The Japanese government and the Bank of Japan could have fueled a downtrend in USD/JPY by selling their $1.3 trillion treasury holdings and hiking rates. But Tokyo says it’s not the time. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Selling treasuries as a negotiation tool is off the table.

- The BoJ kept the overnight rate at 0.5%.

- Derivatives doubt further monetary tightening.

- USD/JPY’s failure to hold on to 144.5 will be a reason to sell.

Weekly Fundamental Forecast for Yen

Japan holds strong cards but isn’t ready to play them — at least not yet. Finance Minister Katsunobu Katō’s statement that Tokyo isn’t considering selling treasuries as a negotiation tactic with the U.S., combined with extending the timeline for hitting the 2% inflation target by a year, inspired USD/JPY bulls to counterattack. But their moment in the sun was short-lived.

Japan began talks with the U.S. to lift 24% tariffs on American imports. Based on Katō’s remarks, Washington wants lower non-tariff barriers and increased Japanese purchases of U.S.-made goods. The pressure was so intense that the finance minister briefly suggested Japan’s $1.13 trillion treasury holdings could be a negotiating tool, only to backtrack later.

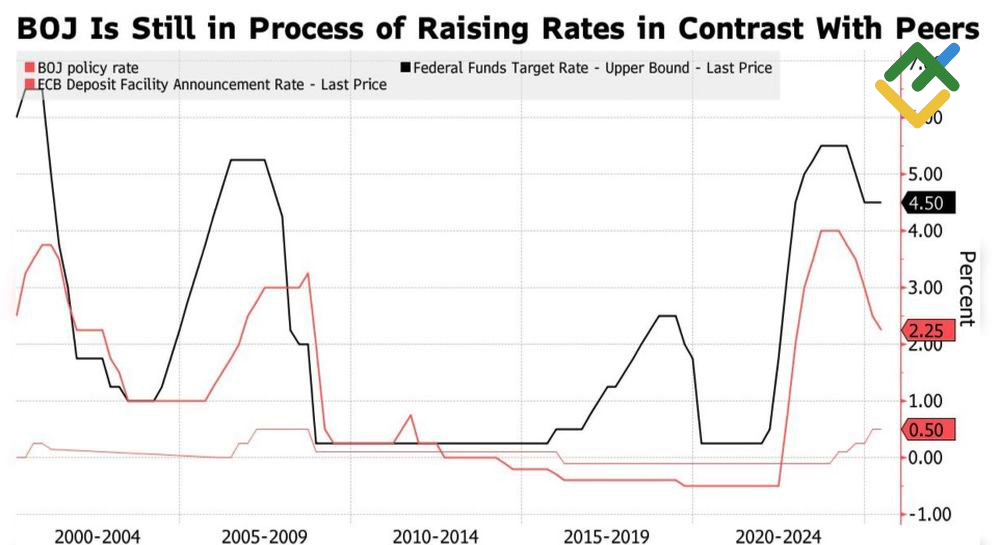

Central-Bank Rate Changes

Source: Bloomberg.

In 2024, the U.S. imported $150 billion in goods from Japan. Draconian tariffs would likely choke Japanese exports. That’s the view of the Bank of Japan, which decided to keep the overnight rate at 0.5% and more than halved its economic growth forecast, from 1.1% to 0.5%.

The timeline for sustainably hitting the 2% inflation target was also pushed from this financial year to the end of the next, paving the way for a USD/JPY surge. BoJ Governor Kazuo Ueda tried to soften the blow at a press conference, saying the revised outlook doesn’t rule out rate hikes in 2025. The futures market didn’t buy it, cutting the odds of even one tightening move this year from 100% to 36%.

Thus, Japan held back its trump cards. Selling treasuries would further ruin confidence in the U.S. dollar while triggering capital repatriation by Japanese residents. Raising the overnight rate would directly fuel a bearish USD/JPY trend due to monetary policy divergence. For context, the futures market expects the Fed to cut the federal funds rate by 83 basis points in 2025.

U.S. Economic Policy Uncertainty Dynamics

Source: Bloomberg.

Yet, the yen has more than a trump card — it has a joker. The U.S. dollar has passed its safe-haven status to the yen on Forex. Meanwhile, uncertainty around the White House’s protectionist policies persists, sustaining strong demand for safe assets.

Weekly Trading Plan for USD/JPY

I doubt Tokyo will sell treasuries, but it doesn’t need to for USD/JPY to resume its downtrend. The pair’s inability to return above resistance at 144.5 will signal bull weakness and will be a reason to sell.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.