Litecoin (LTC) cryptocurrency was created in 2011 by former Google employee Charlie Lee. Litecoin is based on the Bitcoin (BTC) protocol code, featuring a faster blockchain and lower reward per block.

LTC ranks among the top 10 cryptocurrencies, second only to Bitcoin. These two digital assets are often compared: if Bitcoin is the “crypto gold,” then Litecoin is the “silver.” This is probably why the coin manages to attract investor interest, and its price and market cap remain high even in times of market downturns.

This article offers thorough Litecoin price forecasts for 2024 and beyond. Based on the analysis, you will find out what the price of LTC will be in 2030, 2040, and even 2050. How deep may Litecoin plunge in the medium and long term, or, on the contrary, is it poised to exhibit considerable and stable growth? Technical analysis tools, fundamental indicators, and expert forecasts will give us the answers.

The article covers the following subjects:

Key Takeaways: Litecoin Price Prediction 2024-2030

- The Litecoin current price for today 01.07.2024 is 74.63 USD.

- Litecoin is among the top 20 cryptocurrencies by market cap. The coin’s blockchain is faster than that of Bitcoin, and the transaction fee is around $0.01. These factors, combined with the prospects of Litecoin ETFs and founder of Litecoin Charlie Lee’s significance are fueling interest in the asset, allowing many to be optimistic about Litecoin’s prospects.

- Market supply and demand, competition, market sentiment, regulatory news and related ETFs, macroeconomic news, geopolitics, blockchain improvement activities, Charlie Lee activities are among key factors influencing LTC rates.

- Analysts and crypto traders make moderately optimistic forecasts. In 2024, LTC is expected to grow moderately. A negative scenario implies a slight decline, which will be recovered by the end of the year.

- Some analysts are predicting that Litecoin’s average price will continue to move sideways in 2025. Other analysts predict Litecoin to soar rapidly.

- Due to its price cycles usually developing 2–3 years each, the price of Litecoin may experience two cycles of growth and decline by 2030. Experts make optimistic forecasts for 2024 – 2030 if the periodic fluctuations of the exchange rate are excluded.

Despite the obvious connection between LTC and BTC, predictions for the future of Litecoin are not as encouraging. At the end of 2023, the cryptocurrency performed worse than the crypto market in general and gradually became cheaper relative to Bitcoin. Considering the Litecoin price predictions 2024, it makes sense to buy it in the short term only for speculative purposes to make money on the high volatility of the asset.

Litecoin Price Forecast for Today, the Coming Days and the Week: Wave Analysis as of 01.07.2024

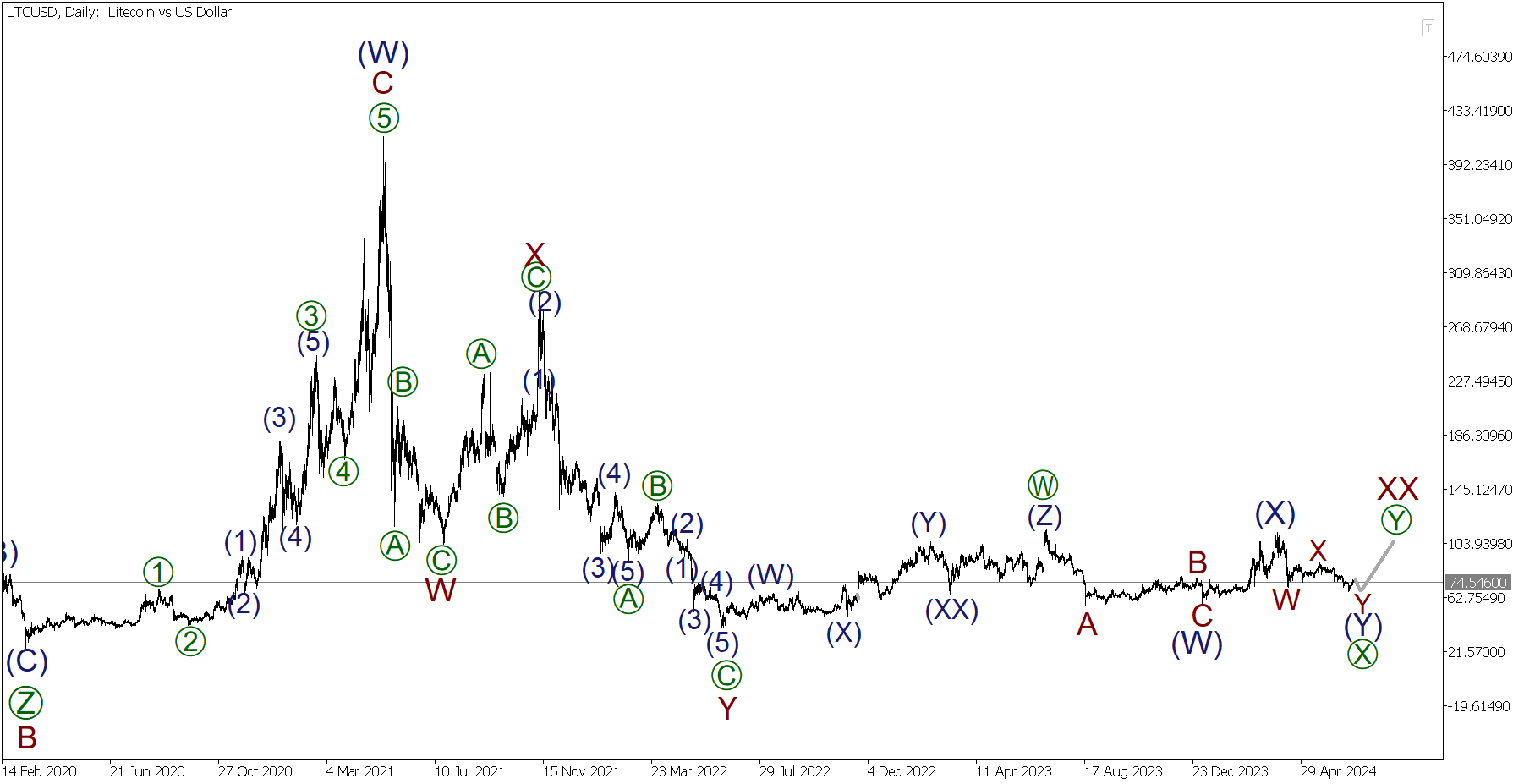

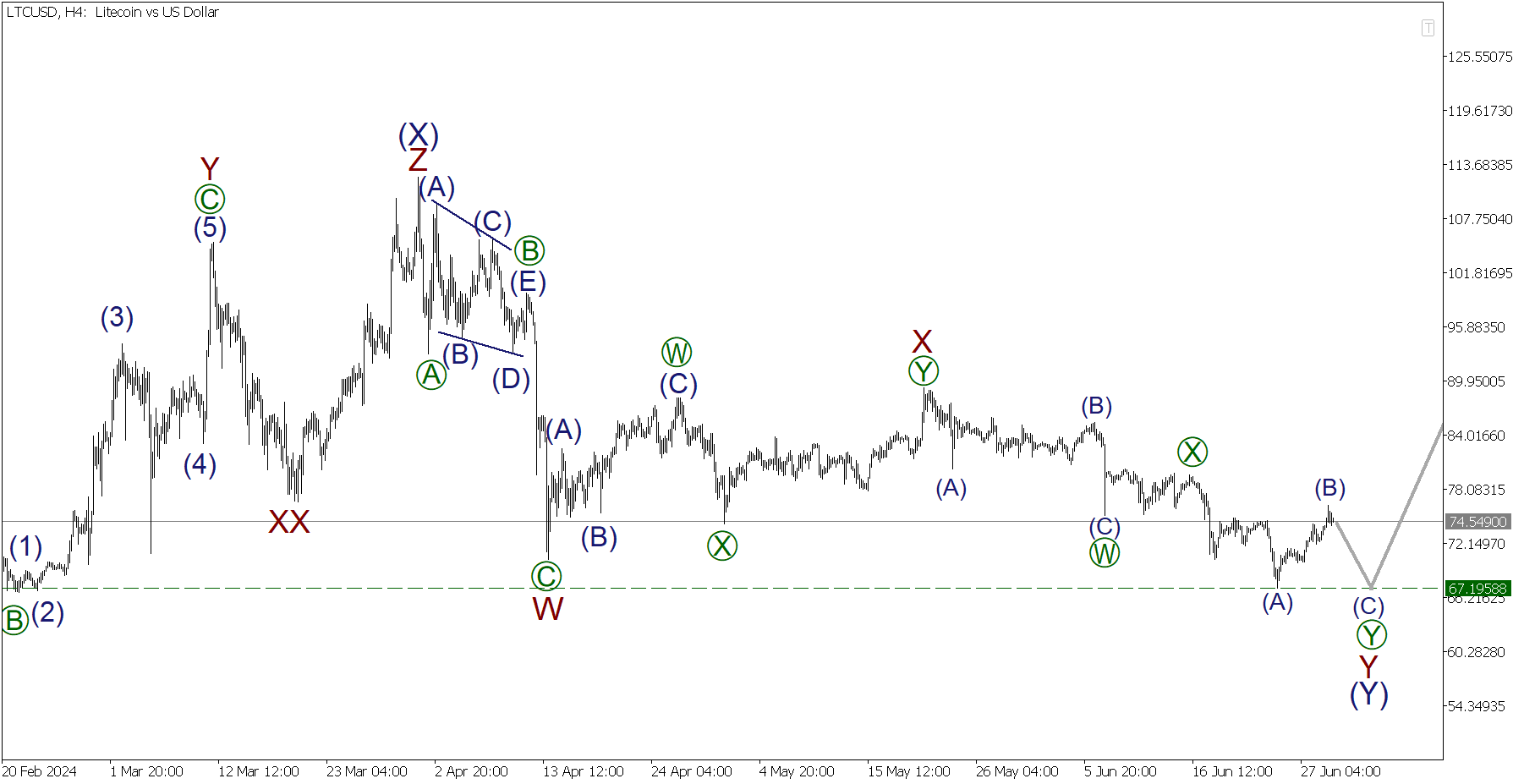

The LTCUSD is forming a global double zigzag (W)-(X)-(Y). The market is falling in the linking wave (X), likely unfolding as a triple zigzag W-X-Y-XX-Z. Sub-waves W-X-Y must have finished, and the linking wave XX is currently unfolding as a double three [W]-[X]-[Y]. The motive wave [W] represents a triple zigzag. The final part of the linking wave [X] is currently forming. Let us analyze the market situation in more detail on the H4 time frame.

The linking wave [X] may form a double zigzag (W)-(X)-(Y). The first two parts of the pattern have been finished. The final motive wave (Y) may complete as a double zigzag W-X-Y. The sub-waves W and X, a zigzag, and a double zigzag have been formed. The final motive wave Y is taking the shape of a double zigzag [W]-[X]-[Y] of a lower degree. The impulse wave A and correction B have ended within wave [Y]. In the short term, the price is likely to decline to 67.19 within the impulse wave (C).

Weekly LTCUSD trading plan:

Sell 74.54, TP 67.19

LTCUSD Elliott wave analysis is presented by an independent analyst, Roman Onegin.

Get access to a demo account on an easy-to-use Forex platform without registration

Litecoin Price Predictions for 2024 by Crypto Experts

Let’s examine crypto experts’ opinions from public sources to get the latest updates on Litecoin price prediction for 2024.

Binance

Analysts and participants of the cryptocurrency exchange Binance do not expect serious changes in the LTC price in 2024. In their view, Litecoin may see only a slight price gain. The cryptocurrency may close with a slight shift from the current price of $81.11 in December 2024. In other words, LTC will likely move sideways this year.

Changelly

Changelly analysts are also cautious when estimating the future price of Litecoin. The minimum price during the year is unlikely to fall below $75, while the expected maximum price for December 2024 will be around $91. Quotes are expected to post steady gains until mid-summer, after which the average price will likely decline until the year-end. The Litecoin price forecast in US dollars suggests that Litecoin will trade around $81.66 at the end of December. You can find more details in the table below.

| Month | Minimum price, $ | Average price, $ | Maximum price, $ |

|---|---|---|---|

| June | 81.67 | 86.91 | 92.14 |

| July | 82.93 | 86.01 | 89.08 |

| August | 80.48 | 85.38 | 90.28 |

| September | 79.89 | 84.31 | 88.72 |

| October | 80.65 | 85.50 | 90.35 |

| November | 79.63 | 85.27 | 90.91 |

| December | 75.17 | 81.66 | 88.15 |

Gov Capital

According to Gov Capital experts, the average price of Litecoin will plummet shortly. In 2024, quotes may plunge by more than 50%. By the end of the year, the maximum price may reach $35, and the average price will likely stand near $30.5.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| June | 16.55 | 19.47 | 22.39 |

| July | 20.35 | 23.95 | 27.54 |

| August | 19.78 | 23.27 | 26.76 |

| September | 15.18 | 17.86 | 20.54 |

| October | 29.32 | 34.5 | 39.67 |

| November | 42.48 | 49.98 | 57.47 |

| December | 25.98 | 30.57 | 35.16 |

CryptoPredictions

CryptoPredictions released a forecast on Litecoin for 2024 and beyond. The price may trade below 2023 levels. The expected minimum price of LTC is $71.30, while the average price is $83.90. By the end of 2024, the maximum price is anticipated at $104.86. The table below shows the maximum and minimum prices for each month of 2024.

| Month | Low, $ | High, $ | Average, $ |

|---|---|---|---|

| June | 71.314 | 104.874 | 83.899 |

| July | 71.322 | 104.885 | 83.908 |

| August | 71.326 | 104.892 | 83.913 |

| September | 71.327 | 104.893 | 83.914 |

| October | 71.325 | 104.890 | 83.912 |

| November | 71.319 | 104.881 | 83.905 |

| December | 71.311 | 104.869 | 83.895 |

PricePrediction

PricePrediction analysts have released an upbeat forecast. The average price will grow throughout 2024. The coin will trade at an average of $107 in December. The minimum price at that time will be around $104, and the maximum price is estimated at around $116.

WalletInvestor

Analysts at WalletInvestor do not predict a rosy future for Litecoin. They expect LTC to drop by more than 20% to $52 by the end of 2024, and the coin may fall to $35-$45 in the fall. However, WalletInvestor’s price analysis includes an optimistic scenario where the maximum price will reach $117 by the end of the year.

| Month | Average, $ | High, $ |

|---|---|---|

| June | 58 | 105 |

| July | 63 | 97 |

| August | 57 | 98 |

| September | 55 | 84 |

| October | 58 | 92 |

| November | 65 | 95 |

| December | 65 | 117 |

DigitalCoinPrice

The Litecoin price forecast by DigitalCoinPrice is moderately optimistic. In 2024, the price is expected to double to $136. The highest price is limited to $143. In a negative scenario, by the end of 2024, Litecoin will cost only $58.

CoinPriceForecast

CoinPriceForecast analytics, like most other forecasts, assumes a stable bullish trend in the coming years. It is expected that by mid-2024, the price will fluctuate around $84, and by December it will increase by another $4-$5 with a total increase of 35% to current values.

LTC Price Prediction 2025 by Crypto Experts

When making long-term price forecasts, it is important to consider the opinions of acknowledged public experts, as they can greatly influence market expectations and market behavior. In addition, significant discrepancies between your forecast and others may indicate errors. Let’s take a look at professional analytics and consider expert Litecoin price predictions 2025.

Binance

The Litecoin price forecast 2025, according to Binance, assumes that the price trend will not undergo major changes. As part of their forecast model, crypto exchange experts expect an average price of $68 per coin.

Changelly

Based on the technical analysis of the Changelly portal, the Litecoin maximum price in 2025 could reach $194. Its minimum price in the same period is expected to be around $160, and the average price is $165.

| Month | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| January | 113 | 117 | 134 |

| February | 118 | 121 | 140 |

| March | 122 | 125 | 145 |

| April | 126 | 130 | 151 |

| May | 131 | 134 | 156 |

| June | 135 | 139 | 161 |

| July | 139 | 143 | 167 |

| August | 143 | 147 | 172 |

| September | 148 | 152 | 178 |

| October | 152 | 156 | 183 |

| November | 156 | 161 | 188 |

| December | 160 | 165 | 194 |

Gov Capital

Gov Capital prediction sees that LTC will grow during 2025. Based on the most pessimistic estimates, the price of the coin will be about $133. The maximum LTC price is expected to be around $180, and the most likely average price is around $157.

TradingBeasts

The 2025 price forecast for the LTCUSD by TradingBeasts is not particularly optimistic. It is expected that the weighted average price for Litecoin will actually remain at the level of 2024, decreasing only slightly – from $73 to $72. The minimum price of Litecoin can be traded within $61, and the maximum price level should be around $90.

| Month | Low, $ | High, $ | Average, $ |

|---|---|---|---|

| January | 62 | 91 | 73 |

| February | 62 | 91 | 73 |

| March | 62 | 91 | 73 |

| April | 62 | 91 | 73 |

| May | 62 | 91 | 73 |

| June | 62 | 91 | 73 |

| July | 62 | 91 | 73 |

| August | 61 | 91 | 72 |

| September | 61 | 91 | 72 |

| October | 61 | 90 | 72 |

| November | 61 | 90 | 72 |

| December | 61 | 90 | 72 |

PricePrediction

When making their LTC price forecast 2025, PricePrediction experts proceeded from the assumption that the cryptocurrency market will begin to recover in the coming years. Therefore, the price and market cap of Litecoin and other cryptocurrencies will increase. By the end of 2025, the minimum and maximum prices of the coin are projected to be around $131 and $159, respectively. The expected average price could be $134.

WalletInvestor

The Litecoin price fprediction 2025 by WalletInvestor predicts a serious drawdown in value. In the worst months, the average transaction price can reach $7-8 per coin. By the end of the year, LTC will regain some of its lost positions and reach an average price of $30. An optimistic development of events – by the end of 2025, Litecoin is expected to be trading at around $93.

| Month | Average, $ | High, $ |

|---|---|---|

| January | 36 | 99 |

| February | 48 | 105 |

| March | 38 | 97 |

| April | 47 | 111 |

| May | 27 | 88 |

| June | 20 | 82 |

| July | 15 | 80 |

| August | 16 | 77 |

| September | 7 | 11 |

| October | 8 | 70 |

| November | 13 | 71 |

| December | 30 | 93 |

DigitalCoinPrice

This Litecoin price forecast for 2025 actually does not leave the coin a chance for a bearish trend, because the minimum limit was determined by experts at $139. That is, DigitalCoinPrice considers the optimistic scenario to be the most likely. The weighted average price by the end of the year is estimated at $168, and the record high is $169.

CoinPriceForecast

According to the CoinPriceForecast crypto forecast, in 2025, the growth of Litecoin should accelerate. By the summer, LTC will trade at $95, after which growth will slow down, and by December, the price will be around $97. Relative to the current price, the total increase by the end of 2025 will be 48%.

Litecoin Technical Analysis

Like other cryptocurrencies, LTC exhibits increased price volatility. Hence, it is possible to gain profits from trading even on a M1 time frame, benefiting from intraday price spikes and plunges.

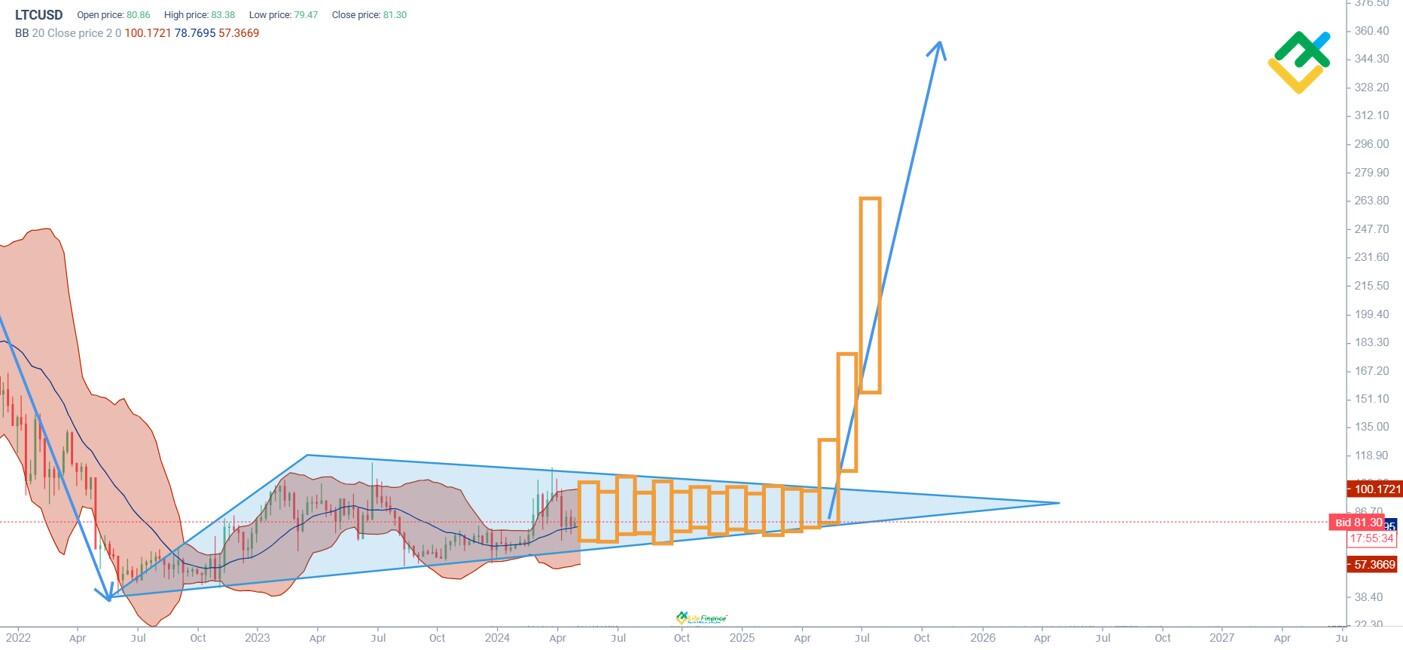

Consider Litecoin’s price movement over the past years when conducting a long-term technical analysis. The above chart shows that LTC moves mainly sideways within a wide channel. When analyzing long-term charts, applying the Fibonacci indicator to them is helpful. With this indicator plotted on the chart, you can identify all significant support and resistance levels.

Keltner channels or envelopes are also very handy in volatile charts. Channel indicators can help even novice traders determine the presence and strength of a trend and identify possible entry and exit points.

At the same time, you can use Bollinger Bands (BB), looking for M- and W-shaped patterns to find reversal points and build a Litecoin forecast.

Another useful indicator is the Parabolic SAR (Stop and Reverse). It is perfect for setting Stop-Loss levels and marking the moment of trend reversal on the Litecoin price chart. Compared to other trend indicators, it stands out for its minimal lag.

Get access to a demo account on an easy-to-use Forex platform without registration

LTC Forecast For Next Three Months

In the short term, it is also essential to understand the general trends that determine the direction of price movement for months and even years ahead. On the weekly chart, an upward trend began in the summer of 2022. The price gradually moved from the lower to the upper border within the Fibonacci channel. At the end of March, the asset bounced from the 0.5 level and began to decline, breaking the 0.38 and 0.236 levels. From a technical point of view, the LTC price is unlikely to showcase a bullish trend in the coming months. The price will likely continue to move sideways, testing the main trend line. On the above chart, a red arrow points to it. At the same time, a strong uptrend may start only after the price rebounds from the trend line. This means that it is better to postpone buying Litecoin for some time.

Let’s apply Bollinger Bands to the chart and find similar price movements. In the spring of 2023, the price traded within a wide range between $55 and $105, identical to the one we currently have. Litecoin price forecasts for 2023 and early 2024 are built using this range.

Meanwhile, Bollinger Bands indicate that LTC has reached a market equilibrium. If the price pierces the middle line, it will likely reach the support level of $55. After that, a sideways movement is expected. If the $65 level is breached, a bearish trend may unfold.

How Will Litecoin Perform in 2024 According to Technical Analysis?

The above chart demonstrates that Litecoin has traded in the $55-$105 range for over a year. As a rule, when Bitcoin hits new all-time highs, LTC does not follow the flagship cryptocurrency. At the same time, when BTC drops, Litecoin does not plunge. Apparently, large players are accumulating the asset. The price is buoyed above the critical levels, but buyers do not have enough strength to keep it above $105. Based on the situation, LTC’s trend will unlikely reverse without additional stimuli. Moreover, the cryptocurrency is likely to remain within the current trading channel throughout 2024.

Long-Term LTC Technical Analysis

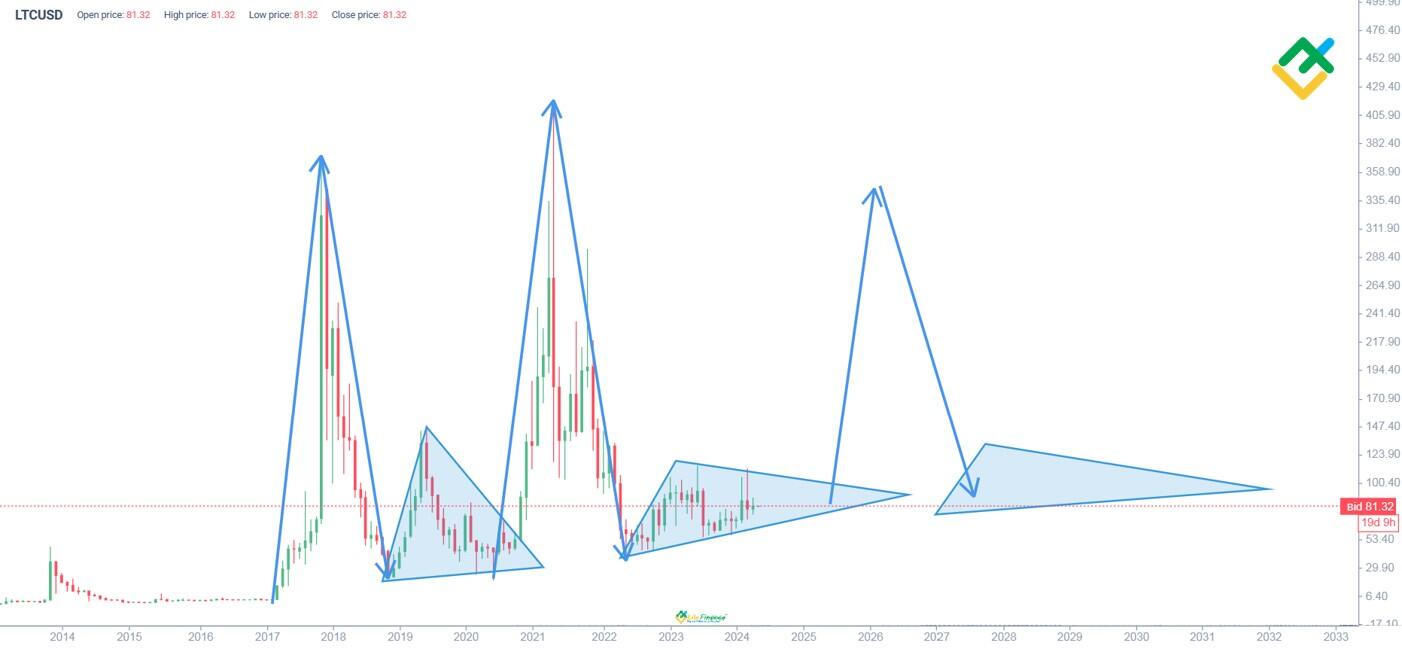

Since the Litecoin price follows certain market cycles, it can be easily predicted. The monthly chart shows the stages of price performance:

- Rapid growth;

- A pullback due to market overheating;

- Consolidation.

Considering these stages, the market is undergoing a consolidation phase in 2024, indirectly confirmed by a narrowing channel than the asset was trading in during 2018–2020. In the consolidation phase, the narrowing price channel indicates that the low volatility in the market is likely to end not earlier than in Q1-2 of 2025. After that, LTC may begin a new growth cycle.

Given the price highs formed in 2018 and 2021, the growth target is located between $350 and $420. More specific targets can be defined during the ascending wave, taking into account its speed, trading volumes, and the inclination angle.

The chart displays a projection of the market movement for the coming year. The price range for each month of 2024 was determined according to the distance between Bollinger Bands in the corresponding market phases. The table below shows the minimum and maximum Litecoin prices for each month of 2024.

| Month | Price projections for LTCUSD | |

|---|---|---|

| Minimum, $ | Maximum, $ | |

| May | $70 | $98 |

| June | $71 | $99 |

| July | $75 | $107 |

| August | $75 | $98 |

| September | $68 | $104 |

| October | $75 | $96 |

| November | $78 | $102 |

| December | $74 | $97 |

Long-Term Trading Plan for LTCUSD

Based on the expert assessments and technical analysis, let’s make a trading plan for the next three months and a year.

Trading plan for 2024

The range-bound trading strategy is the best fit given Litecoin’s movement within a wide channel. The principle of trading is simple:

- Sell at the upper boundary of the channel near $100–$105

- Buy at the channel’s lower boundary near $57–$60

- Stop-Loss orders should be placed outside the channel boundaries with a 10-15% margin.

- Take-Profit orders can be placed at the opposite boundary according to the same principle. Take into account other market participants who use the same strategy and lock in profits before the price touches the key level. Do not be greedy; make an allowance of 5–7% to set the Take-Profit level.

Since the trading channel is wide and the volatility is low, the expected frequency of trades will not be high, about 1-2 monthly trades. Therefore, this strategy best suits position traders.

Trading plan for next three months

The Bollinger Bands indicator can be used for more frequent trading over a shorter period. Unlike static key levels, the channel boundaries of this indicator are dynamic and change depending on price movement. Moreover, the middle line of the channel can also be used as a signal line.

If we look closer at the Litecoin price chart with Bollinger Bands, we can see how the price has exceeded the middle line. Thus, short-term long trades can be considered with a small volume. If the price goes below the middle line by 20–30%, the position can be averaged, doubling it until it becomes profitable when the LTC price returns to the middle line.In this case, you should close your positions with a loss if the price crosses the lower Bollinger Band. On the contrary, profits can be taken once the price breaks through the upper Bollinger Band. Remember that the indicator lines are moving, which means that the parameters of the placed order should be adjusted periodically.

Based on the current situation, the strategy is as follows:

- Buy level is in the area of $81

- Take-Profit order is in the area of $100

- Position averaging should be made at $63

- Stop-Loss level is at $56

Notably, if the price crosses the middle line from above, the trade size should be reduced at the first opportunity. Averaging, in this case, is a preventive measure aimed at protecting the deposit and making a profit even in case of market movement against the buyer’s expectations.

Litecoin Price Predictions for 2025 by Crypto Experts

When making long-term price forecasts, it is crucial to consider the opinions of acknowledged public experts, as they can significantly influence market expectations and behavior. In addition, significant discrepancies between your forecast and others may indicate errors. Let’s take a look at professional analytics and consider expert Litecoin price predictions for 2025.

Binance

The Litecoin price forecast 2025, according to Binance, assumes that the price trend will not undergo major changes. As part of their forecast model, crypto exchange experts anticipate an average price of $83.69 per coin.

Changelly

Based on the technical analysis of the Changelly portal, the Litecoin maximum price in 2025 could reach $172. Its minimum price in the same period is expected to be around $77.11, and the average price is $149.32.

| Month | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| January | 77.11 | 90.29 | 99.22 |

| February | 83.21 | 97.74 | 103.78 |

| March | 89.32 | 105.20 | 108.33 |

| April | 95.43 | 112.65 | 112.89 |

| May | 101.53 | 120.10 | 117.44 |

| June | 107.64 | 122 | 127.55 |

| July | 113.75 | 126.55 | 135 |

| August | 119.85 | 131.10 | 142.45 |

| September | 125.96 | 135.66 | 149.91 |

| October | 132.07 | 140.21 | 157.36 |

| November | 138.17 | 144.77 | 164.81 |

| December | 144.28 | 149.32 | 172.26 |

Gov Capital

Gov Capital prediction suggests that LTC will grow during 2025. Based on the most pessimistic estimates, the price of the coin will be about $133. The maximum LTC price is expected to be around $180, and the most likely average price is around $157.

CryptoPredictions

The 2025 price forecast for the LTCUSD by CryptoPredictions is not particularly optimistic. It is expected that the weighted average price for Litecoin will remain at the level of 2024, decreasing only slightly to $72–$70. The minimum price of Litecoin can be near $70.09, and the maximum price level should be around $83.9.

| Month | Low, $ | High, $ | Average, $ |

|---|---|---|---|

| January | 71.3 | 104.9 | 83.9 |

| February | 71.3 | 104.8 | 83.9 |

| March | 71.3 | 104.8 | 83.8 |

| April | 71.2 | 104.8 | 83.8 |

| May | 71.2 | 104.7 | 83.8 |

| June | 71.2 | 104.7 | 83.7 |

| July | 71.2 | 104.6 | 83.7 |

| August | 71.1 | 104.6 | 83.7 |

| September | 71.1 | 104.5 | 83.6 |

| October | 71.0 | 104.5 | 83.6 |

| November | 71.0 | 104.4 | 83.5 |

| December | 70.9 | 104.3 | 83.4 |

PricePrediction

When making their LTC price forecast for 2025, PricePrediction experts proceeded from the assumption that the cryptocurrency market will begin to recover in the coming years. Therefore, the price and market cap of Litecoin and other cryptocurrencies will increase. By the end of 2025, the minimum and maximum prices of the coin are projected to be around $131 and $159, respectively. The expected average price could be $134.

WalletInvestor

The Litecoin price forecast for 2025 by WalletInvestor predicts a serious drawdown in value. In the worst months, the average transaction price can reach $7–$8 per coin. By the end of the year, LTC will regain some of its lost positions and reach an average price of $30. An optimistic scenario assumes that by the end of 2025, Litecoin is expected to be trading at around $93.

DigitalCoinPrice

This Litecoin price forecast for 2025 actually does not leave the coin a chance for a bearish trend, because the minimum limit was determined by experts at $170. That is, DigitalCoinPrice considers the optimistic scenario to be the most likely. The weighted average price by the end of the year is estimated at $183, and the record high is $205.

| Month | Low, $ | High, $ | Average, $ |

|---|---|---|---|

| January | 173.82 | 180.10 | 186.58 |

| February | 172.57 | 177.76 | 182.20 |

| March | 172.08 | 180.35 | 184.34 |

| April | 173.78 | 176.26 | 188.19 |

| May | 171.05 | 177.78 | 181.10 |

| June | 171.88 | 183.85 | 187.70 |

| July | 171.23 | 200.76 | 205.07 |

| August | 173.18 | 180.76 | 190.65 |

| September | 174.49 | 184.82 | 188.08 |

| October | 171.05 | 180.03 | 198.52 |

| November | 170.81 | 187.53 | 198.08 |

| December | 171.95 | 180.78 | 187.98 |

H3: CoinPriceForecast

According to CoinPriceForecast, in 2025, the growth of Litecoin should accelerate. By the summer, LTC will trade at $136.7, after which growth will slow down, and by December, the price will be around $143.6. Relative to the current price, the total increase by the end of 2025 will be 77–95%.

Litecoin Price History

Today, Litecoin is in the TOP 10 cryptocurrencies in terms of capitalization and demand in the market. Coin developer Charlie Lee prides himself on the fact that LTC is faster and cheaper to use than Bitcoin. However, “cryptocurrency silver” did not become this way right away; Litecoin experienced several ups and downs in its history.

Despite the fact that the Litecoin project was published on the GitHub service on October 7, 2011 by Charlie Lee, the crypto market only learned about the new token in the spring of 2013. LTC originated as a fork of the Bitcoin client and was valued at $4.30 or 0.031 BTC per coin.

At first, not many bulls took up the idea of a new cryptocurrency, so the price of Litecoin quickly dropped to $1.50. However, the emerging altcoin market at the same time began to attract the attention of an increasing number of enthusiasts, who also highlighted LTC. Even before the end of 2013, the coin significantly increased in price and began to trade around $44.

During one of the bullish breakouts, the value of the token increased by 100% in 24 hours. However, the maximum price did not last long. The initial bubble of 2013–2014 subsided, and virtual money began to lose value sharply, including the top cryptocurrencies by market cap. Litecoin was no exception; by the end of 2014, it was worth only about one dollar. The reason for this sharp drop was also a twofold decrease in the number of coins issued for a mined block from 50 to 25 pieces. The rate remained stable until 2017, fluctuating in the range of $1-$4.

Bullish Breakout of 2017

Starting the year at less than four dollars, the price of Litecoin surprised even the most optimistic experts. In April 2017, after SegWit support was activated, Litecoin price soared and reached $50. By December, the cost of the coin reached a phenomenal $400.

The reason for this was the money of retail investors pouring into the market. Almost all cryptocurrencies known at that time increased in price in 2017. But Litecoin became one of the leaders in the race primarily due to Charlie Lee’s media activity, his effective PR, and his promotion of LTC.

Charlie Lee’s Letter

In 2018, LTC began to lose value, dropping to $20 rapidly. The reason was the outflow of funds from Bitcoin and the cryptocurrency market in general. However, some analysts attribute the fall to the fact that in December 2017, Charlie Lee announced the sale of all his tokens. This demonstrative gesture was directed at haters who accused Charlie of manipulating the price of Litecoin for his own interests.

Second Pump in 2021

In mid-2021, the second sharp rise in the history of cryptocurrency occurred. Then, the token almost broke out the $400 level. The rise to the maximum price of LTC occurred against the backdrop of a sharp influx of capital into the crypto industry. Litecoin’s price and market cap are closely linked, so the capital injection sent the coin price soaring. Subsequent outflows in 2022 resulted in a similarly sharp decline.

Litecoin Halving

One of the events that has a significant impact on the price of Litecoin is halving. This is the process of reducing the reward for mining cryptocurrency by half, occurring at certain intervals. It is considered an important factor influencing the price since it directly affects the supply of Litecoin in the market.

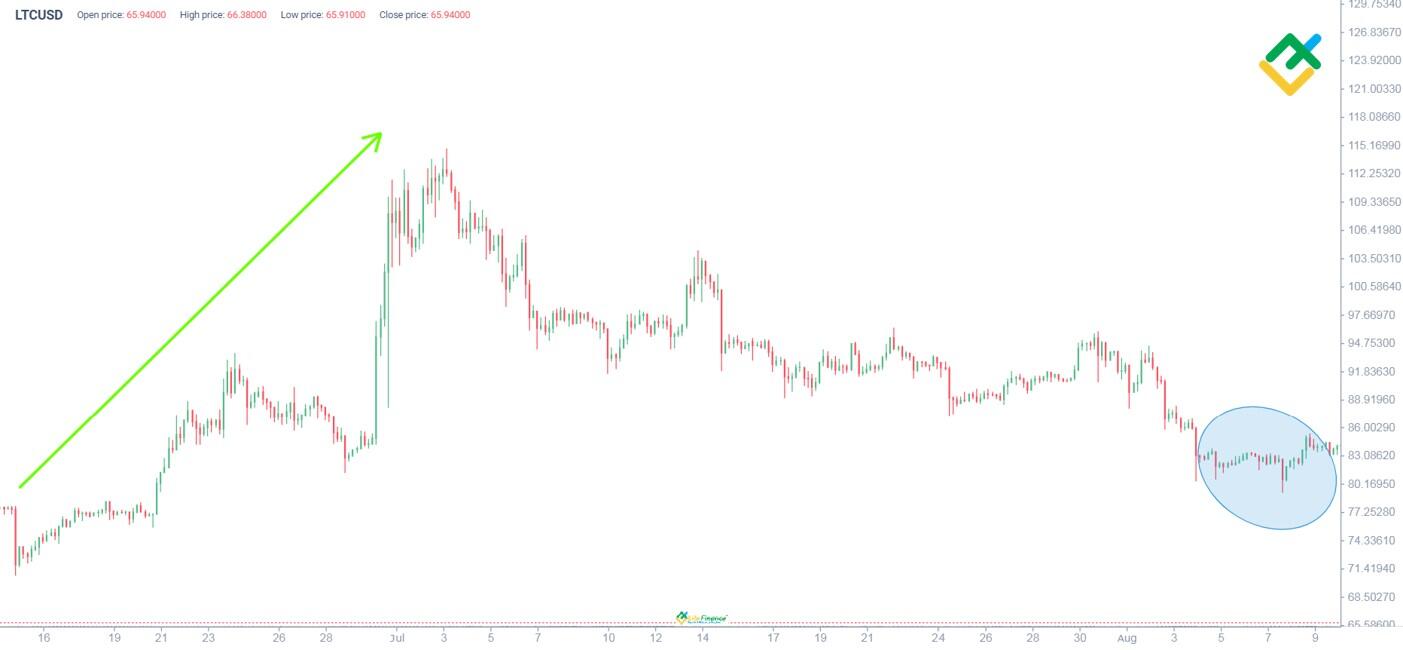

For example, in anticipation of the halving scheduled for August 2023, the cryptocurrency showed significant growth. In the weeks leading up to the event, Litecoin was up about 8% in seven days. According to historical data, LTC begins to rise approximately 200 days before the halving event and continues to rise until approximately 35-40 days before it. In 2023, the token began to increase in price on January 16, which led to an increase in its value by 15%.

The first Litecoin halving event took place on August 25, 2015, when the developers decided to reduce the block reward from 50 to 25 coins. In anticipation of the procedure, there was a fivefold increase in trading volumes and prices. However, after the reduction in production, miners lost interest in the coin, which led to a decrease in investment and a subsequent drop in prices.

The second Litecoin halving event was scheduled for August 5, 2019, when 840,000 blocks were encoded in the network system. The miners’ reward was again reduced by two times – from 25 to 12.5 coins. A few months before the procedure, miners also became actively interested in cryptocurrency, which led to an increase in its value. In the chart, the growth wave on the eve of halving is marked with a green arrow and the event itself with a blue circle.

What factors affect Litecoin’s price rate?

Analyzing the history of the LTCUSD pair’s movement, it becomes clear that it is entirely different from the BTCUSD pair. This is a sure sign that Litecoin has internal and external factors that significantly affect its price. Let’s take a closer look at them.

Cryptocurrency Market News

Cryptocurrency market news affects every virtual coin in one way or another, including Litecoin. The launch of BRC-20 in the spring of 2023 was indicative. This is a new smart contract protocol standard that allows one to create Web3 applications based on the Bitcoin blockchain.

Due to the technological similarity of the two cryptocurrencies, it was not difficult for the LTC team to copy successful BTC solutions and implement them into their blockchain. The hype around BRC-20 led to a sharp increase in the Litecoin demand, which almost at the same time acquired a similar standard, LTC-20.

The chart above shows how these events affected the price. Since the beginning of May, “cryptocurrency silver” has risen in price by 20% – to $97 dollars. The maximum price with minor pullbacks remained until the beginning of June.

The next information wave began in July and was dedicated to the upcoming Litecoin halving. Then, the price approached record highs for 2023 and exceeded them.

General Economic News and Geopolitics

Contrary to the opinion of some crypto traders, news from the sphere of politics and macroeconomics has a significant impact on the cryptocurrency market and, in particular, on the price of Litecoin.

The new variant of coronavirus Omicron has caused the withdrawal of large amounts of capital from risky assets. Already on November 26, 2021, Bitcoin collapsed by 8%; altcoins reacted a few days later. A sharp drop in Litecoin prices began on November 10. The cost of the coin, which was $295 at its peak, dropped to $91 by February 2022.

Then came a new shock – the conflict between the Russian Federation and Ukraine. This event affected the cryptocurrency rate from two sides. Private investors saw the salvation of their capital in cryptocurrency, but this did not add confidence in the long term. Geopolitical tensions and instability in the stock market and the commodity market contributed to the development of the bearish trend for the LTCUSD pair from March to June 2022.

Token’s supply and demand

Determining the supply and demand for LTC is a challenging task as the asset is decentralized. Nevertheless, there are several indicators and tools that can help you assess the current situation. You can analyze the demand through the following indicators:

- Trading volume

- Market sentiment – the Fear and Greed index

- Social media sentiment

- Number of holders and wallets

- LTC futures open interest

The following indicators can be used to gauge supply:

- Number of coins in circulation

- Number and size of transfers from cold wallets to exchanges

- Depth of Market

- Technical indicators such as MACD can indicate whether a coin is oversold or overbought.

Long-Term Litecoin Prediction for Five Years

When the price breaks through historical maximum prices, things get a little more complicated. Ideally, it is logical to expect an overshoot at the peak of each cycle, but this is not necessary due to the strong influence of market sentiment and the future position of Litecoin among its competitors. My vision of the trading ranges for the LTCUSD pair for the next five years is reflected in the table:

| Year | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| 2024 | 53 | 81 | 105 |

| 2025 | 70 | 185 | 300 |

| 2026 | 80 | 165 | 250 |

| 2027 | 120 | 310 | 500 |

| 2028 | 150 | 215 | 280 |

Litecoin Price Predictions 2026-2029

Experience with Litecoin shows that the asset can be predicted over several years. The reason for this is the high market capitalization, which ensures the relative stability of quotes. However, long-term Litecoin forecasts should be taken into account only for information purposes for trading in the coming years.

Binance

The LTC price forecast by Binance is based on the principle of a smooth recovery of the crypto market. Therefore, in the period 2026–2029, crypto exchange experts predict a gradual increase in the average price of the asset. In 2027, the future price is expected to be around $92.27, and by the end of 2030, Litecoin could be at $108.57.

| Year | Price, $ |

|---|---|

| 2026 | 87.88 |

| 2027 | 92.27 |

| 2030 | 108.57 |

Changelly

To forecast the price of LTC for 2026–2029, experts analyzed historical data and built a predictive model for changes in the price chart several years in advance. In 2026, the average coin price will be $229. In subsequent years, the Litecoin forecast assumes a steep bullish trend, which will raise the weighted average price to $370 in 2027, $449 in 2028, and $678 in 2029. The table shows the predicted prices for each year.

| Year | Low, $ | High, $ | Average, $ |

|---|---|---|---|

| 2026 | 213 | 256 | 219 |

| 2027 | 309 | 370 | 318 |

| 2028 | 436 | 532 | 449 |

| 2029 | 660 | 760 | 678 |

Gov Capital

The Litecoin forecast by Gov Capital for the indicated period is very optimistic. It is expected that between 2026 and 2029, prices will increase more than fivefold – from $157 at the beginning of 2026 to $806 in 2029. At the same time, Gov Capital analysts estimate the minimum price threshold for Litecoin in 2029 at $685, and the maximum at $927.

CryptoPredictions

CryptoPredictions analysts limit the long-term forecast for the price of Litecoin to 2028. In the next few years, in their opinion, the slow decline in price and market capitalization will continue. In 2026, the average price per coin will stand at $82, $80 in 2027, and in 2028, the average price of LTC may be about $77.

PricePrediction

The LTC price forecast for 2026–2029 suggests a strong bull run. The average LTC price will increase from $185 in 2026 to $538 in 2029. That is, in fact, the price can triple in 3 years. At the same time, the LTC maximum price in the forecast for 2029 may reach $633.

WalletInvestor

According to the WalletInvestor forecast, by the end of 2026, a serious drawdown is expected, down to $8 per coin. In 2027, the Litecoin price forecast predicts a pullback up to $30. In 2028, the average price is expected to be around $50. An optimistic forecast predicts a drawdown to $69 in 2026 and an increase to $75 by 2028. Following the logic of the forecast model, we can assume that in 2029, trading is expected to return to the current price level.

DigitalCoinPrice

In the period of 2026–2029, DigitalCoinPrice analysts expect a stable bullish trend. In 2026, the Litecoin price forecast determines the weighted average price of around $226. By the end of 2029, the price is expected to stand around $340. Below is a detailed table with the minimum and maximum LTC values for each year.

| Year | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| 2026 | 192 | 224 | 236 |

| 2027 | 250 | 283 | 295 |

| 2028 | 250 | 283 | 295 |

| 2029 | 309 | 340 | 358 |

CoinPriceForecast

Between 2026 and 2029, the LTC price is expected to experience slight volatility with an overall positive trend. At the end of 2026, the forecast assumes the LTCUSD rate should be around $92. In 2027, a record high is expected around $115. By the end of 2028, analysts expect a pullback to $94, but in 2029, the price will return to its peak value of nearly $110. Below is a detailed table with average prices for each half of the 2026–2029 years.

| Year | Mid-year, $ | End of the Year, $ |

|---|---|---|

| 2026 | 97 | 91 |

| 2027 | 103 | 115 |

| 2028 | 103 | 94 |

| 2029 | 101 | 109 |

Litecoin price prediction 2030

Litecoin price forecast for 2030 refers to long-term planning. In a few years, Litecoin may begin to move in a different direction due to important news, political risks, and blockchain updates. Such forecasts should be considered as an analysis of current trends.

Binance

According to Binance, the Litecoin price would fluctuate around $108.57 by the suggested period. In their Litecoin prediction from 2023 to 2030, crypto exchange analysts predicted a slow but stable growth of 4%-5% per year. That is, the LTC should increase in value by 25% over six years.

Changelly

The LTC price forecast suggests that the coin could break out the important psychological level of $1,000. However, these are the most optimistic expectations. According to more conservative estimates, the minimum price of the coin will be $902, and the average price will be $935. Below, you can see the monthly Litecoin forecast for 2030.

| Month | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| January | 656 | 679 | 800 |

| February | 678 | 703 | 828 |

| March | 700 | 726 | 857 |

| April | 723 | 749 | 885 |

| May | 745 | 772 | 914 |

| June | 768 | 796 | 942 |

| July | 790 | 819 | 971 |

| August | 813 | 842 | 999 |

| September | 835 | 865 | 1 027 |

| October | 857 | 889 | 1 056 |

| November | 880 | 912 | 1 084 |

| December | 902 | 935 | 1 113 |

PricePrediction

By 2030, the Litecoin current price could increase tenfold, reaching an incredible $917. Crossing the psychological level of $1,000 after 2030 will be an important milestone in the history of Litecoin. However, these are the maximum allowable forecast values from 2023 to 2030 by PricePrediction. The average values are much lower, and amount to $797, and the minimum acceptable price of a coin is $770.

DigitalCoinPrice

The LTC price prediction 2030 by DigitalCoinPrice suggests that the coin will experience a strong bullish trend. The most probable price is estimated at $478, and the all-time high is $488. Even in a negative scenario, the price of Litecoin in 2030 will significantly increase to $440.

CoinPriceForecast

The Litecoin forecast 2030 by CoinPriceForecast predicts significant growth. By summer, the price will rise by about $7–$8 to $117, and by December, it will rise to $124.

Litecoin Price Prediction 2040

The long-term price of a coin, especially if we are talking about a 15–20-year horizon, can only be used as an additional indicator. It can take into account trends emerging at the time the forecast is made. Given the unpredictability of the cryptocurrency market and the rapid development of the big data industry, in 2040, the price and market capitalization of Litecoin and other top-listed cryptocurrencies may be completely different compared to the Litecoin price prediction today.

Changelly

In 2040, Changelly analysts expect truly phenomenal growth for the coin. Litecoin will grow by several thousand dollars per month. If, at the beginning of the year, the average price is predicted to be around $4,856, then by December, the minimum price is expected to be around $30,070, and the maximum – $40,553. To be honest, such a forecast seems unrealistic, but there have already been similar rate hikes in the cryptocurrency market. Therefore, just in case, below is a detailed table of prices by month.

| Month | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| January | 4 635 | 4 856 | 5 478 |

| February | 7 311 | 7 698 | 8 667 |

| March | 9 987 | 10 541 | 11 855 |

| April | 12 663 | 13 383 | 15 044 |

| May | 15 339 | 16 226 | 18 233 |

| June | 18 014 | 19 068 | 21 421 |

| July | 20 690 | 21 911 | 24 610 |

| August | 23 366 | 24 753 | 27 799 |

| September | 26 042 | 27 596 | 30 987 |

| October | 28 718 | 30 438 | 34 176 |

| November | 31 394 | 33 281 | 37 365 |

| December | 34 070 | 36 124 | 40 553 |

PricePrediction

Technical analysis of Litecoin and prediction suggests that the coin’s value could reach another all-time high by 2040. In the optimistic scenario, the price of Litecoin will rise to $55,840. The average price is expected to be around $48,901. Even the negative scenario inspires optimism because the Litecoin price will reach $4,596 in this case.

DigitalCoinPrice

For the period 2030–2040, experts predict explosive growth. By 2033, when the Litecoin price forecast from DigitalCoinPrice ends, the LTCUSD exchange rate should overcome the psychological level of $1,000. In 2033, the average price of LTC will reach $1,269. Following the logic of this forecast, we can assume that by 2040, the price of Litecoin could reach $2,000.

CoinPriceForecast

From 2030 to 2040, the Litecoin price will steadily increase with minor pullbacks lasting several months. By 2035, the last year indicated in the forecast, CoinPriceForecast analysts expect the LTCUSD rate at $180. If the chart continues to follow this trend in subsequent years, then the coin will confidently consolidate above $200 by 2040.

Litecoin Price Prediction 2050

As a rule, experts do not take a 25-year price forecast as investment advice seriously. The cryptocurrency market is developing too quickly and may undergo dramatic changes in the coming years, not to mention several decades. Therefore, the presented forecasts for the future of Litecoin should be considered only as assumptions about the possible path of development of the coin and the cryptocurrency market as a whole.

Changelly

According to Changelly technical analysis, the Litecoin price forecast for 2050 suggests that by the middle of the century, the coin will trade on average at $51,749. In the pessimistic scenario, the cryptocurrency price will not exceed $50,000 and will stop at $49,494. Experts predict the maximum acceptable price level at the end of 2050 is around $56,380.

| Month | Low, $ | Average, $ | High, $ |

|---|---|---|---|

| January | 35 355 | 37 426 | 41 872 |

| February | 36 640 | 38 728 | 43 191 |

| March | 37 926 | 40 030 | 44 510 |

| April | 39 211 | 41 332 | 45 829 |

| May | 40 496 | 42 634 | 47 148 |

| June | 41 782 | 43 936 | 48 467 |

| July | 43 067 | 45 238 | 49 786 |

| August | 44 352 | 46 541 | 51 105 |

| September | 45 638 | 47 843 | 52 424 |

| October | 46 923 | 49 145 | 53 743 |

| November | 48 208 | 50 447 | 55 061 |

| December | 49 494 | 51 749 | 56 380 |

PricePrediction

PricePrediction experts went further and made forecasts for Litecoin prices up to 2050, by which time LTC, in their opinion, will trade in the range from $68,282 to $77,339. The average price by 2050 is predicted to be around $71,105.

How to Predict Litecoin Price?

Making a Litecoin price forecast is a complex process that involves various methods and tools. I have defined six approaches to predicting the price of cryptocurrency. If you find more, share them in the comments.

1. Technical analysis

The method involves studying historical price data and trading volumes. Analysts use various indicators such as moving averages, support and resistance levels, the RSI (relative strength index) and MACD (moving average convergence divergence) indicators, etc. Personally, I often use chart patterns, Price Action, Fibonacci levels, the Keltner channel and SAR indicators, as well as Bollinger Bands.

2. Fundamental analysis

The approach is based on studying fundamental factors influencing Litecoin value, such as technical updates, halving, and other mining decisions, indicators of the supply and demand of the token in the market. Fundamental analysis must take into account the general state of the international investment market and the macroeconomic indicators of advanced economies.

3. News environment

The cryptocurrency market often responds to news events. Positive news includes recognition from large companies and favorable regulatory changes. These factors can increase the price of Litecoin, while negative news can cause it to decrease.

4. Market sentiment analysis

Using social media and analytical platforms, you can assess the general sentiment of market participants. High levels of enthusiasm, greed, or fear can indicate potential market movements. One of the most accessible sentiment analysis tools is search query statistics, which can be found in Google Trends. Less known but free resources for sentiment analysis include coincodex.com, alternative.me, coinstats.app. Among the conditionally paid applications are augmento.ai and santiment.net.

5. Econometric and statistical models

Some analysts use complex mathematical models to make LTC price forecasts based on historical data and probability calculations. For example, the ARIMA model is designed for time series analysis and forecasting. It combines autoregressive (AR), integrated (I), and moving average (MA) components.

6. Machine learning and artificial intelligence

Recently, machine learning algorithms, which analyze large amounts of data to identify hidden patterns and predict future price movements, have become increasingly popular. These models gained particular demand with the boom in generative models, such as Chat GPT. It is the dream of any trader to obtain artificial intelligence that will trade at a professional level. Unfortunately, it remains a dream. So far, you cannot find a single service on the public Internet that would offer effective AI solutions for trading.

Before you make your own forecast, you need to understand that even using all these methods does not guarantee 100% accuracy. The cryptocurrency market is unpredictable and characterized by high volatility; many external factors can change the price trend at any time. Investors and traders should conduct analysis and consider the risks of their investment decisions.

Is Litecoin a Good Investment?

Whether Litecoin is a good investment depends on many factors. To answer this question objectively, let’s look at it from several angles.

1. Rich history

Litecoin is one of the oldest cryptocurrency assets. It has certainly generated thousands of percent returns for early investors, even at current levels. We also should not forget that the cryptocurrency market has experienced several crises since the Litecoin foundation. The fact that the coin continues to exist and remains a leader in a number of parameters speaks of its reliability.

2. Pros and Cons

Compared to Bitcoin, Litecoin has a number of advantages, such as faster transactions and lower commission costs. The disadvantage of Litecoin is its relatively high centralization and price dependence on the public behavior of its creator, Charlie Lee.

3. Investment strategy

Whether LTC is a good investment depends largely on your investment horizon and risk appetite. Litecoin prices have pronounced cycles lasting 2-3 years. We are currently at a notional plateau, so if your investment horizon does not exceed 12 months, then “cryptocurrency silver” could indeed be a good investment.

4. Risks and prospects

Despite the potential profits, there are risks, including a lack of investor interest and competition with other cryptocurrencies. The Litecoin blockchain is developing rapidly, but this has little effect on the price of the asset itself. The latest Mimblewimble Extension Block (MWEB) updates and halving added only a few percent and largely went unnoticed. High competition among more modern blockchains makes the prospects for Litecoin very vague.

5. Various Litecoin forecasts

Some sources suggest significant growth over the long term. For example, it is predicted that the average price could reach between $2,755 and $3,190 by 2032. I would not recommend using such long-term estimates to make investment decisions. When determining investment goals, it is wiser to start from those historical highs that have already been achieved. “Cryptocurrency silver” has the potential to grow to $400, which, from current levels, promises to bring investors hundreds of percent of net profit.

It is important to remember that price and investment forecasts may not be accurate. It is up to you to decide whether to buy LTC or not. And that decision should take into account your individual risk profile and investment objectives. Always do your own research, and do not invest more than you can afford to lose.

FAQs on Litecoin Price Prediction

The current price of Litecoin is $74.63.

There is no consensus on this issue. Expert estimates vary from $50 to $150. The average price is around $80.

Experts do not have a common opinion on Litecoin price in 2025. If we follow the logic of Litecoin price cycles, 2025 may not be the best time to invest since the LTC price might test support levels around $100.

Optimists and devoted fans predict a huge increase in the price of Litecoin and see LTCUSD at levels of $2000–$3000. I do not share this opinion and do not think that LTC will rise above $500. Perhaps this is the case when I will be glad to be wrong.

I am sure that Charlie Lee himself will not answer this question. In order not to descend into guesswork, you can build a model based on the projection of long-term trends. According to this hypothesis, the future price of Litecoin in 2040 will be in the range of $200 to $600.

Yes, Litecoin will rise again. At the very least, it has the potential for further growth. Of course, “cryptocurrency silver” is a serious competitor to other digital currencies, and LTC investments look quite promising.

According to CryptoPredictions and Changelly, the LTC rate will begin to recover in 2024 and reach $80–$100. It is expected that from the beginning of 2025, the average annual price will be $165, and by the end of the year, it will exceed $190. Therefore, we can say that the Litecoin price is gaining traction now. However, experts expect higher growth rates in the long term.

Despite optimistic forecasts, experts do not believe that LTC will grow to $10,000 even in the distant future. Nevertheless, this scenario cannot be completely ruled out. The crypto world has seen enough examples of explosive growth despite all predictions.

While some experts predict a bright future for LTC, others are hesitant to make such bold predictions. However, it can be said that Litecoin is not worth investing in if you prefer short-term strategies. It will take time for the coin to recover after its fall. In addition, the coin is not growing in price as quickly as other cryptocurrencies. However, if you prefer long-term strategies, investing in Litecoin can bring good profits. It is expected that in 2024, the bullish trend will prevail. Moreover, short-term dips provide a good opportunity to buy a coin at a good price before it surges again.

Price chart of LTCUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.