The GBPUSD pair has managed to rebound amid an increased appetite for risk and the stabilization of the UK debt market. However, Trump’s tariffs remain on the table, and the Bank of England’s rate cuts do not allow the pair to reverse the downtrend. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Postponed Trump’s tariffs have led to a rebound in the GBPUSD pair.

- Surging global risk appetite has supported the British pound.

- The Bank of England will make more than two rate cuts.

- Short trades on the GBPUSD pair can be opened at the current rate or on a breakout of 1.226.

Weekly Fundamental Forecast for Pound Sterling

In the face of a challenging start to 2025, characterized by concerns over a potential debt crisis reminiscent of 2022, the impact of Donald Trump’s universal tariffs, and the economic challenges faced by the UK, the British pound initially exhibited signs of weakness. However, the subsequent recovery, marked by a modest 0.1% expansion in November’s GDP, prompted Goldman Sachs to anticipate a contraction in the fourth quarter and advocate for a substantial repo rate reduction. Contrary to initial expectations, the economic landscape proved to be more resilient, and the GBPUSD pair has managed to stabilize.

The government’s efforts to reassure investors, coupled with slower inflation growth, have increased the likelihood of additional monetary expansion by the BoE, pushing UK bond yields lower. This has led to a stabilization of the debt market, and the factors that previously dragged GBPUSD quotes to the bottom have contributed to a bullish sentiment.

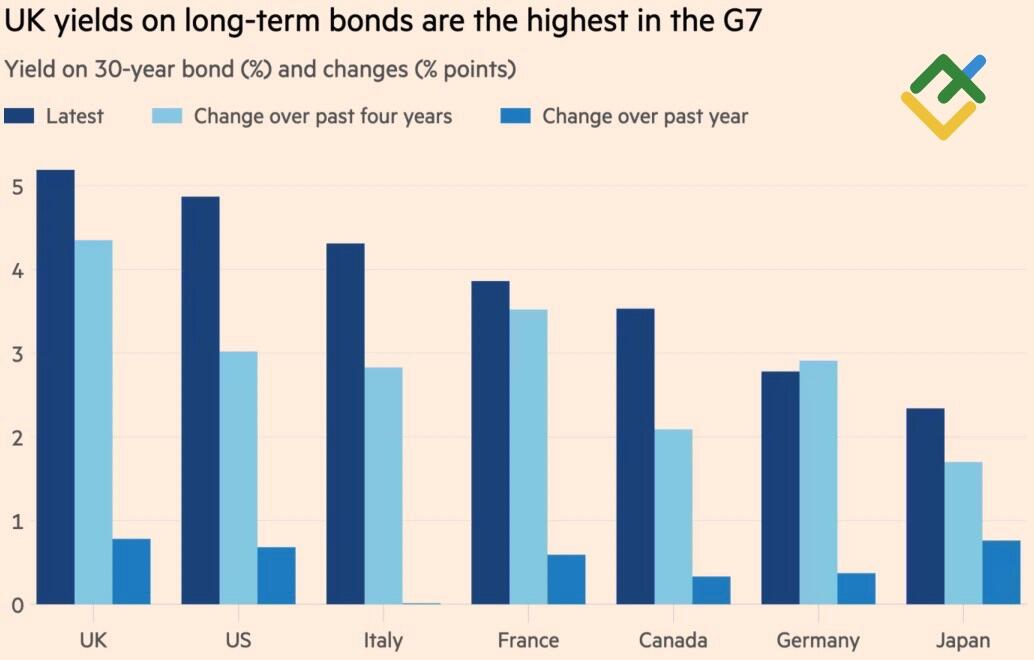

Despite this decline, UK bond yields remain the highest among G7 countries. This, coupled with a growing appetite for risk globally, has enabled the GBPUSD pair to recover and exceed the 1.235 level.

G7 Countries’ Bond Yields

Source: Financial Times.

Meanwhile, Donald Trump’s recent actions have had an impact on US stock indices. During his inauguration, he refrained from making any remarks on tariffs that could potentially disrupt the market. Subsequently, he unveiled a significant initiative to support the development of the AI sector, which contributed to a boost in stocks and other risk assets. The pound sterling, given its high debt rates, experienced similar shifts.

Despite Britain’s sluggish GDP growth at the end of 2024, the IMF raised its forecast for 2025 from 1.5% to 1.6% and kept it at 1.6% for 2026. Against this backdrop, Rachel Reeves, the Chancellor of the Exchequer, highlighted that the British economy was expected to expand at a faster rate than any major European economy over the following two years.

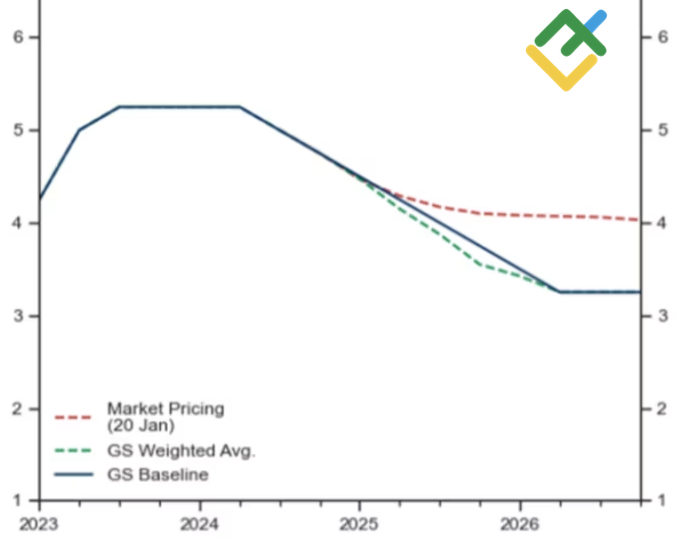

According to the consensus forecast of Bloomberg experts, GDP growth is projected to reach 1.3% this year, while the Bank of England anticipates 1.5% and Goldman Sachs estimates 0.9%. This positive outlook enables the company to forecast a reduction in the repo rate to a neutral level of 2.75%, a shift from the previously expected rate of 4% according to the derivatives market.

Bank of England REPO Rate Forecasts

Source: Financial Times.

The GBPUSD pair will likely see a short-lived uptick. While Donald Trump has postponed tariffs, he has not abandoned this idea entirely. The Goldman Sachs forecast is a valid prediction, but the truth is likely somewhere in the middle. The repo rate is expected to fall by more than 50bp in 2025, and as the market aligns with this prediction, the pound sterling will likely continue to plunge.

Weekly GBPUSD Trading Plan

The GBPUSD pair’s upswing provides a great opportunity to open short trades with targets at 1.205 and 1.195. One can open short positions at the current level or once the pair breaches the support level of 1.226.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.