If China’s retaliatory measures during the initial trade war bolstered the US dollar, this strategy might not be as effective in the current context. The loss of American exceptionalism will likely weaken the US dollar. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Investors do not believe in the White House’s strategy.

- China’s response to US tariffs has weakened the euro.

- The greenback cannot grow while the S&P 500 is falling.

- Long trades on the EURUSD pair can be opened if the pair rises above 1.1.

Weekly US Dollar Fundamental Forecast

Donald Trump hates it when the economy fails, but what is more important is that the White House finally achieved what it wanted, lowering Treasury bond yields. It does not really matter that the collapse is based on fear of an impending recession. The retreat of recession fears amid an unexpectedly strong US labor market report allowed EURUSD bears to push the major currency pair down.

Meanwhile, Scott Bessent anticipates a robust US dollar in the long term, while Pictet Asset Management forecasts a 10–15% decline in the USD index over the next five years. The Treasury Secretary has stated that there are no signs of a recession, while JP Morgan anticipates that the US economy may face a recession as early as 2025. At the same time, the firm has revised its GDP forecast from 1.3% to -0.3%.

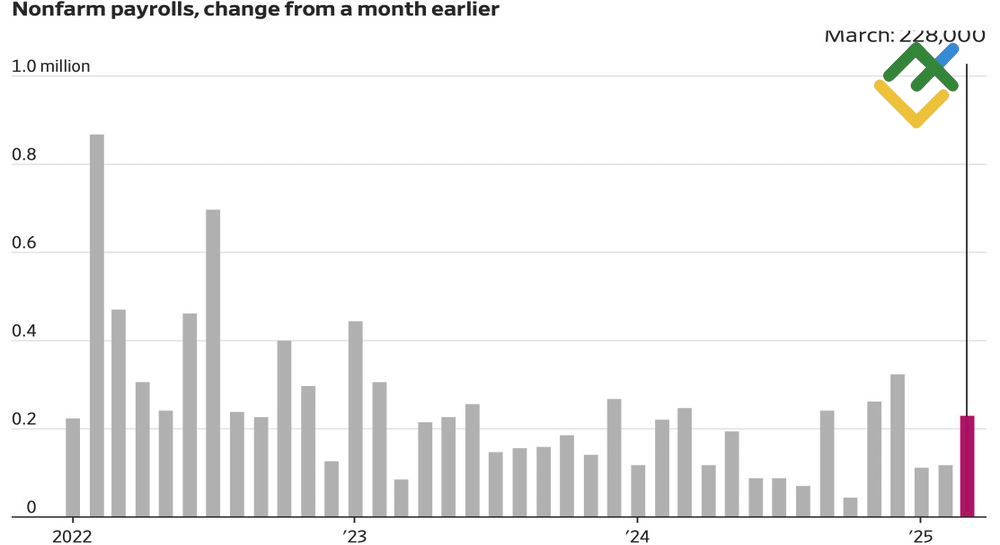

US Nonfarm Payrolls Change

Source: Wall Street Journal.

The White House has encouraged investors to maintain a bullish outlook, citing the significant 228,000 employment gain as a notable achievement. However, it is important to acknowledge the broader context. This figure was achieved prior to the announcement of tariffs by Donald Trump. Furthermore, the indicator for the previous months has been revised downward, and when combined with the rise in unemployment to 4.2%, the March report could be seen as the calm before the storm.

Nevertheless, this report generated optimism among EURUSD bears. Market concerns included the possibility of stagflation, a scenario characterized by a slowdown in economic growth coupled with high inflation. The market expected four acts of monetary expansion from the Fed in 2025. However, the actual outcome has been less severe than anticipated. Jerome Powell has consistently emphasized the need to move slowly. In a sharp comment, Donald Trump said that the Fed chairman was always “late” and called for a rate cut as soon as possible.

In addition, the EURUSD pair was under pressure from China’s announcement of 34% tariffs on US imports. The markets remember the first trade war when Beijing adopted a retaliatory stance but subsequently abandoned its confrontational approach. As a result, the yuan weakened by 10%, and the sentiment of retaliation exerted further downward pressure on it. A similar trend was observed in the euro.

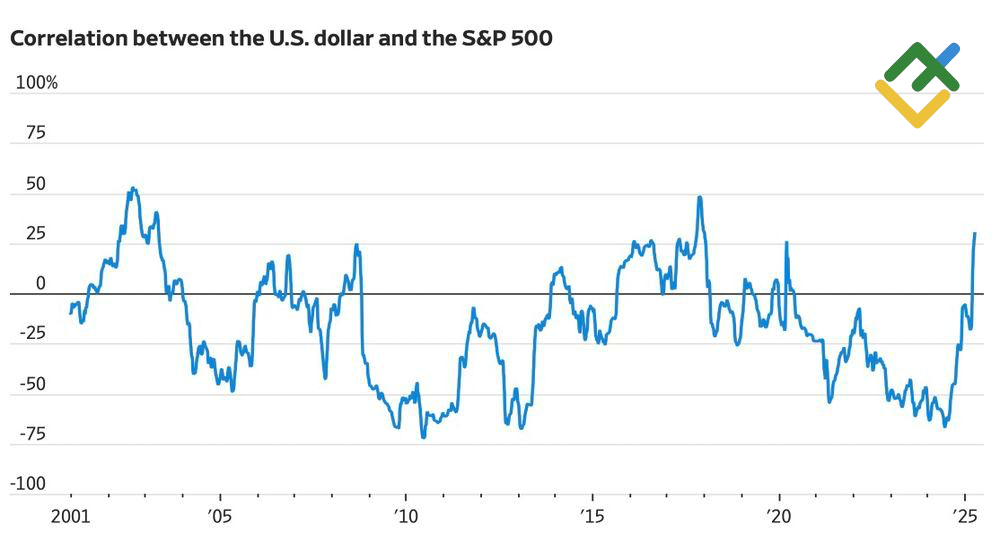

Correlation Between the S&P 500 and US Dollar

Source: Wall Street Journal.

The main issue lies in the fundamental difference between the current trade war and that of eight years ago. In the past, the US dollar was not facing the threat of losing credibility. It was not experiencing the same challenges related to its perceived status as a leading global currency, as demonstrated by the strengthening correlation between the USD index and the S&P 500. As long as the broad stock index remains in a downward trend, the outlook for a recovery remains favorable for bullish investors.

Weekly EURUSD Trading Plan

The strategy of selling the EURUSD pair at 1.105 has proven successful, but the continuation of the decline in the US stock market will allow traders to buy the euro again. The level of 1.1 offers the line in the sand. If bulls fail to push the quotes above this level, it may be profitable to consider short positions.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.