The strategy to reduce inflation in the US, as outlined by President Trump, involves increasing the supply of goods and reducing oil prices. Meanwhile, the conflict in Ukraine could reach a resolution. However, not all goals are achievable. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- If businesses do not produce in the US, they will face tariffs.

- OPEC must slash oil prices.

- Donald Trump will demand the Fed to cut rates.

- Short positions on the EURUSD pair can be opened on a rebound from 1.047 and 1.054.

Weekly US Dollar Fundamental Forecast

The future trajectory of the EURUSD pair is highly uncertain. However, it is likely to remain volatile as Donald Trump’s statements add to market fluctuations. According to Morgan Stanley, there are a lot of US dollar bulls in the Forex market, but their optimism is waning rapidly. The slowdown in US inflation will likely prompt the Fed to cut interest rates. In addition, the ongoing fiscal negotiations in Congress may disappoint investors, and the US trade policy may not be as detrimental as expected. The USD index is poised for a significant change in sentiment, and Donald Trump’s remarks have been driving economic shifts.

During the International Economic Forum in Davos, the US President made remarks encouraging businesses to manufacture their products in the US, promising tax incentives for doing so. Otherwise, firms will face tariffs. In addition, Trump has urged OPEC to reduce oil prices, indicating a potential demand for an immediate reduction in interest rates if this occurs.

Republican policymakers appear to believe that falling energy prices will slow inflation, but this may not be the case. While energy prices contribute to PCE growth, there are other factors to consider, such as the core personal consumption price index, which exceeds 3%. Experts at the Wall Street Journal have adjusted their 2025 forecast for US consumer prices from 2.3% to 2.7%, recognizing the pro-inflationary impact of Donald Trump’s policies.

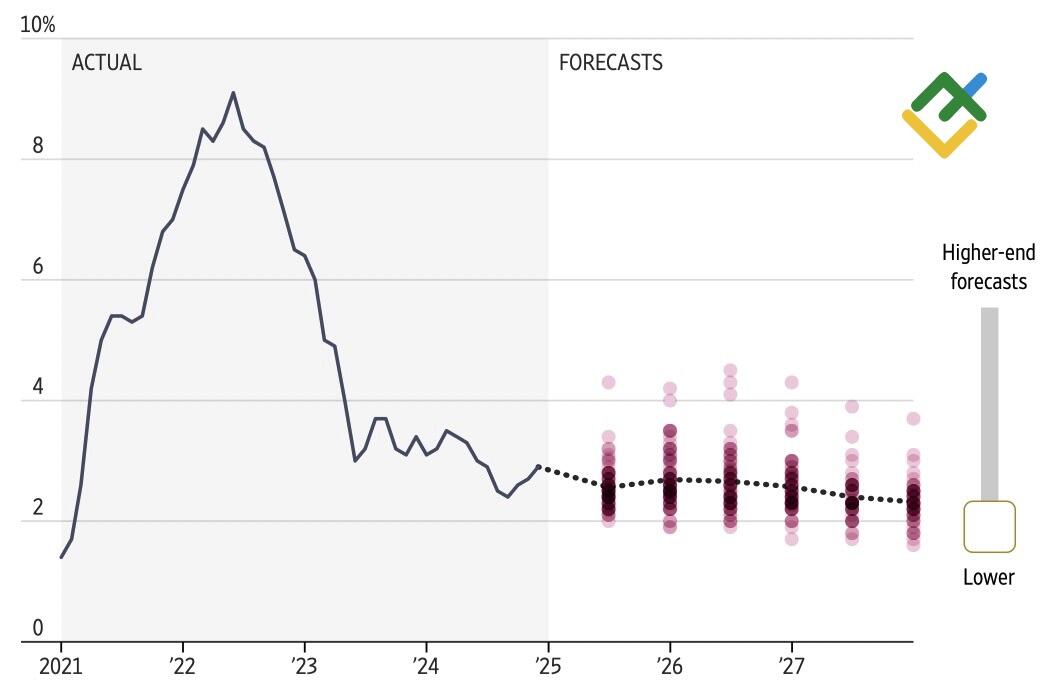

US Inflation Change and Forecasts

Source: Wall Street Journal.

Nonetheless, Trump’s prominent statements in Davos have pushed the US stock indices to new all-time highs, propelling global risk appetite and boosting the EURUSD pair. This dynamic is particularly notable in light of Donald Trump’s commitment to ending the military conflict in Ukraine. He attributes a substantial portion of the responsibility for the events in Eastern Europe to OPEC. If the cartel had not maintained high oil prices, the situation would have reached a resolution long ago.

The end of armed conflict is beneficial for the euro. In 2022, the currency fell below parity in 2022 amid Europe’s decoupling from Russian gas. If natural gas supplies resume at previous levels, energy prices will drop, and the eurozone economy will recover.

At the same time, the euro was bolstered by Donald Trump’s statement that he would prefer not to use tariffs against China. The US President has a long-standing relationship with Xi Jinping. This sentiment is not unprecedented; it echoes the 2018–2019 period when Trump also expressed optimism and simultaneously implemented tariffs. However, a sudden shift in his stance may trigger a swift change in the EURUSD exchange rate.

Weekly EURUSD Trading Plan

It is impossible to become accustomed to Donald Trump’s erratic behavior, but you must do this to survive and thrive in such an environment. Meanwhile, the Fed will unlikely align with the president’s objectives, regardless of his expectations. The pursuit to achieve lower oil prices and the cessation of hostilities in Ukraine are not within the scope of a single day. In light of these considerations, it would be prudent to initiate short trades on the EURUSD pair at 1.047 and 1.054.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.