After years of operating under the Admirals brand,

AMTS Solutions has taken a step toward independence. The management team, led

by industry veteran Dmitry Rannev, reportedly acquired a majority stake from

Admirals Group AS.

Speaking to Finance Magnates RU about the acquisition, Rannev

emphasized the company’s new direction. “We used to work mainly for

Admirals, without paying due attention to third-party clients, now we are

changing the course of development” he said.

With full control over its operations, AMTS Solutions

is now focusing on expanding its client base and offering trading technology to

a broader market.

Majority Buyout Reshapes AMTS Solutions’ Future

Estonia-based Admirals Group AS, controlled by

Aleksandr Tsikhilov and Dmitry Lausch, has been restructuring its business,

leading to the sale of its 62% stake in AMTS Solutions.

This opportunity was seized by AMTS management, with

co-founder Vitaly Myrsikov and technical director Yuri Kovalenko leading the

acquisition . AMTS Solutions gains full autonomy, with Rannev

holding 33% and Myrsikov increasing his stake to 5%. However, the financial

details of the deal remain undisclosed.

For nearly two decades, AMTS Solutions has built

trading technology but remained closely tied to Admirals. With its newfound

independence, the company is actively targeting a broader client base.

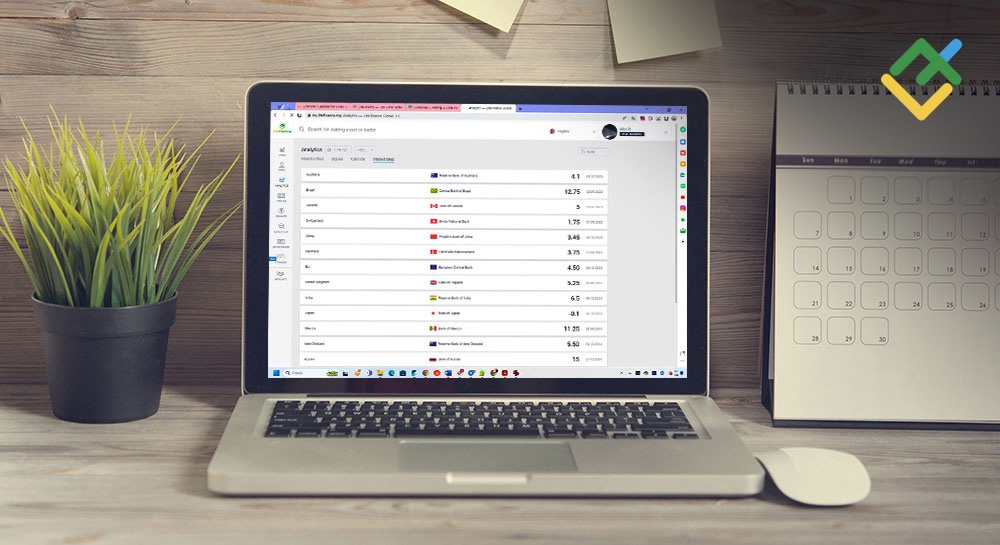

One of its key initiatives is a new web application

designed to help brokers administer their accounts more efficiently. Additionally, AMTS has introduced a high-quality

aggregated liquidity pool under the FSA (Seychelles) license of Rannev’s

brokerage, RannForex.

The company aims to attract brokers with competitive

pricing and no minimum monthly commission, an appealing offer for smaller

players in the industry.

Boosting Operational Capacity

Beyond these developments, AMTS continues to enhance

its technology stack. The firm’s software supports multiple liquidity

providers, flexible execution models (A/B-book or hybrid), risk management

systems, and advanced order execution features.

“We have been in this business for a long time,

have gone through all the pitfalls, and will be happy to pass on our experience

to brokers,” Rannev said. With a renewed focus on growth and innovation,

AMTS Solutions is positioning itself as a competitive force in trading

technology.

While this is a major turning point, it is not AMTS

Solutions’ first attempt at expansion. In 2020, the company introduced a range

of public products, including MetaTrader 5 gateways for liquidity providers.

After years of operating under the Admirals brand,

AMTS Solutions has taken a step toward independence. The management team, led

by industry veteran Dmitry Rannev, reportedly acquired a majority stake from

Admirals Group AS.

Speaking to Finance Magnates RU about the acquisition, Rannev

emphasized the company’s new direction. “We used to work mainly for

Admirals, without paying due attention to third-party clients, now we are

changing the course of development” he said.

With full control over its operations, AMTS Solutions

is now focusing on expanding its client base and offering trading technology to

a broader market.

Majority Buyout Reshapes AMTS Solutions’ Future

Estonia-based Admirals Group AS, controlled by

Aleksandr Tsikhilov and Dmitry Lausch, has been restructuring its business,

leading to the sale of its 62% stake in AMTS Solutions.

This opportunity was seized by AMTS management, with

co-founder Vitaly Myrsikov and technical director Yuri Kovalenko leading the

acquisition . AMTS Solutions gains full autonomy, with Rannev

holding 33% and Myrsikov increasing his stake to 5%. However, the financial

details of the deal remain undisclosed.

For nearly two decades, AMTS Solutions has built

trading technology but remained closely tied to Admirals. With its newfound

independence, the company is actively targeting a broader client base.

One of its key initiatives is a new web application

designed to help brokers administer their accounts more efficiently. Additionally, AMTS has introduced a high-quality

aggregated liquidity pool under the FSA (Seychelles) license of Rannev’s

brokerage, RannForex.

The company aims to attract brokers with competitive

pricing and no minimum monthly commission, an appealing offer for smaller

players in the industry.

Boosting Operational Capacity

Beyond these developments, AMTS continues to enhance

its technology stack. The firm’s software supports multiple liquidity

providers, flexible execution models (A/B-book or hybrid), risk management

systems, and advanced order execution features.

“We have been in this business for a long time,

have gone through all the pitfalls, and will be happy to pass on our experience

to brokers,” Rannev said. With a renewed focus on growth and innovation,

AMTS Solutions is positioning itself as a competitive force in trading

technology.

While this is a major turning point, it is not AMTS

Solutions’ first attempt at expansion. In 2020, the company introduced a range

of public products, including MetaTrader 5 gateways for liquidity providers.

This post is originally published on FINANCEMAGNATES.