In the ever-evolving landscape of online sports betting and gaming, Draftkings Inc. (DKNG) stands out as a prominent player with its innovative platform that allows users to engage in sports betting, and iGaming. Since it first appeared publicly, Draftkings has experienced ups and downs in the stock market, attracting the interest of investors and those who watch the market. With its aggressive expansion and strategic partnerships, the company continually seeks to redefine the digital sports entertainment and gaming industry.

What does the future hold for Draftkings stock? Are (DKNG) Draftkings stock forecast prices expected to go up or down? This article delves into the technical and fundamental aspects driving Draftkings’ valuation, providing you with well-rounded short- and long-term forecasts from reputable analysts.

The article covers the following subjects:

Highlights and Key Points: (DKNG) DraftKings Stock Forecast 2024–2030

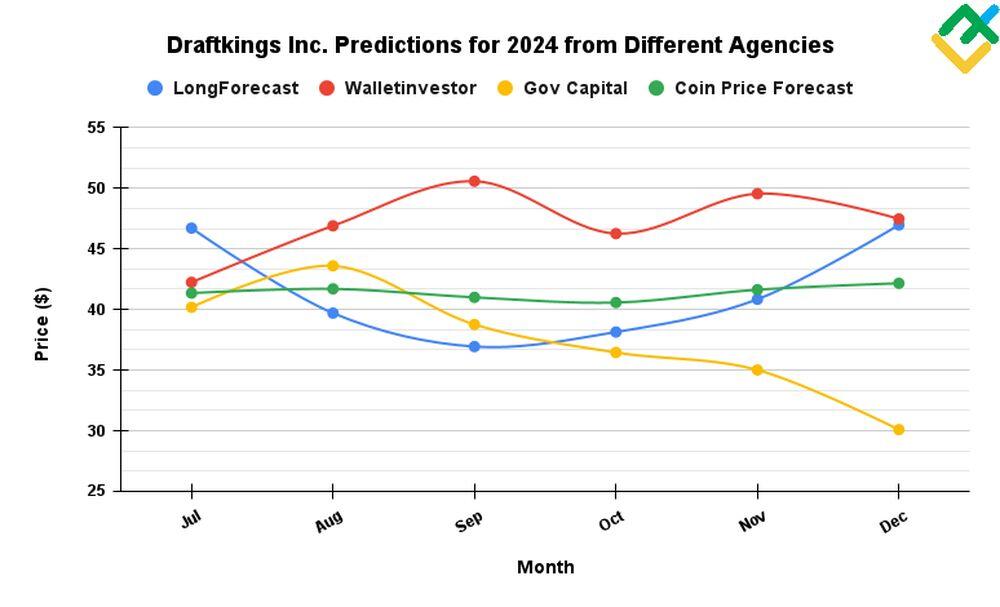

- For 2024, most analysts forecast the uptrend in DraftKings stock to continue. According to various estimates, the asset may increase to an average of $38.28 – $51.04 by the end of the year.

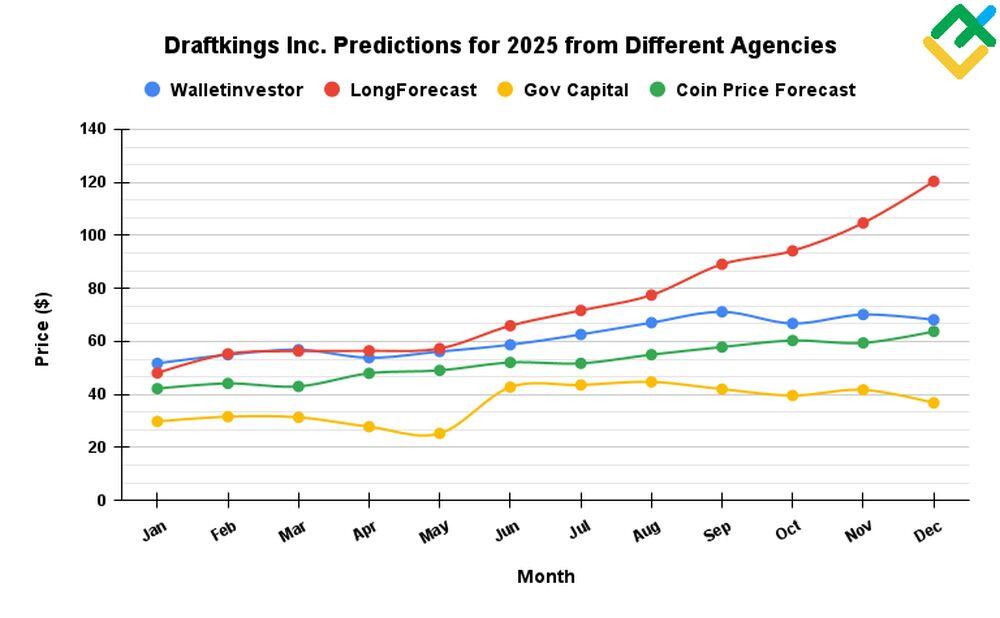

- According to optimistic forecasts, the stock is projected to rise as high as $96.91 per share in 2025. More subdued forecasts expect DKNG to trade in the range of $48,82 – $73.986.

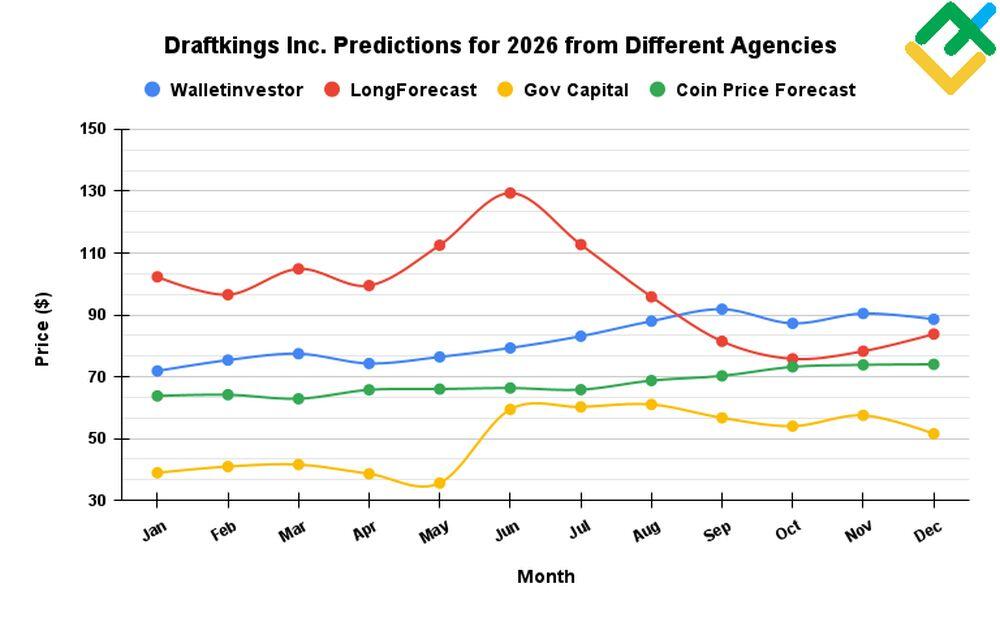

- Various analysts forecast that the DraftKings stock price in 2026 could range between $94.431 and $104.19. More cautious forecasts anticipate the quotes in the range of $67.22 – $67,27 per share.

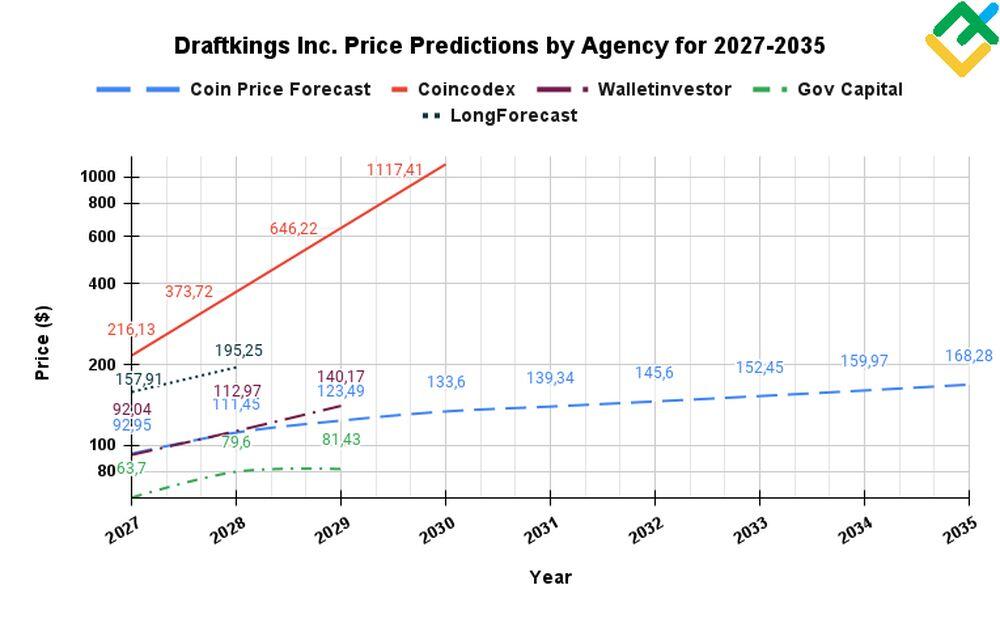

- Forecasts for 2027–2035 diverge, but almost all of them see the stock price growth. According to CoinCodex, the asset’s price could reach $991.91 per share by 2030. More conservative agencies and analytical platforms expect DKNG to grow to $72,08 – $145.54 in 2027–2030. Experts from CoinPriceForecast forecast the asset’s value to rise to $121.29 by 2030.

(DKNG) DraftKings Stock Forecast Today Coming Days and Week

When forecasting DraftKings’ stock for the near term, focus on several crucial factors. Monitor quarterly earnings reports for insights into revenue growth, user acquisition costs, and profitability. Pay close attention to regulatory developments in the online gambling and sports betting sectors, as changes can significantly impact operations and market potential. Stay updated on partnerships and sponsorship deals, which can enhance brand visibility and user base. Track market sentiment and analyst ratings, as they reflect investor confidence. Additionally, consider broader economic indicators, such as consumer spending trends, as they influence discretionary spending on entertainment and betting activities. In addition, take into account broad market trends, especially those related to consumer spending, as they have an indirect impact on the amount of spending on betting and online gaming.

Analysts’ (DKNG) Draftkings stock Projections for 2024

Let’s have a look at analysts projections on 2024 DraftKings stock performance. Most experts predict moderate growth in DKNG shares.

Predict-Price

Price range for 2024: $32.79 – $83.71 (as of June 28, 2024)

According to the AI-based forecast by analytical portal Predict-Price, the price of DraftKings shares may reach $83.71 or by the end of 2024 in the optimistic and pessimistic scenario, respectively. Notably, DKNG is more likely to follow the optimistic scenario.

CoinPriceForecast

Price range for 2024: $37.54 – $38.28 (as of June 28, 2024)

According to CoinPriceForecast, the DKNG price may hit $38.28 per share by the end of 2024.

| Year | Mid-Year | Year-End |

|---|---|---|

| 2024 | $37.54 | $38.28 |

LongForecast

Price range for 2024: $25.35 – $41.26 (as of June 28, 2024)

Analysts at LongForecast suggest that DraftKings may hit a swing high of $41.26 as early as July 2024 for the first time since October 2021. However, the rate is expected to decline for two months to $27.55 and resume the uptrend thereafter.

At the end of the year, experts forecast price fluctuations in the range of $30.45-37.82.

| Month | Opening, $ | Min-Max, $ | Closing, $ |

|---|---|---|---|

| July | 37.11 | 29.30-41.26 | 34.83 |

| August | 34.83 | 27.24-37.62 | 29.61 |

| September | 29.61 | 25.35-29.75 | 27.55 |

| October | 27.55 | 26.16-30.72 | 28.44 |

| November | 28.44 | 28.01-32.89 | 30.45 |

| December | 30.45 | 30.45-37.82 | 35.02 |

CoinCodex

Price range for 2024: $17.99 – $38.90 (as of June 28, 2024)

CoinCodex predicts that DraftKings’ stock price can lose 46.42% and reach $19.88 by the end of 2024.

| Year | Prediction |

|---|---|

| 2024 | $19.88 |

Gov.Capital

Price range for 2024: $24,67 – $45,88 (as of June 28, 2024)

According to GovCapital, the price of DraftKings will range from $24,67 to $45,88 in the third quarter. In the fourth quarter, experts predict that the share price will decline to $29,02 by the end of the year.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| July | 36,94 | 31,40 | 42,48 |

| August | 39,32 | 33,42 | 45,22 |

| September | 39,89 | 33,91 | 45,88 |

| October | 34,82 | 29,60 | 40,05 |

| November | 33,70 | 28,64 | 38,75 |

| December | 29,02 | 24,67 | 33,37 |

30Rates

Price range for 2024: $25.35–$41.26 (as of June 28, 2024)

30Rates analysts forecast the price to move between $25.35 and $41.26 for the rest of 2024. By mid-July, the price is expected to be around $34.83 per share. At the beginning of September, the stock is expected to reach $29.61, and by the end of the year, the DKNG rate is expected in the area of $35.02.

| Month | Open, $ | Low-High, $ | Close, $ |

|---|---|---|---|

| July | 37.11 | 29.30-41.26 | 34.83 |

| August | 34.83 | 27.24-37.62 | 29.61 |

| September | 29.61 | 25.35-29.75 | 27.55 |

| October | 27.55 | 26.16-30.72 | 28.44 |

| November | 28.44 | 28.01-32.89 | 30.45 |

| December | 30.45 | 30.45-37.82 | 35.02 |

StockAnalysis

Price range for 2024: $23 – $60 (as of June 28, 2024)

StockAnalysis forecasts an average price of $49.18 for DraftKings. A pessimistic scenario suggests that the price will stand near $23, while an optimistic scenario estimates the price at $60 per share. Recommendation: strong buy.

| Year | Minimum price | Average price | Maximum price |

|---|---|---|---|

| 2024 | $23 | $49.18 | $60 |

DraftKings Stock Technical Analysis

Let’s analyze the H4, D1, W1, and MN time frames to forecast the DraftKings stock price for 2024.

The RSI, MACD, MFI, and VWAP indicators combined with the SMA20 and tick volume indicators are sufficient. These tools allow you to track the movement of large volumes in more detail, identify potential pivot points, assess the strength of the current trend, and gauge the overbought/oversold market condition.

Technical indicators, in combination with candlestick and chart analysis, are recommended. This will allow you to assess the market’s current state better. In addition, Japanese candlestick patterns will help you identify the optimal entry/exit points and stop-loss levels.

On the DraftKings chart, the most common chart patterns include “Engulfing,” “Double top and bottom,” “Hammer,” and “Hanged man” reversal patterns.

Conducting a technical analysis of the monthly time frame will be necessary for a preliminary assessment of the current market conditions.

Since the end of 2022, DraftKings shares have been in an uptrend. A “Bullish engulfing” pattern was formed near the key support level of $32.05, after which the price continued to grow and reached $48.97. The quotes have slightly decreased after the formation of the “Shooting star” pattern.

The MACD indicator is declining in the positive zone, demonstrating a weakening uptrend. The RSI is also turned downward and is located at 57, confirming that bulls are weakening.

Along with this, there is a decrease in tick volumes, signaling a reduction in trading operations. The MFI values are also turning downward from the upper boundary of the indicator, demonstrating an outflow of liquidity.

Nevertheless, the price of DraftKings shares continues to move within the ascending channel. There is a potential for further growth. This is indicated by the weighted average price on the VWAP indicator, it is located below the price on the chart. The SMA20 is also moving below the price, pointing to the continuation of the upward trend.

Preliminary analysis gives multidirectional signals. Nevertheless, there is still a high probability that the uptrend will continue until the end of the year.

Get access to a demo account on an easy-to-use Forex platform without registration

#DKNG Stock Analysis For Next Three Months

Let’s use the H4 and D1 charts to forecast the DKNG price for the next few months.

On the 4-hour chart, a “Bearish flag” pattern is forming. The price is expected to pierce its lower boundary. Notably, tick volumes are also decreasing. The MFI indicator has turned downward, suggesting an outflow of funds from the asset.

The RSI is above 55, which suggests that bulls are trying to return the price to the resistance levels of $40.40–$48.94. The VWAP and SMA20 are below the price, pointing to bullish sentiment in the market.

Nevertheless, the MACD is smoothly declining in the positive zone, signaling that bulls are losing their strength.

On the daily chart, the stock maintains an uptrend. Bulls have formed a “Bear trap” pattern and turned the price upwards again, building a series of “Hammer” candlestick patterns near the support at 36.71.

The MACD crossed the zero threshold from below and is growing in the positive zone. As a result, the trend is ready to turn bullish. The RSI is neutral and moves horizontally, giving no clear signals. The MFI is increasing, showing a slight inflow of liquidity.

The current price is positioned above the weighted average price on the VWAP indicator, a positive sign, but it remains below the SMA20. This suggests a level of uncertainty in the market, with the balance of bullish and bearish forces currently equal.

The price of the trading instrument is likely to continue to move within a global uptrend in the next three months and could reach $48.94 by the end of the third quarter.

At the same time, if bears push the price below the key support level of $36.71, the downtrend could continue to $34.66–$29.75.

Long-Term DraftKings Shares Technical Analysis for 2024

Let’s analyze the weekly time frame to determine DKNG’s long-term trend for 2024.

On the weekly chart, a “Bearish marubozu” pattern is forming between $40.40 and $36.71, signaling increased bearish pressure on the price. A “Three Stair Steps” downtrend continuation pattern was formed, which includes a bullish “Hammer” pattern.

Such a controversial picture was caused by bulls. They attempted to keep their positions open in the area of the lower boundary of the large ascending channel near the key support of $36.71.

Nevertheless, tick volumes are declining, showing a weak appetite for the asset. At the same time, the MFI indicator shows an inflow of cash into the asset.

The RSI is neutral, slightly increasing above 49. The MACD gradually increases in the negative zone, indicating the bullish pressure.

The price is trading above the VWAP indicator’s weighted average and below the SMA20.

Technical indicators and candlestick patterns give mixed signals on further price direction. If bulls manage to hold their positions above the key support at $36.71 and bring the price back to the uptrend boundaries, we can expect further growth towards $40.40–$48.94.

On the contrary, if bears consolidate their positions below the level of $36.71, one can open short trades with targets in the area of $34.66–$27.45.

Below is the table with forecasted values of price minimums and maximums for the current year.

| Month | DraftKings Inc. (#DKNG) projected values | |

|---|---|---|

| Minimum | Maximum | |

| July | $40.33 | $44.32 |

| August | $43.45 | $46.56 |

| September | $44.50 | $46.87 |

| October | $44.19 | $46.50 |

| November | $46.25 | $48.37 |

| December | $48.31 | $49.43 |

Long-Term Trading Plan for DraftKings Inc. (#DKNG)

The technical analysis allows us to determine key support and resistance levels, which can be used in a trading strategy for the next few months and until the end of 2024.

Trading plan for three months

- DraftKings stock will likely continue to rise in the coming months, confirmed by a series of bullish “Hammer” patterns on the daily chart. However, the price may fall as the “Bear flag” pattern is formed.

- If the price settles above the resistance level of 40.40, it may grow to $44.29–$48.94.

- If bears push the price below the lower boundary of the ascending channel and fix it below $36.71, bearish momentum may drag the stock price to $34.66–$29.75.

- Key support levels: $36.71, $34.66, $32.05, and $29.75.

- Key resistance levels for the next three months are $40.40, $44.29, $46.33, and $48.94.

Trading plan for 2024

- Indicators and candlestick patterns give mixed signals for DraftKings stock. The chart shows heavy selling pressure, as evidenced by the “Bearish marubozu” pattern. However, the subsequent bullish “Hammer” pattern indicates that the price has likely hit the bottom and is ready to turn upward. However, further confirmation is needed.

- A breakout and consolidation above $40.40 will allow bulls to push the price to $48.94.

- If the price consolidates below $36.71, it may fall as low as $27.45 by the end of the year.

- Key support levels: $36.71, $34.66, $32.05, $29.75, $27.45.

- Key resistance levels: $40.40, $42.18, $44.29, $46.33, $48.94.

(DKNG) Draftkings stock Forecast for 2025

Let’s take a look at expert forecasts for the DKNG rate in 2025. Experts anticipate an increase in DKNG stock, but projections on the growth pace differ.

CoinPriceForecast

Price range for 2025: $47.27 – $57.91 (as of June 28, 2024)

By mid-2025, analysts at CoinPriceForecast forecast DraftKings’ share price to reach $47.27. During the second half of the year, experts anticipate the asset to grow up to $57.91.

| Year | Mid-year | Year-End |

|---|---|---|

| 2025 | $47.27 | $57.91 |

CoinCodex

Price range for 2025: $19.88 – $64.17 (as of June 28, 2024)

CoinCodex forecasts that the average DraftKings share price will rise to $64.17 in 2025. The forecast is based on statistical data on the average annual increase in the value of DKNG over the past 10 years.

| Year | Prediction |

|---|---|

| 2025 | $64.17 |

WalletInvestor

Price range for 2025: $49.612 – $73.986 (as of June 28, 2024)

According to WalletInvestor analysts, in the first quarter of 2025, DraftKings stock will vary in the range of $49.612 – $59.578. In the second and third quarters, the upward trend is expected to continue to $73.514 by the end of September. In the fourth quarter, a depreciation is predicted with the price falling to $69.118 per share.

| Month | Opening, $ | Closing, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|---|

| January | 50.025 | 54.125 | 49.612 | 54.125 |

| February | 54.813 | 57.338 | 54.813 | 57.338 |

| March | 57.569 | 59.222 | 57.569 | 59.578 |

| April | 59.220 | 56.305 | 56.267 | 59.348 |

| May | 56.066 | 58.576 | 55.517 | 58.576 |

| June | 59.062 | 61.005 | 59.062 | 61.205 |

| July | 61.054 | 64.959 | 61.054 | 64.959 |

| August | 65.093 | 69.389 | 65.093 | 69.389 |

| September | 70.131 | 73.514 | 70.131 | 73.986 |

| October | 73.595 | 69.118 | 69.070 | 73.595 |

| November | 69.243 | 72.489 | 69.243 | 72.679 |

| December | 72.181 | 70.527 | 70.402 | 72.201 |

LongForecast

Price range for 2025: $32.99 – $96.91 (as of June 28, 2024)

In the first half of the year, the price will fluctuate in a wide range of $32.99 – $96.91, according to analysts at LongForecast. By the end of June, the price could be as high as $49.13.

In the second half of the year, experts project continued growth. The price may reach a new all-time high of $96.91 by the end of December.

| Month | Opening, $ | Min-Max, $ | Closing, $ |

|---|---|---|---|

| January | 35.02 | 32.99-38.73 | 35.86 |

| February | 35.86 | 35.86-44.54 | 41.24 |

| March | 41.24 | 38.65-45.37 | 42.01 |

| April | 42.01 | 38.71-45.45 | 42.08 |

| May | 42.08 | 39.30-46.14 | 42.72 |

| June | 42.72 | 42.72-53.06 | 49.13 |

| July | 49.13 | 49.13-57.70 | 53.43 |

| August | 53.43 | 53.14-62.38 | 57.76 |

| September | 57.76 | 57.76-71.73 | 66.42 |

| October | 66.42 | 64.57-75.81 | 70.19 |

| November | 70.19 | 70.19-84.27 | 78.03 |

| December | 78.03 | 78.03-96.91 | 89.73 |

GovCapital

Price range for 2025: $21,69 – $48,82 (as of June 28, 2024)

According to GovCapital, the asset’s performance in 2025 will be mixed.

DraftKings stock price will range between $26,13 and $26,21 in the first six months. Analysts predict a sharp rise to $42,45 per share in August. In the second half of the year, DKNG will trade in a range of $36,79 to $40,95. By the end of the year, the average price will be around $36,79.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| January | 26,21 | 22,28 | 30,14 |

| February | 28,64 | 24,35 | 32,94 |

| March | 27,79 | 23,62 | 31,95 |

| April | 26,47 | 22,50 | 30,44 |

| May | 25,52 | 21,69 | 29,34 |

| June | 26,13 | 22,21 | 30,05 |

| July | 40,95 | 34,80 | 47,09 |

| August | 42,45 | 36,09 | 48,82 |

| September | 41,83 | 35,55 | 48,10 |

| October | 38,07 | 32,37 | 43,80 |

| November | 39,54 | 33,61 | 45,47 |

| December | 36,79 | 31,27 | 42,31 |

Long-Term (DKNG) DraftKings Stock Forecast for 2026

Let’s take a look at expert forecasts for the DKNG rate in 2026. According to analysts, DKNG will continue its bullish trend, but corrections are not excluded.

WalletInvestor

Price range for 2026: $70.091 – $94.431 (as of June 28, 2024)

According to WalletInvestor, DraftKings’ share price will be $70.367 at the beginning of 2026. By the end of the first half of the year, quotes could climb to $81.642. In the second half, it is expected to rise to $92.768 by the end of December.

| Month | Opening, $ | Closing, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|---|

| January | 70.367 | 74.212 | 70.091 | 74.212 |

| February | 74.945 | 77.665 | 74.945 | 77.665 |

| March | 77.869 | 79.714 | 77.869 | 80.033 |

| April | 79.847 | 76.669 | 76.669 | 79.847 |

| May | 76.531 | 78.765 | 75.904 | 78.765 |

| June | 79.270 | 81.486 | 79.270 | 81.642 |

| July | 81.667 | 85.355 | 81.568 | 85.355 |

| August | 85.675 | 90.223 | 85.675 | 90.223 |

| September | 90.543 | 94.151 | 90.543 | 94.431 |

| October | 93.950 | 89.535 | 89.535 | 93.950 |

| November | 89.569 | 92.727 | 89.569 | 93.127 |

| December | 92.686 | 90.870 | 90.870 | 92.768 |

LongForecast

Price range for 2026: $51.98 – $104.19 (as of June 28, 2024)

LongForecast anticipates a bearish trend for DKNG shares in 2026. In the first half of the year, the price may climb from $76.27 in January to $83.89 in early June.

A short-term growth will follow, dragging the price to the peak of $104.19 at the end of June. After hitting a new all-time high, the stock will gradually decline to $62.46 by the end of December. At the same time, the minimum price may reach $51.98 in October.

| Month | Opening, $ | Min-Max, $ | Closing, $ |

|---|---|---|---|

| January | 89.73 | 70.17-89.73 | 76.27 |

| February | 76.27 | 66.20-77.72 | 71.96 |

| March | 71.96 | 71.93-84.45 | 78.19 |

| April | 78.19 | 68.24-80.10 | 74.17 |

| May | 74.17 | 74.17-90.60 | 83.89 |

| June | 83.89 | 83.89-104.19 | 96.47 |

| July | 96.47 | 77.33-96.47 | 84.05 |

| August | 84.05 | 65.72-84.05 | 71.44 |

| September | 71.44 | 55.86-71.44 | 60.72 |

| October | 60.72 | 51.98-61.02 | 56.50 |

| November | 56.50 | 53.66-63.00 | 58.33 |

| December | 58.33 | 57.46-67.46 | 62.46 |

CoinPriceForecast

Price range for 2026: $60.26 – $67.22 (as of June 28, 2024)

According to CoinPriceForecast, the asset may reach $60.26 by mid-2026. By the end of the year, the DKNG rate may rise to $67.22.

| Year | Mid-Year | Year-End |

|---|---|---|

| 2026 | $60.26 | $67.22 |

GovCapital

Price range for 2026: $29,76 – $67,27 (as of June 28, 2024)

In the first half of 2026, according to GovCapital, DraftKings shares will trade in the range of $35,01 – $38,50. At the same time, experts believe the rate will rise sharply to $58,50 by August. The maximum price will stand at $67,27 at the end of August.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| January | 35,01 | 29,76 | 40,26 |

| February | 38,90 | 33,06 | 44,73 |

| March | 38,61 | 32,82 | 44,40 |

| April | 37,72 | 32,06 | 43,37 |

| May | 37,39 | 31,78 | 42,99 |

| June | 38,50 | 32,72 | 44,27 |

| July | 58,18 | 49,45 | 66,91 |

| August | 58,50 | 49,72 | 67,27 |

| September | 58,10 | 49,39 | 66,82 |

| October | 53,84 | 45,76 | 61,91 |

| November | 55,83 | 47,46 | 64,21 |

| December | 52,59 | 44,70 | 60,47 |

Long-Term (DKNG) Draftkings Stock Forecast for 2027–2030

Let’s take a look at expert forecasts for the DKNG rate in 2027–2030. The estimates are quite approximate, and the forecasts may change at any point in time.

WalletInvestor

According to the long-term forecast from WalletInvestor, the bullish trend for DraftKings stock will continue in 2027–2029. Thus, at the beginning of 2027, the asset may reach $94.288. By the end of 2028, it is expected to soar to $133.579. By the middle of 2029, the price will reach $140.738.

| Month | Opening, $ | Closing, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|---|

| 2027 | ||||

| January | 90.813 | 94.288 | 90.516 | 94.288 |

| February | 95.056 | 98.005 | 95.056 | 98.005 |

| March | 98.180 | 100.340 | 98.180 | 100.476 |

| April | 100.188 | 97.136 | 97.136 | 100.188 |

| May | 96.680 | 99.469 | 96.321 | 99.469 |

| June | 99.704 | 102.100 | 99.704 | 102.100 |

| July | 101.995 | 105.604 | 101.977 | 105.604 |

| August | 105.955 | 110.636 | 105.955 | 110.636 |

| September | 111.089 | 114.503 | 111.089 | 114.855 |

| October | 114.407 | 109.991 | 109.991 | 114.407 |

| November | 109.932 | 113.228 | 109.932 | 113.544 |

| December | 113.323 | 111.316 | 111.316 | 113.323 |

| 2028 | ||||

| January | 111.080 | 115.149 | 110.924 | 115.149 |

| February | 115.470 | 118.638 | 115.470 | 118.638 |

| March | 118.913 | 120.632 | 118.911 | 120.907 |

| April | 120.401 | 117.753 | 117.753 | 120.505 |

| May | 117.263 | 120.272 | 116.766 | 120.272 |

| June | 120.352 | 122.427 | 120.352 | 122.539 |

| July | 122.382 | 126.222 | 122.382 | 126.222 |

| August | 126.404 | 131.350 | 126.404 | 131.350 |

| September | 131.621 | 134.956 | 131.621 | 135.255 |

| October | 134.577 | 130.403 | 130.333 | 134.577 |

| November | 130.631 | 133.674 | 130.598 | 133.928 |

| December | 133.579 | 131.816 | 131.816 | 133.579 |

| 2029 | ||||

| January | 131.582 | 136.016 | 131.356 | 136.016 |

| February | 136.178 | 139.229 | 136.178 | 139.229 |

| March | 139.218 | 141.123 | 139.218 | 141.322 |

| April | 140.905 | 137.862 | 137.862 | 141.018 |

| May | 137.776 | 140.554 | 137.240 | 140.554 |

| June | 140.738 | 142.832 | 140.738 | 142.914 |

GovCapital

At the beginning of 2027, GovCapital experts forecast the value of DraftKings shares at $50,10. By the end of the year, the average price will grow to $65,90. The experts also forecast the DKNG rate to rise in 2028 to $69,15 by the end of December.

However, the stock is expected to decline in 2029. In the first quarter, the asset’s price will range between $66,00 and $67,14. After that, DKNG’s value will decline to $62,87 at the end of May.

| Month | Average, $ | Minimum, $ | Maximum, $ |

|---|---|---|---|

| 2027 | |||

| January | 50,10 | 42,58 | 57,61 |

| February | 53,76 | 45,70 | 61,82 |

| March | 53,26 | 45,27 | 61,25 |

| April | 51,53 | 43,80 | 59,26 |

| May | 49,84 | 42,37 | 57,32 |

| June | 50,77 | 43,16 | 58,39 |

| July | 75,56 | 64,22 | 86,89 |

| August | 76,27 | 64,83 | 87,71 |

| September | 75,31 | 64,01 | 86,61 |

| October | 70,18 | 59,65 | 80,70 |

| November | 70,29 | 59,74 | 80,83 |

| December | 65,90 | 56,01 | 75,78 |

| 2028 | |||

| January | 62,80 | 53,38 | 72,22 |

| February | 65,43 | 55,59 | 75,20 |

| March | 64,09 | 54,45 | 73,67 |

| April | 62,01 | 52,77 | 71,39 |

| May | 60,33 | 51,40 | 69,55 |

| June | 60,41 | 50,78 | 68,70 |

| July | 79,43 | 67,50 | 91,32 |

| August | 79,51 | 67,59 | 91,44 |

| September | 78,08 | 66,47 | 89,93 |

| October | 72,99 | 62,08 | 83,99 |

| November | 73,38 | 62,39 | 84,41 |

| December | 69,15 | 58,87 | 79,64 |

| 2029 | |||

| January | 66,00 | 56,10 | 75,90 |

| February | 68,61 | 58,32 | 78,90 |

| March | 67,14 | 57,07 | 77,22 |

| April | 64,87 | 55,14 | 74,60 |

| May | 62,87 | 53,44 | 72,31 |

| June | 62,95 | 53,28 | 72,08 |

CoinPriceForecast

Analysts from CoinPriceForecast give moderate forecasts for the value of DraftKings stock for 2027–2030. According to experts, the share price may reach $118.84 by the middle of 2030.

| Year | Mid-Year | Year-End |

|---|---|---|

| 2027 | $75.86 | $84.39 |

| 2028 | $92.83 | $101.18 |

| 2029 | $104.29 | $112.11 |

| 2030 | $118.84 | $121.29 |

LongForecast (DKNG) Draftkings stock Forecast for 2027–2028

LongForecast predicts the price of DKNG stock will range from $55.83-81.45 in 2027 and $47.38-61.00– in the first two months of 2028.

| Year | Name of the Agency | Min Price,$ | Max Price,$ |

|---|---|---|---|

| 2027 | Gov Capital | 1.12 | 38 |

| 2027 | LongForecast | 55.83 | 90.07 |

| 2028 | Gov Capital | 0.6171 | 1.3869 |

| 2028 | LongForecast | 47.38 | 61.00 |

CoinCodex

CoinCodex analysts offer more optimistic forecasts for 2027-2030. The value of DKNG may surge to $191.86 in 2027. By 2030, the stock may showcase an unprecedented growth up to $991.91.

| Year | Average price |

|---|---|

| 2027 | $191.86 |

| 2028 | $331.75 |

| 2029 | $573.64 |

| 2030 | $991.91 |

LongForecast

LongForecast provides more conservative but still highly positive forecasts for 2027-2028. By the end of 2027, DKNG quotes may reach $127.13. In 2028, experts project a continuation of the upward trend up to $157.18 at the end of July.

| Month | Opening price | Min/Max price | Closing price |

|---|---|---|---|

| 2027 | |||

| January | 62.46 | 62.46-77.58 | 71.83 |

| February | 71.83 | 59.73-71.83 | 64.92 |

| March | 64.92 | 64.92-80.63 | 74.66 |

| April | 74.66 | 63.54-74.66 | 69.06 |

| May | 69.06 | 63.10-74.08 | 68.59 |

| June | 68.59 | 59.28-69.60 | 64.44 |

| July | 64.44 | 64.44-80.04 | 74.11 |

| August | 74.11 | 74.11-87.05 | 80.60 |

| September | 80.60 | 80.16-94.10 | 87.13 |

| October | 87.13 | 87.13-108.22 | 100.20 |

| November | 100.20 | 97.42-114.36 | 105.89 |

| December | 105.89 | 105.89-127.13 | 117.71 |

| 2028 | |||

| January | 117.71 | 117.71-146.20 | 135.37 |

| February | 135.37 | 105.86-135.37 | 115.06 |

| March | 115.06 | 99.88-117.24 | 108.56 |

| April | 108.56 | 108.51-127.39 | 117.95 |

| May | 117.95 | 102.94-120.84 | 111.89 |

| June | 111.89 | 111.89-136.68 | 126.56 |

| July | 126.56 | 126.56-157.18 | 145.54 |

Recent Price History of the (DKNG) DraftKings stock

In 2021, Draftkings’ stock experienced significant fluctuations. Starting around $51.34 in January, it saw various ups and downs throughout the year, reaching highs around $62.63 in April but declining towards the end of the year to about $28.40 in December.

Moving into 2022, the volatility continued. The stock began the year at a lower point, around $24.41 in January, reflecting the broader market uncertainties and specific Challenges within the gaming sector. It saw a downward trend for most of the year, with notable dips and occasional recoveries, ending around $12.92 in July.

As for 2023, Draftkings’ stock has shown signs of recovery. Starting the year at approximately $11.48 in January, it has gradually increased over the months. The stock price has been hovering around $33.18 recently, indicating a positive outlook and recovery from the previous lows.

Which Factors Impact (DKNG) DraftKings Stock Forecast?

Like other stocks, DKNG’s exchange rate depends on certain fundamental factors.

- Firstly, regulatory changes are a significant factor. As DraftKings operates in the online betting and gaming industry, any changes in legal frameworks across different states or countries can significantly impact the stock price.

- Secondly, the company’s financial health and quarterly earnings reports are vital. As investors digest these reports, significant variances from expected earnings can lead to volatility in the stock price.

- Market competition and partnerships also play a crucial role. As DraftKings vies for market share against other betting and gaming platforms, strategic partnerships or losses can sway investor sentiment, impacting the stock forecast.

- Technological advancements and platform enhancements can lead to positive revisions in the DraftKings stock forecast, as they improve user experience and potentially increase the user base.

- Lastly, broader market trends and economic conditions, including interest rates, inflation, and consumer spending habits, can influence the stock price.

Is It Worth Investing in DraftKings Stock?

DraftKings stock is an attractive investment with a relatively high annual yield. In the fiercely competitive betting industry, DraftKings has demonstrated its resilience by maintaining a leading position, a testament to its continuous improvement in gaming and online sports betting services.

Due to several factors affecting DKNG stock, the company’s shares are subject to high volatility. This creates additional risks for investors and traders, making the stock more suitable for short-term trading.

However, DraftKings stock can also be considered a long-term investment, but it requires a special approach to analyzing the gaming market and all its risks.

(DKNG) Draftkings stock Forecast FAQs

The current price that #DKNG is trading at is around $ per

share as of today 28.06.2024.

Analysts give different estimates regarding the further rate of DKNG for 2024. However, most experts anticipate the rate to rise to $38.28 – $51.04.

According to experts, the value of DKNG securities may reach $48,82–$73.986 in 2025. Some analysts predict that the share price may increase to $96.91.

In the next five years, the DraftKings shares may appreciate to $112.11–$142.914. At the same time, the most optimistic forecast is given by CoinCodex experts. Thus, the value of DKNG can grow to $573.64.

DraftKings does not pay dividends, but it gives a good annualized yield due to the intense growth in stock price.

DKNG stock is considered a high-risk asset due to its high volatility. Before investing in DraftKings shares, investors should carefully analyze the company’s financial statements and monitor changes in the gambling and online sports betting market.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.