Markets expect the Fed to cut interest rates by 70 basis points in 2025, while the Bank of Japan is considering rate hikes from 0.5% to 1.25%. This anticipated divergence in monetary policy will likely drag the USDJPY pair down. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The yen has become sensitive to Japan’s economic data.

- The yield differential defines the USDJPY pair’s trajectory.

- Lower US tariffs will likely weaken the US dollar.

- Short trades opened on a rebound from 150.75 should be kept open.

Weekly Fundamental Forecast for Yen

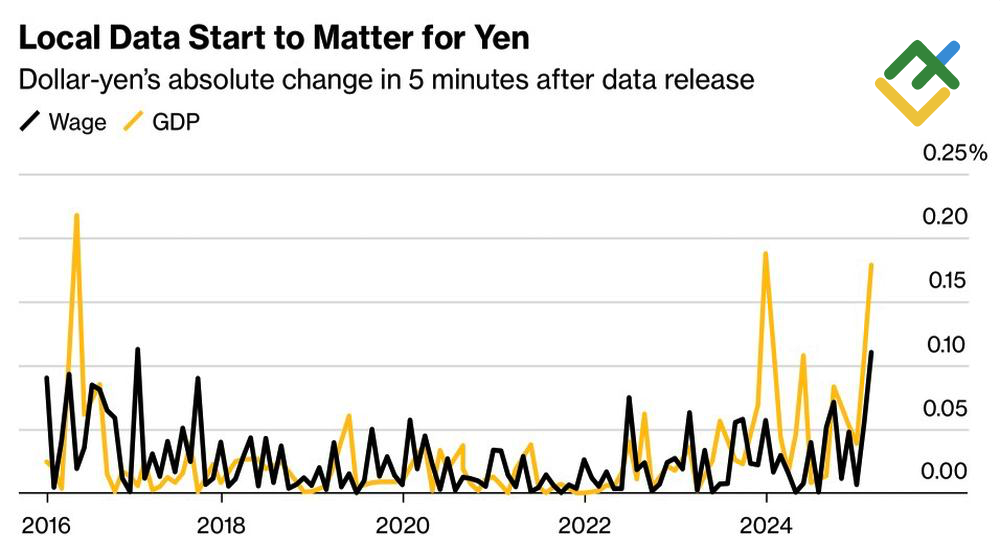

For years, the yen remained unresponsive to Japanese macroeconomic statistics, while the USDJPY pair exhibited notable sensitivity to US reports and Treasury yields. In 2025, a significant shift occurred, marked by a reaction to Tokyo’s wage, GDP, and inflation data that signaled the pair’s highest sensitivity since at least 2016. Notably, the divergence in monetary policy is at the core of this transformation.

Yen’s Performance Following Japan’s Macro Statistics

Source: Bloomberg.

Consumer prices in Tokyo, a leading indicator for the national CPI, slowed from 2.5% to 2.2% in February, more than the forecast of 2.3%. According to Sony Financial Group, this suggests that an overnight rate hike is not imminent. However, Japanese inflation is higher than in Tokyo, having accelerated to 3.2% in January.

The derivatives market is confident that the Bank of Japan will tighten monetary policy by September, with a 50% likelihood of the central bank taking the next action in June. Bloomberg experts concur with this estimate, while Capital Economics anticipates that Kazuo Ueda will initiate this move earlier at the April 30–May 1 meeting. By early 2026, they foresee that the overnight rate will be increased from 0.5% to 1.25%.

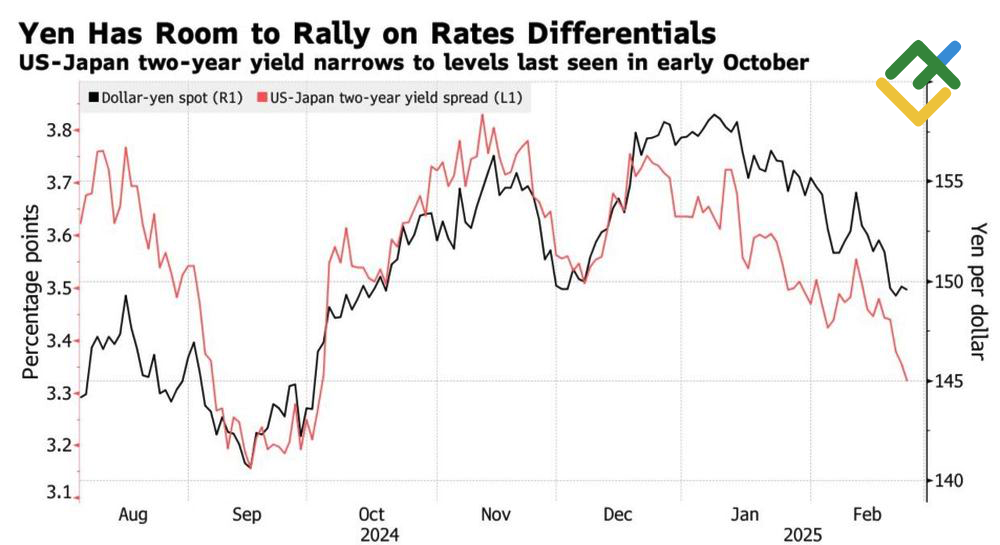

The Bank of Japan’s ongoing normalization cycle, coupled with positive economic data, is driving local bond yields higher and reducing the rate differential with their US counterparts. This process is underpinning the USDJPY correction within the general uptrend. Against this backdrop, the correction may become the onset of a global downtrend.

USDJPY Rate and US-Japan Yield Spread

Source: Bloomberg.

Signs of a cooling US economy and the White House’s desire to see lower Treasury yields add to the US dollar’s slide against the Japanese yen. According to Treasury Secretary Scott Bessent, the US dollar’s decline, along with the decline in mortgage rates, indicates that inflation will likely slow to 2% in the near future.

In this context, the greenback might be supported by tariffs against Mexico and China, the postponement of which is set to expire in early March. However, Mexico’s compliance with Washington’s import duty demands against China could postpone tariffs again, potentially fueling a sell-off in the USDJPY pair. Tariffs could spur US inflation, but if not, the Fed may shift to a more accommodating monetary policy sooner than anticipated, which would be unfavorable for the US dollar.

Weekly USDJPY Trading Plan

In light of these considerations, it is strategically sound to keep your short positions initiated on a rebound from the resistance level of 150.75 open. Should Donald Trump adopt more moderate protectionist policies, the USDJPY pair may slump to 147.5 and 145.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.