When the central bank accelerates its rate-cutting cycle, the currency typically encounters a decline. However, the GBPUSD pair surged on the back of slowing inflation in the UK. At first glance, this may seem counterintuitive, but the surge was driven by underlying factors. The pound sterling has suffered from capital flight, but a stabilized debt market has buoyed the British currency. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The recent slowdown in UK inflation has been viewed positively by the Exchequer.

- The Bank of England may cut rates 5–6 times in 2025.

- The pound is turning into an underdog in the Forex market.

- Short trades can be opened if GBPUSD quotes fail to return above 1.226.

Weekly Fundamental Forecast for Pound Sterling

It may seem that the British pound has been experiencing significant fluctuations due to the intricate interplay of fiscal and monetary policies. Indeed, the GBPUSD has plummeted precipitously amid a rally in UK bond yields but rose as the scope of the Bank of England’s monetary expansion in 2025 expanded. This is an atypical occurrence, but investor concerns have contributed to the pound’s momentum.

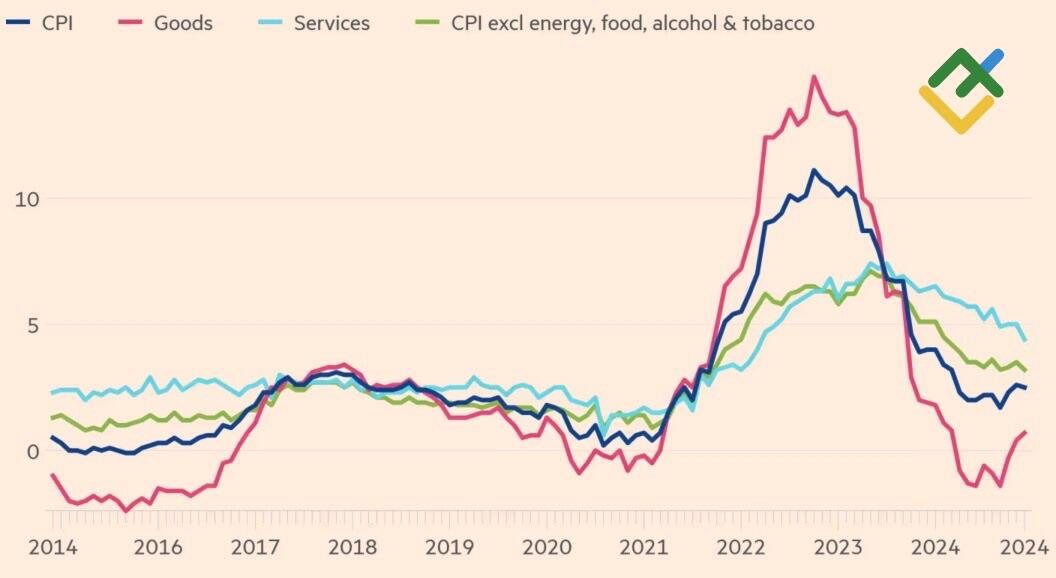

A recent statement by Rachel Reeves, who asserted that the rise in debt market rates was not due to government actions but rather to global market trends, forced GBPUSD bears to retreat. However, subsequent data on UK inflation showed a slowdown in consumer prices to 2.5% in December, core inflation to 3.2%, and services inflation to 4.4%, allowing bulls to start a counterattack. These figures fell short of expectations, providing a respite for HM Treasury and the Bank of England.

UK Inflation Change

Source: Financial Times.

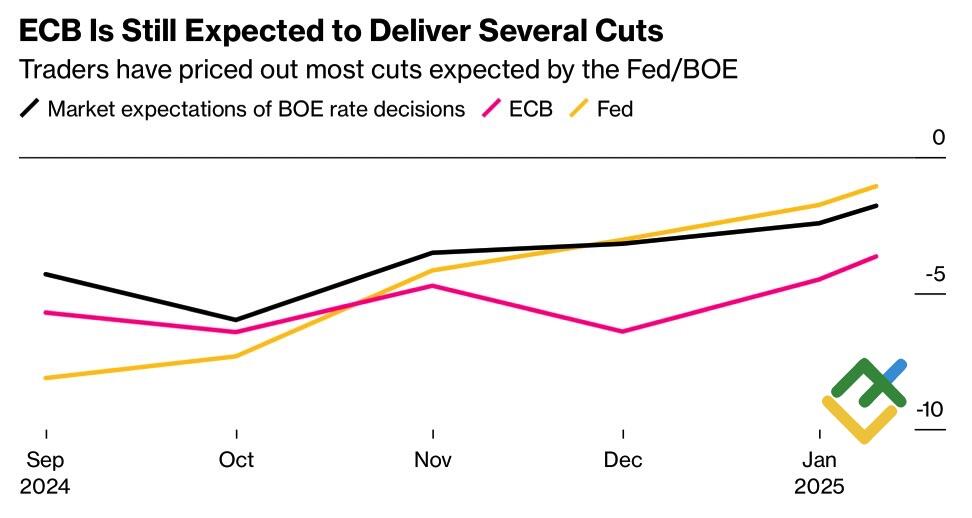

The derivatives market immediately raised the odds of a repo rate cut in February from 60% to 85% and the overall scope for monetary expansion in 2025 from 40bp to 54bp. MPC member Alan Taylor has indicated that the BoE should cut borrowing costs by 125–150 bps to ensure the UK economy achieves a soft landing, thereby avoiding the risk of deflation. A prompt reduction in rates would serve as a safeguard against this possibility.

Historically, an increase in the expected scale of monetary expansion has a tendency to weaken a currency and vice versa. However, GBPUSD bulls appeared more optimistic about the deceleration in British inflation. The pair’s decline at the beginning of the year was driven by capital flight from the country amidst concerns that the government might not meet its financial obligations. However, the stabilization of the debt market halted this process, thereby supporting the British currency.

Market Expectations on BoE Interest Rate

Source: Bloomberg.

The recent turbulence in the British debt market has abated, but the weakness of the sterling is likely to persist. The surge in UK bond yields may be attributable to external factors, but this should not be viewed as a positive development. Soaring debt servicing costs will widen the budget deficit, prompting the Exchequer to consider either raising taxes or reducing government spending, which will likely lead to a slowdown in GDP growth.

The most effective solution in this scenario would be to accelerate the Bank of England’s monetary expansion cycle. This may entail cutting the repo rate four times in 2025 instead of two acts, a move that would position the pound as an outsider in the Forex market.

Weekly GBPUSD Trading Plan

The GBPUSD pair has hit the bearish target of 1.22 and rebounded. One can consider opening short trades if the pair fails to return above 1.226.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.