed the price beyond the high of May 12. The Target Zone 63.61 – 62.83 was also tested. If this zone is broken out from below, the next upside target will be the Gold Zone 65.70 – 65.44.

If the sellers hold the Target Zone, we can expect a bearish correction, with prices potentially reaching support (А) 60.85 – 60.59 or support (В) 59.55 – 59.16. After these levels are tested, consider opening new trend-following long positions.

USCrude Trading Ideas for Today:

Buy near support (А) 60.85 – 60.59. TakeProfit: 62.03, 63.46. StopLoss: 60.07.

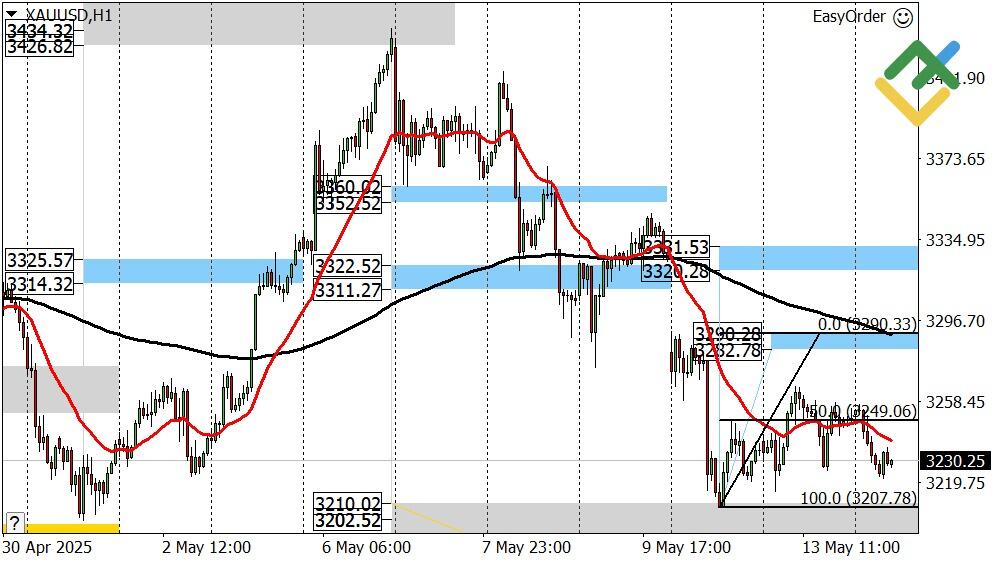

Gold Forecast for Today: XAUUSD Analysis

Gold continues to trade in a short-term downtrend. If the May 12 low is broken today, market participants will likely attempt a breakout below the Target Zone 3210 – 3187. If this zone is broken out to the downside, the next sell target will be the Gold Zone 3135 – 3127.

If a correction develops, the price may rise to resistance (A) 3290 – 3282 or resistance (B) 3331 – 3320. New shorts can be considered in those areas, with a key target at the low of May 12.

XAUUSD Trading Ideas for Today:

Sell near resistance (А) 3290 – 3282. TakeProfit: 3249 – 3207. StopLoss: 3305.

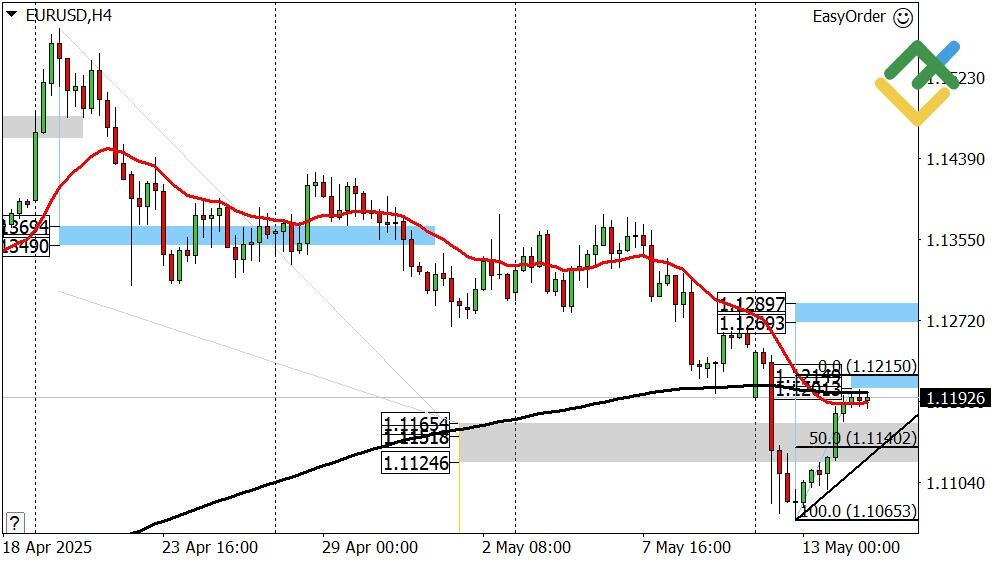

Euro/Dollar Forecast for Today: EURUSD Analysis

EUR/USD traders failed to break through the Target Zone 1.1165 – 1.1124 and settle below it. Instead, the price is rising and approaching the resistance zone (A) 1.1214 – 1.1201. The short-term trend remains bearish. Thus, after a test of resistance (A), consider selling the instrument, with the first target at 1.1140 and the second one near the May 12 low of 1.1065.

A breakout above resistance (A) may trigger a correction to the key resistance area at 1.1289 – 1.1269, where selling opportunities remain attractive.

EURUSD Trading Ideas for Today:

Sell near resistance (А) 1.1214 – 1.1201. TakeProfit: 1.1140, 1.1065. StopLoss: 1.1240.

Would you like to learn more about technical analysis methods and principles? Explore our comprehensive guide.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you”

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of USCRUDE in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.