The impact of US tariffs may not be as devastating as expected. There is no evidence of a debt crisis in the UK, and the US Federal Reserve is not expected to raise interest rates. This suggests that EURUSD bulls may start a correction, provided that inflation in the US does not derail this process. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Investors continue to wind down long positions on the greenback due to tariffs.

- The Exchequer has managed to stabilize both the pound and the euro.

- The Fed needs time to switch from rate cuts to rate hikes.

- Disinflation in the US may lead to a pullback to 1.039 and 1.0445.

Daily Euro Fundamental Forecast

As a rule, shock is an instant reaction to an unexpected event that eventually passes. Investors were concerned that Donald Trump’s sweeping tariffs would threaten the global economy, that the debt crisis in the UK would be contagious, and that Bank of America’s prediction that the Fed would start raising rates in 2025 would come true. In each case, the situation has not been as dire as predicted. The shock is gradually subsiding, leading to a pullback in the EURUSD pair.

Donald Trump has not refuted the Bloomberg report on the phased introduction of tariffs. Notably, the president-elect denied the Washington Post’s report that said his aides were exploring tariff plans. Therefore, there is credibility to the claim, which forces speculators to liquidate their long positions on the US dollar.

According to Chancellor of the Exchequer Rachel Reeves, it is unwise to assume that the rapid rally in UK bond yields is the result of measures taken by the government. Despite heightened market volatility, the Chancellor is committed to adhering to the established borrowing rules. The pound has stabilized, and the euro has followed suit.

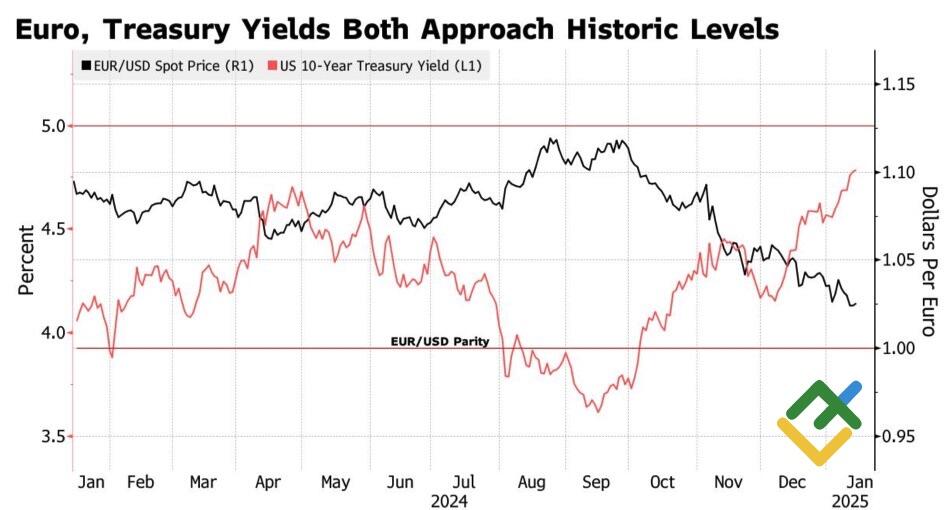

Euro Performance Against US Dollar and 10-Year US Treasury Yield

Source: Bloomberg.

The contrived debt crisis in the UK stems from skyrocketing US Treasury yields. According to State Street Global Advisors, if 10-year rates exceed 5%, the EURUSD pair is expected to decline towards parity.

Despite the robust state of the US labor market, it is more challenging for the Fed to raise the federal funds rate than to lower it. Since 1994, the US regulator has only once shifted from monetary expansion to restriction within less than one year. In 1998, due to concerns that the collapse of Long-Term Capital Management would trigger a market meltdown, monetary policy was eased. However, as conditions stabilized, the Fed resumed tightening.

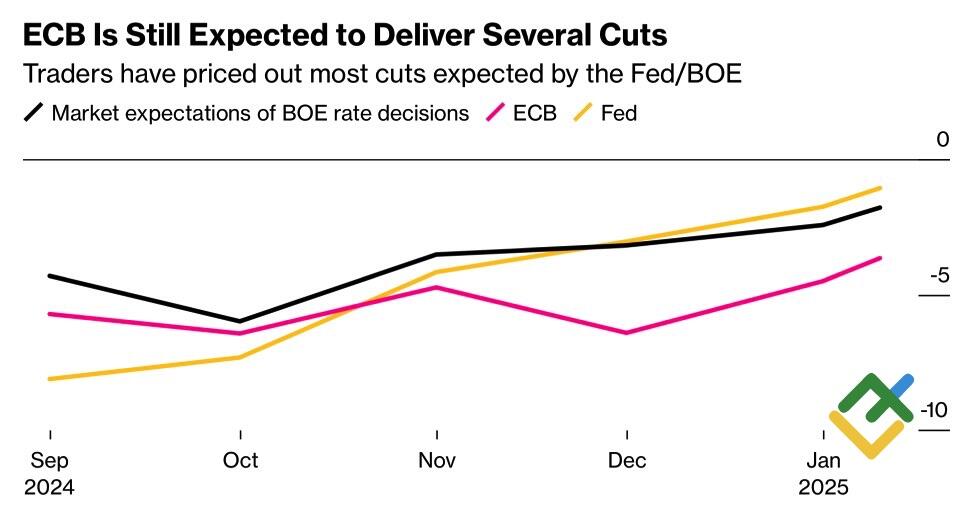

Market Expectations on Interest Rates

Source: Bloomberg.

The derivatives market is anticipating a single act of monetary expansion by the Fed in 2025, with a less than 10% probability of a second one, and three similar acts by the ECB, with a 60% likelihood of a fourth one. The varying pace of rate cuts is a key factor in the EURUSD‘s decline. How will investor sentiment evolve?

A significant shift is expected following the release of US CPI data for December. According to Bloomberg experts, the index is projected to grow by 0.3% m/m, with a slight majority of 39 experts forecasting this growth. The remaining 32 anticipate a 0.2% increase. The current outlook is relatively cautious, leaving room for a pullback in the major currency pair or a revival of the downtrend.

Daily EURUSD Trading Plan

The resumption of a disinflationary process bodes well for the EURUSD pair, which could surge to 1.039 and 1.0445, allowing traders to open short-term long positions. Conversely, one may consider short trades if the euro fails to settle above 1.03 on the back of robust US inflation data.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.