President Trump has stated that Europe should purchase more American oil and natural gas, and China should sell TikTok and fulfill the terms of the previous trade agreement. Otherwise, they will face tariffs. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The US is not yet ready for universal tariffs.

- On February 1, 25% duties await Mexico and Canada.

- Europe and China should buy more American commodities.

- Short trades on the EURUSD pair can be opened on a rebound from 1.044, 1.047, and 1.054.

Weekly US Dollar Fundamental Forecast

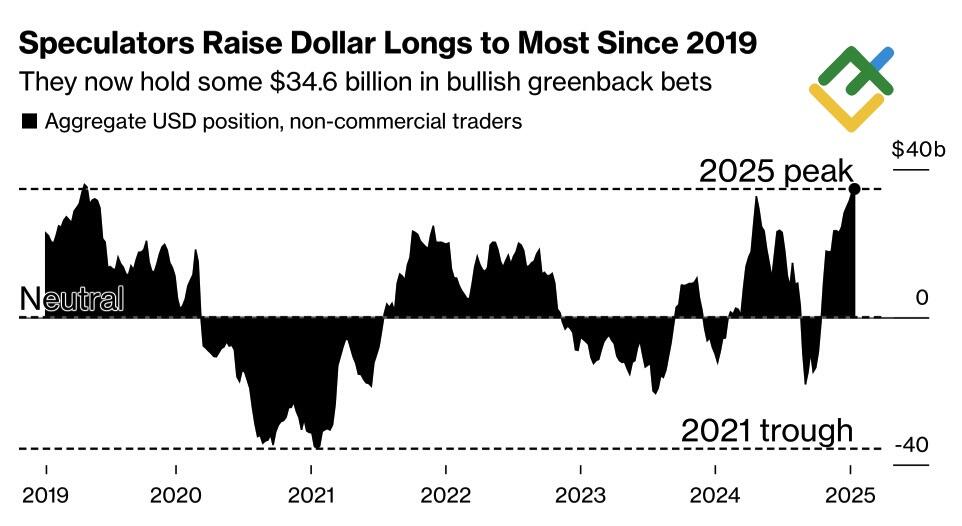

The discrepancy between expectations and reality is evident in the recent market fluctuations. The US dollar experienced a significant decline following President Donald Trump’s indications regarding tariffs, marking the worst sell-off since November 2023. The greenback was initially considered the most vulnerable currency to the inauguration due to record net long positions since 2019. The subsequent statement by Trump, which included the announcement of 25% import duties on trade with Canada and Mexico, led to a recovery in the EURUSD exchange rate.

Non-commercial Traders’ Positions on US Dollar

Source: Bloomberg.

The market’s initial reaction to the absence of tariffs on Inauguration Day has given way to a period of uncertainty as observers eagerly await the Senate’s confirmation of Donald Trump’s cabinet nominees. According to DBS Group Research, the implementation of effective protectionist policies necessitates a well-coordinated team, suggesting that the president may be holding off until his team is in place.

“I was saved by God to make America great again,” Trump said, underscoring his commitment to revitalizing the nation. The US president’s plans include tax cuts in the US and the imposition of tariffs on the rest of the world, which supports American exceptionalism and is a strong argument in favor of maintaining the EURUSD downtrend, no matter how deep the pullback is.

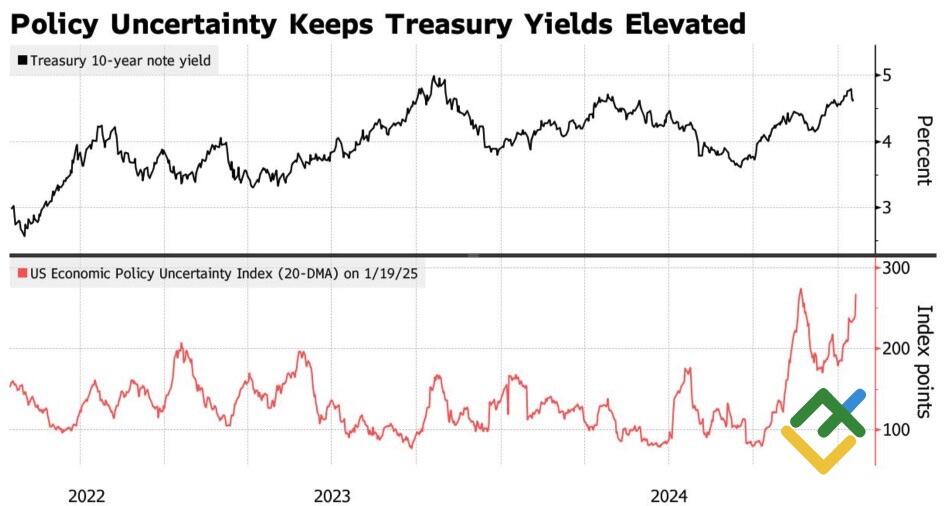

At the same time, political uncertainty, which previously boosted US Treasury bond yields and reinforced the US dollar, led to the opposite result after the inauguration.

10-Year Treasury Yield and US Economic Policy Uncertainty Index

Source: Bloomberg.

President Donald Trump has made it clear that the threat of tariffs can remain just a threat if the rest of the world complies with US demands. The president has urged Europe to purchase American oil and natural gas and China to sell TikTok. If they do not comply, they will face tariffs. At the same time, Trump believes that the US is not yet prepared for universal duties on imports of 10%.

Instead of implementing broad tariffs immediately, the president has directed federal agencies to investigate global trade practices and assess China’s compliance with a previous trade agreement to purchase an additional $200 billion in American products. Given China’s failure to meet these terms, tariffs could be reinstated at any moment, just as the EURUSD pair could revert to a downtrend.

Weekly EURUSD Trading Plan

Therefore, the world avoided an economic disaster on the day of Donald Trump’s inauguration. Investors’ worst fears did not come true, but markets will have to consider the possibility of tariffs. Given the sensitivity of the US dollar to import duties, it is strategically sound to consider switching from long trades formed at 1.0335 to short trades if the EURUSD pair fails to break above the resistance levels of 1.044, 1.047, and 1.054.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.