Australia faces heavy tariffs that make little sense in its case. Coupled with global stock market sell-offs and the U.S.-China trade war, that makes the future of AUD/USD bleak. Will the Aussie find a way to fight back? Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The U.S. imposed tariffs despite a trade surplus with Australia.

- The U.S.-China trade war scares the Aussie.

- The Reserve Bank of Australia (RBA) won’t meet the derivatives market’s expectations.

- AUD/USD’s failure to hold on to 0.6235 is a reason to sell.

Weekly Fundamental Forecast for Australian Dollar

When someone’s actions lack logic, it’s wise to stay away. Donald Trump’s decisions, which often defy common sense, have pushed investors to turn away from anything American. Stock sell-offs resumed the day after the White House delayed tariffs, and bond sales sped up. Against this backdrop, attempts by AUD/USD bulls to recover look uncertain.

Australian Prime Minister Anthony Albanese said there’s no logic in U.S. import duties. Donald Trump set a 10% tariff rate on a country with which the U.S. has a trade surplus. In 2024, the U.S. exported $34.6 billion in goods to Australia and imported $16.7 billion. Investors didn’t expect such harsh measures from the White House, and their disappointment helped push AUD/USD to its lowest since the pandemic.

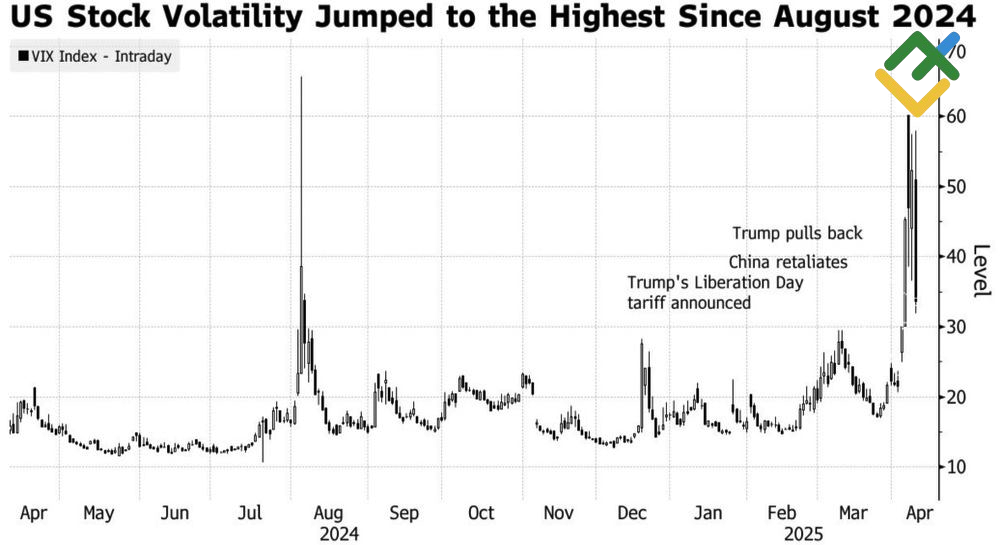

US Stock Market Volatility

Source: Bloomberg.

Other nails in the Aussie’s coffin include rising volatility in global stock markets — driven primarily by the U.S. — the ongoing U.S.-China trade war, and growing expectations of aggressive rate cuts by the Reserve Bank of Australia (RBA).

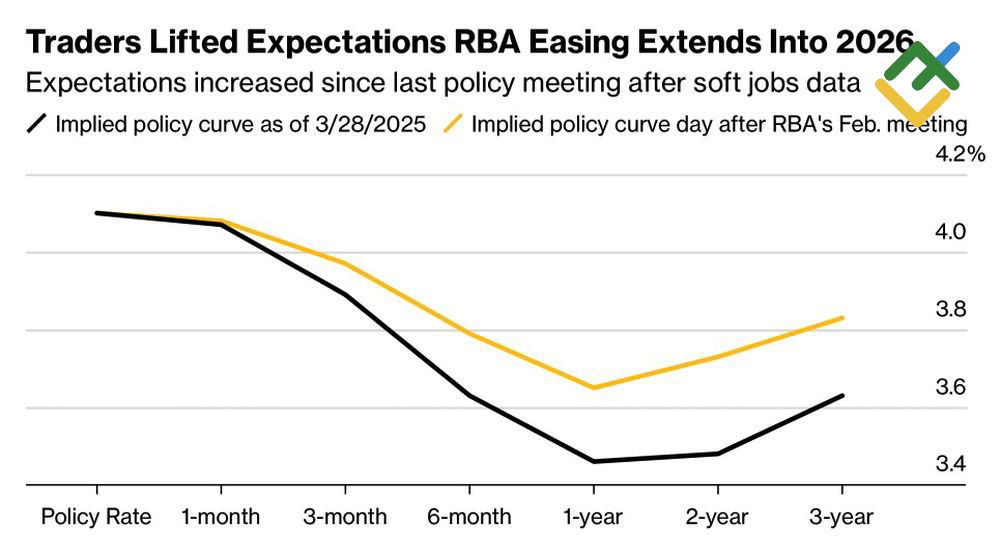

While the RBA held the cash rate steady at 4.1% in March, the fallout from the U.S.-China trade conflict is expected to slow down Australia’s exports and overall economic growth. It’s no surprise that the derivatives market keeps increasing its expectations for the extent of monetary easing, pointing to four rate cuts in 2025, with a 67% probability of a fifth. The odds of a 50-basis-point cut at the May 19-20 meeting are estimated at one in three.

Market Expectations for RBA Rates

Source: Bloomberg.

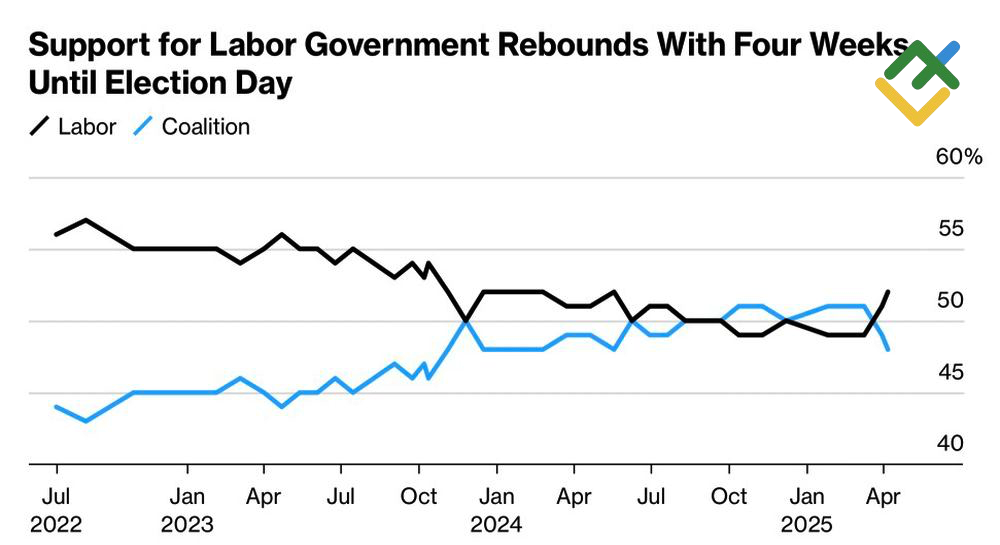

The upcoming parliamentary election, about four weeks away, could add pressure on the Aussie. However, the fact that the ruling Labor Party leads in polls supports AUD/USD more than it hurts its recovery.

Australian Political Party Ratings

Source: Bloomberg.

In my view, the RBA will ease monetary policy more slowly than markets expect, which could, in theory, support the Australian dollar. However, the U.S.-China trade war, the related drop in global risk appetite, and a cooling world economy will help AUD/USD bears pull the rope their way. Meanwhile, their opponents hope for continued capital flight from the U.S., which has already pushed the USD index to a six-month low.

Weekly Trading Plan for AUD/USD

With opposing forces at play, AUD/USD risks falling into mid-term consolidation between 0.595 and 0.63. If the bulls fail to hold at 0.6235, it’s a signal to sell.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.