By Andrea Shalal and David Lawder

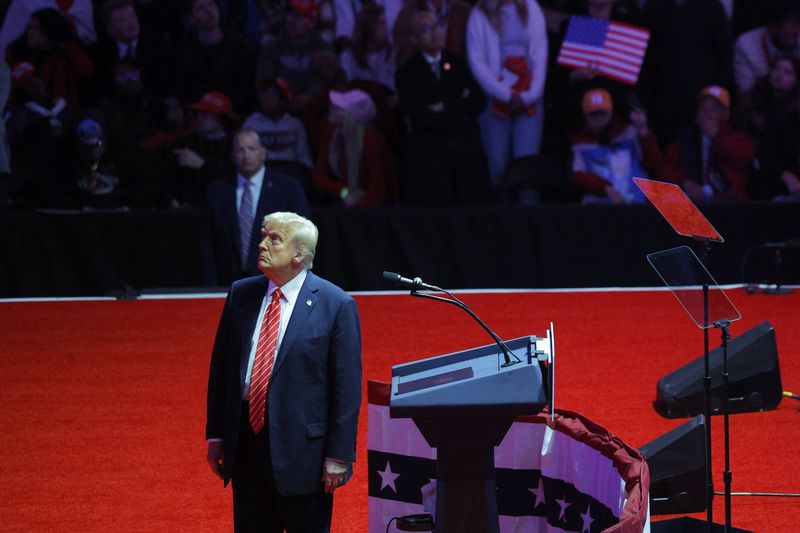

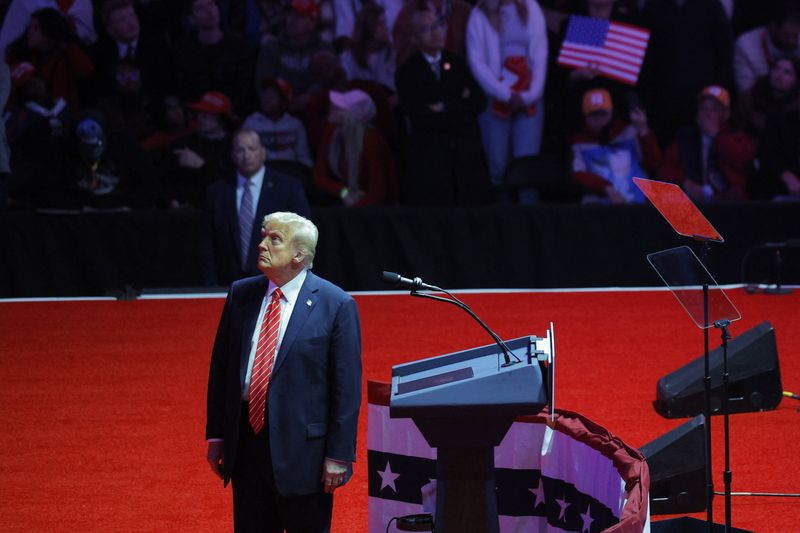

WASHINGTON (Reuters) – President-elect Donald Trump will sign an executive order declaring a national energy emergency aimed at “unleashing affordable and reliable American energy,” an official with the incoming White House said on Monday.

Trump, who vowed during his campaign to “drill, baby, drill,” will also sign an executive order focused on Alaska, the official said, adding that the state was critical to U.S. national security and could allow exports of LNG to other parts of the United States and allies.

No details were provided for either measure, but the official said Trump’s orders would cut “the red tape and the burden and regulations” to boost U.S. energy production and lower costs for American consumers.

The official said there was no specific target for the oil price, adding that the Trump administration aimed to ensure an abundance of American energy that would allow prices to drop.

The energy order would also seek to reverse efforts by the outgoing Biden administration to encourage development of electric vehicles and set requirements for energy efficiency of common household appliances, the official said, without providing any details.

On the Alaska initiative, the official said Trump would take “decisive action to unleash Alaska’s natural resource potential,” citing an abundance of resources such as oil and gas, seafood, timber and critical minerals. No further details were provided, but the official said past regulations by the Interior and Agriculture departments had limited Alaska’s production.

This post is originally published on INVESTING.