The article covers the following subjects:

Major Takeaways

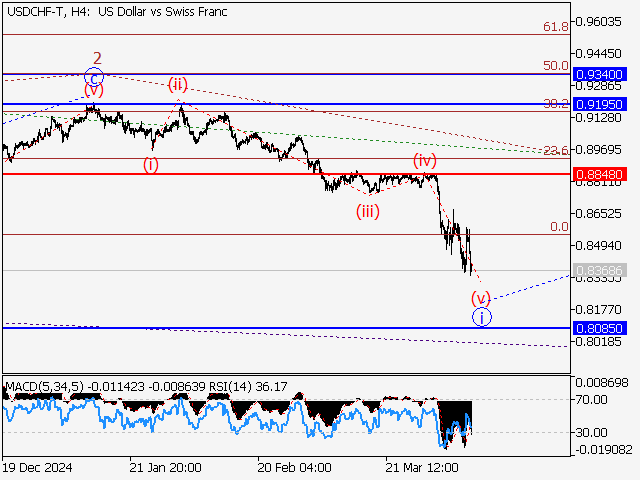

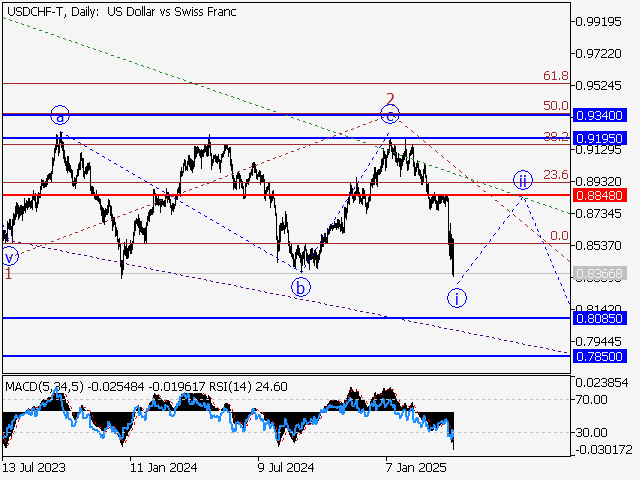

- Main scenario: Consider short positions from corrections below the level of 0.8848 with a target of 0.8085 – 0.7850. A sell signal: the price holds below 0.8848. Stop Loss: above 0.8880, Take Profit: 0.8085 – 0.7850.

- Alternative scenario: Breakout and consolidation above the level of 0.8848 will allow the pair to continue rising to the levels of 0.9195 – 0.9340. A buy signal: the level of 0.8848 is broken to the upside. Stop Loss: below 0.8810, Take Profit: 0.9195 – 0.9340.

Main scenario

Consider short positions from corrections below the level of 0.8848 with a target of 0.8085 – 0.7850.

Alternative scenario

Breakout and consolidation above the level of 0.8848 will allow the pair to continue rising to the levels of 0.9195 – 0.9340.

Analysis

The bearish fifth wave of larger degree 5 is developing on the weekly chart, with wave (5) of 5 forming as its part. Apparently, the bullish correction has finished developing as the second wave 2 of (5) on the daily chart, and the third wave 3 of (5) has started forming. The first counter-trend wave of smaller degree i of 3 is nearing completion on the H4 chart, with wave (v) of i of 3 forming as its part. If the presumption is correct, the USD/CHF pair will continue to drop to the levels of 0.8085 – 0.7850 once the local correction ii of 3 has finished developing. The level of 0.8848 is critical in this scenario. Its breakout will allow the pair to continue rising to the levels of 0.9195 – 0.9340.

This forecast is based on the Elliott Wave Theory. When developing trading strategies, it is essential to consider fundamental factors, as the market situation can change at any time.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.