Concerns regarding US tariffs have triggered a silver rush. Flows of silver are heading to the US, but if tariffs are not imposed on the precious metal, the reverse process will begin. How will this affect XAGUSD quotes? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

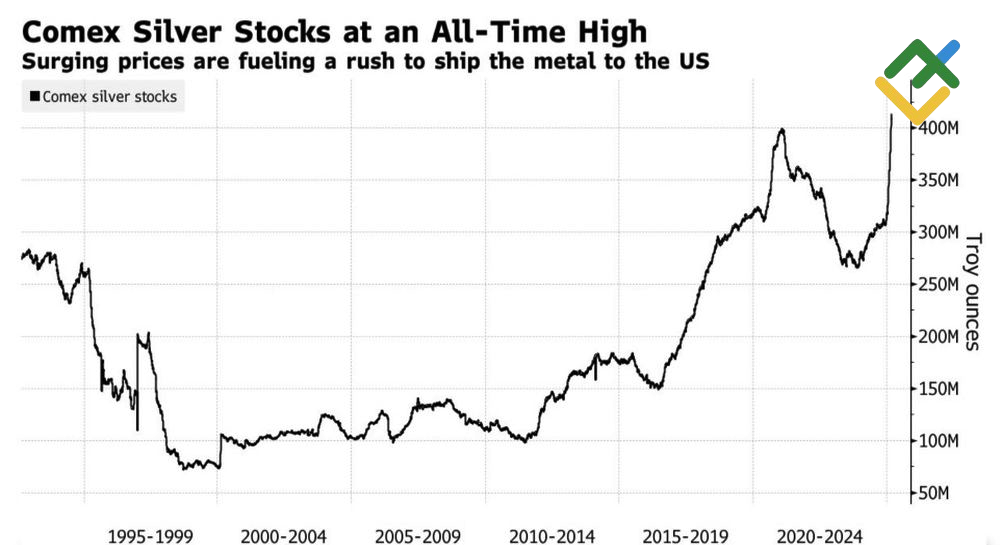

- Silver stocks on COMEX reached record levels.

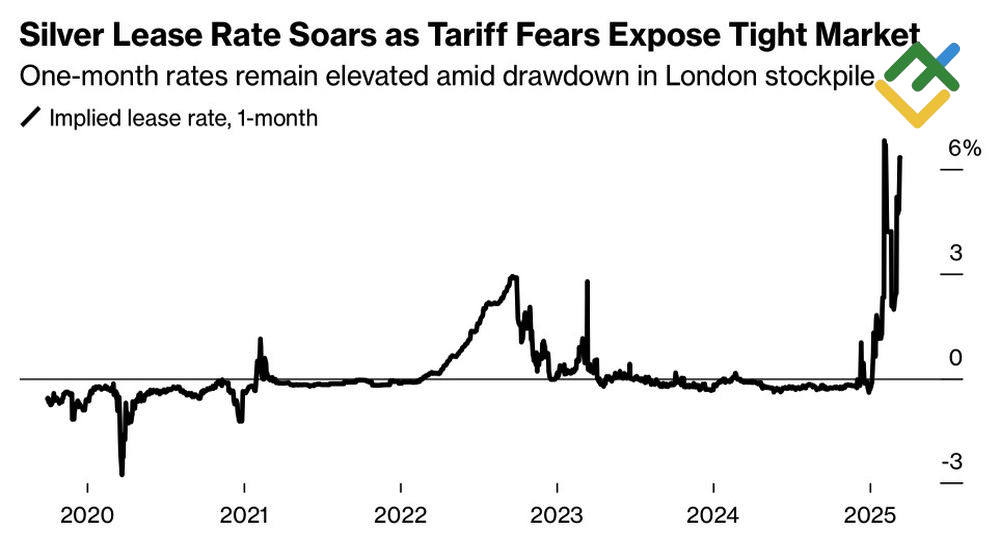

- Silver lease rates in London are growing rapidly.

- The XAGUSD performance will depend on US tariffs.

- Long trades can be considered as long as silver is trading above $32.8.

Weekly Fundamental Forecast for Silver

Donald Trump will reportedly impose duties on imports of other metals following steel and aluminum. Silver is being relocated from Europe to North America, and silver stocks on the COMEX are reaching record highs. Meanwhile, lease rates in London are increasing rapidly. As a result, prices are also soaring. Since the beginning of the year, XAGUSD quotes have increased by 17%. Notably, silver failed to outperform copper, which posted a 32% gain, but managed to surpass gold.

COMEX Silver Stocks Change

Source: Bloomberg.

In 2024, US silver production reached approximately 1,100 tons, while demand stood at 5,100 tons. The US is unable to cover its needs on its own. The majority of this white metal is imported from Mexico. Approximately 10% of the supply comes from Canada. Most likely, the US will exercise discretion in its tariff policies for silver shipments from neighboring countries to mitigate the potential economic impact on the US economy.

If the US opts not to impose tariffs on copper, it may have implications for the XAGUSD. Copper is the primary driver of the metals’ migration from Europe to North America. If this trend persists, it could potentially lead to a situation where US stocks exceed half of the global reserves. However, the country’s consumption of this metal stands at 10%. There is a high probability that the flows will reverse, and prices will plummet, putting pressure on gold and silver.

Lease Rate for Silver in London

Source: Bloomberg.

Along with the uncertainty around tariffs, XAGUSD bulls are supported by expectations of stagflation in the US economy and a high level of geopolitical risks. The ongoing conflict in Ukraine and the resumption of hostilities in the Middle East prompt investors to seek refuge in safe-haven assets such as precious metals.

As the US economy slows and prices rise, silver is in demand due to declining real yields on US Treasuries. While the white metal may not be able to compete with interest-earning assets, a decline in interest rates bodes well for XAGUSD quotes.

The pressure on silver is exerted by the fact that the US manufacturing sector fell below the critical 50 threshold, separating expansion from contraction. Given that about 50% of the demand for silver is driven by the industrial sector, the slowdown in the PMI is a negative indicator for XAGUSD bulls.

As a result, investments in silver are becoming increasingly binary in nature. If it is excluded from the list of tariffs, there is a high probability of a significant pullback in XAGUSD quotes. Otherwise, the price is expected to rise towards $36 and $37.5 per ounce.

Weekly Trading Plan for Silver

America’s Liberation Day, as designated by Donald Trump on April 2, is around the corner. As long as silver quotes are trading above $32.8 per ounce, traders can consider long positions. A decline below this level could trigger a significant pullback, prompting traders to open short positions.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.