The Reserve Bank of Australia has been increasing its interest rate too slowly. Inflation remains stubborn and does not slow down. It may be necessary to tighten the monetary policy again. Let’s discuss this topic and make a trading plan for AUDUSD.

Weekly Australian dollar fundamental forecast

During the recent weeks, it was recommended to buy the Australian dollar. However, the AUDUSD pair is trapped in a narrow trading range of 0.662-0.669. The aussie still has some trump cards, and bulls are waiting for the Fed to finally start hinting at a rate cut. The signal of a rapid rally could come as early as Friday this week.

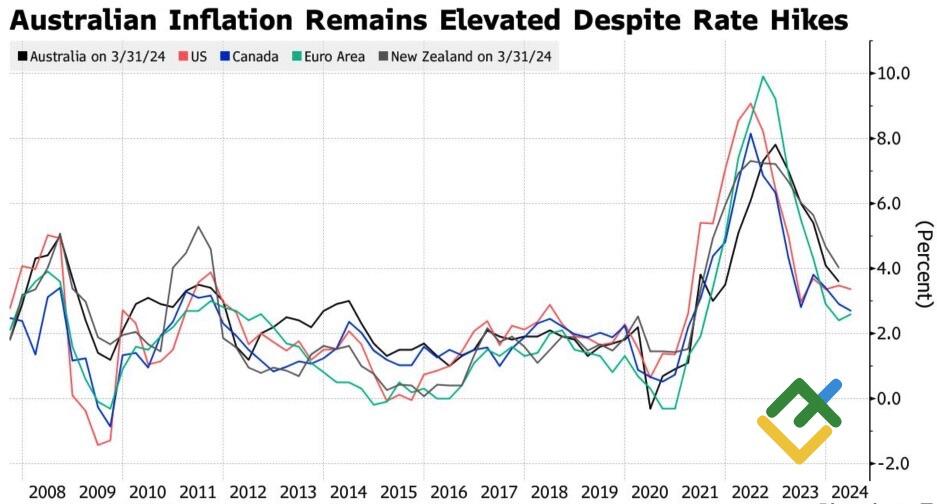

Caution during a monetary expansion cycle tends to strengthen currencies. However, excessive caution could turn into a longer struggle with inflation. The Reserve Bank of Australia has only raised the cash rate by 425 bps since May 2022. The regulator may have to increase the cost of borrowing to 5% from 4.35%, triggering a rally in the AUDUSD pair.

The main reasons are the strength of domestic demand and favorable external conditions for the export-oriented economy. Australia’s retail sales growth of 0.6% in May was twice as strong as forecast. The strong data helps explain why inflation accelerated to 4%. If it demonstrates growth in the second quarter, the RBA will have to raise the cash rate.

Inflation rate in Australia and other countries

Source: Bloomberg.

The futures market gives a 65% chance of a tightening this year and a 40% chance of a tightening in August. Positive statistics on the labor market, inflation, and retail sales allowed Bloomberg experts to revise their forecast. In May, they expected the cash rate to fall to 4.1% from 4.35%. In June, they are betting that the cost of borrowing will remain unchanged in 2024.

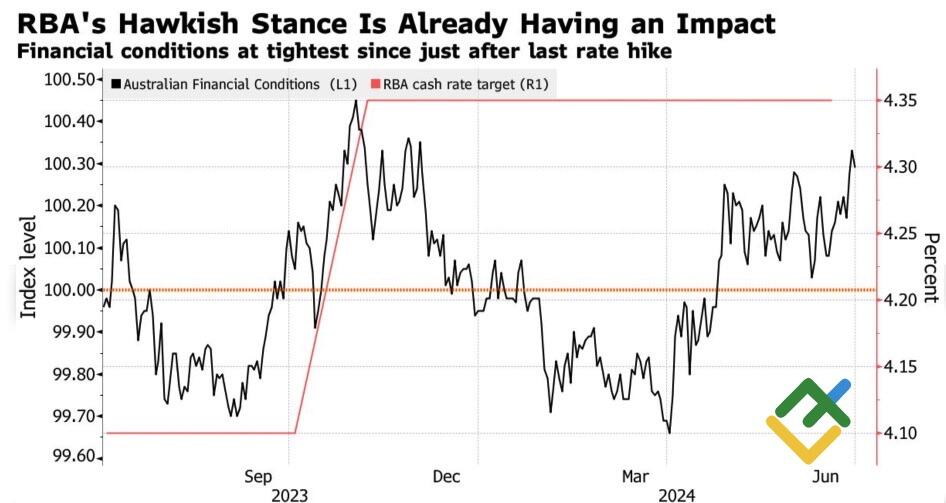

Australia follows a different path. The eurozone, Canada, Sweden, and Denmark have already cut rates, and Switzerland has done so twice. The US and UK are ready to ease. On the other hand, the RBA discusses issues of monetary restraint at its meetings. This is not surprising, as weakening financial conditions increase the risk of soaring inflation.

Financial conditions and cash rate in Australia

Source: Bloomberg.

Despite the short-term consolidation in the S&P 500, we will only be able to talk about a break in the uptrend if the United States faces a recession or the Fed suddenly raises interest rates. Otherwise, bulls will continue to control the stock index, which will keep global risk appetite high and create a tailwind for AUDUSD.

Meanwhile, the Chinese yuan dropped against the monetary policy divergence between the Fed and the People’s Bank of China. Once the Fed starts hints at rate cuts, the renminbi and its proxies will recover.

Weekly AUDUSD trading plan

Therefore, long trades on the AUDUSD pair can be initiated on pullbacks. A weak US Non-Farm Payrolls report for June could drive the pair above the 0.662-0.669 consolidation range, allowing traders to open more long trades with targets at 0.675 and 0.69.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.