Donald Trump’s policies are anticipated to slow the already fragile eurozone economy even more, providing the ECB with a compelling reason to cut rates as scheduled, a move that contrasts with the Fed’s hesitant approach. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Trump’s protectionist policies are expected to reduce eurozone GDP by approximately 0.1%.

- The ECB is not concerned about the export inflation from the US.

- The divergence in monetary policy is pushing the euro down.

- One can open more short trades on the EURUSD pair at 1.039.

Weekly US Dollar Fundamental Forecast

Historically, the US economy has been a locomotive for the global economy, but this paradigm will likely change this year. The strength of the US economy has allowed other countries’ exporters to thrive. However, President Trump’s trade policies aim to change this trend. He has proposed 25% import duties on goods from Canada and Mexico, 10% on goods from China, and has expressed dissatisfaction with the European Union’s trade practices, citing a $350 billion trade surplus. Tariffs are imminent, which hinders the EURUSD pair’s capacity to recover.

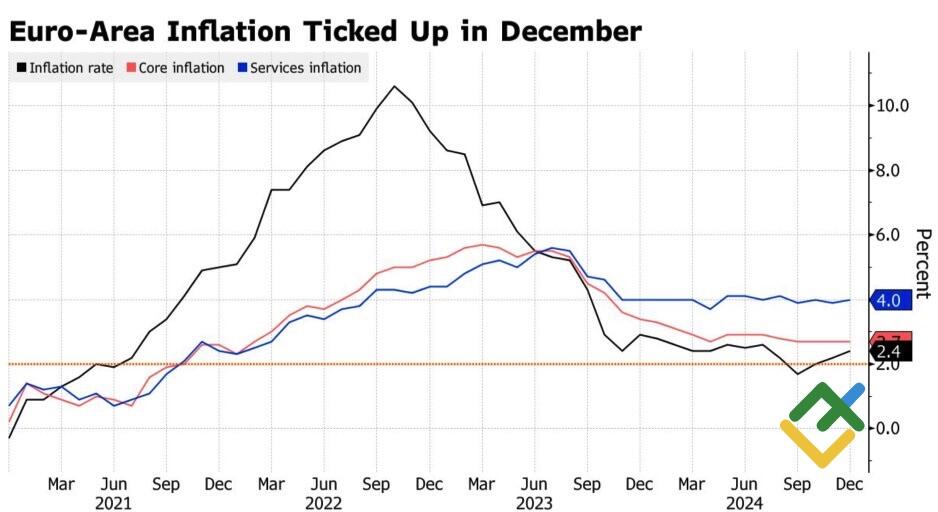

As Bank of the Netherlands Governor Klaas Knot astutely noted, while the impact of duties on GDP may be negligible – approximately 0.1% – the prevailing concern lies in the fragility of the eurozone economy. A prominent hawk at the ECB concurs with market predictions that the upcoming January and March Governing Council meetings will result in a deposit rate reduction from 3% to 2.5%. His counterparts in France and Greece foresee borrowing costs declining to 2% in 2025 as inflation steadily approaches the 2% target.

Eurozone Inflation Change

Source: Bloomberg.

According to Christine Lagarde, the Fed should be concerned about the impact of Donald Trump’s policies on prices. In the eurozone, disinflationary processes continue, and the European Central Bank is not overly concerned about inflation exports. It will be interesting to observe some events, particularly the EURUSD pair’s performance.

The ECB is maintaining its plans to cut rates by 100 basis points in 2025, but the Fed may encounter challenges in achieving the December FOMC forecasts of two acts of monetary expansion. Each of Donald Trump’s policies, including fiscal stimulus, deregulation, tariffs, and deportations, is pro-inflationary. Against this backdrop, the Fed may consider monetary policy tightening.

ABP Invest anticipates a rise in the federal funds rate in September, attributing this prediction to the robust state of the US economy, accelerating inflation due to the influence of Donald Trump, and the Fed’s reluctance to lose its credibility. The US regulator will likely observe developments in the first quarter, potentially issuing hawkish signals in the second quarter and taking action in the third quarter.

The divergence in monetary policy is the primary driver of Forex rates. If ABP Invest’s predictions are accurate, the EURUSD pair is likely to decline significantly below parity. Despite tailwinds such as stock index rallies and falling Treasury yields, the major currency pair has failed to settle above 1.045.

Weekly EURUSD Trading Plan

The EURUSD pair continues to exhibit a downward trend. It failed to breach the resistance level of 1.044, prompting traders to open short positions on a rebound. Should the pair decline below 1.039, there will be an opportunity to open more short positions.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.