In the fall, the US labor market showed signs of cooling, but now, many experts believe that this is no longer the case. The US Fed is planning to hold rates for an extended period, spurring US Treasury yields and sending shockwaves across global markets. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Strong US employment data has pushed Treasury yields higher.

- Bond yields are rising worldwide.

- Central banks led by the ECB are forced to cut rates.

- The EURUSD pair is sliding steadily towards 1.012 and 1.

Weekly US Dollar Fundamental Forecast

The market is experiencing significant turbulence on a global scale. A robust US jobs report has triggered a surge in US Treasury bond yields, exerting considerable pressure on the global debt market. While the US Federal Reserve has the capacity to maintain high interest rates due to the robust economy, other central banks may not have the same option. As a result, financial regulators, spearheaded by the European Central Bank (ECB), are compelled to reduce rates, dragging the EURUSD exchange rate to parity.

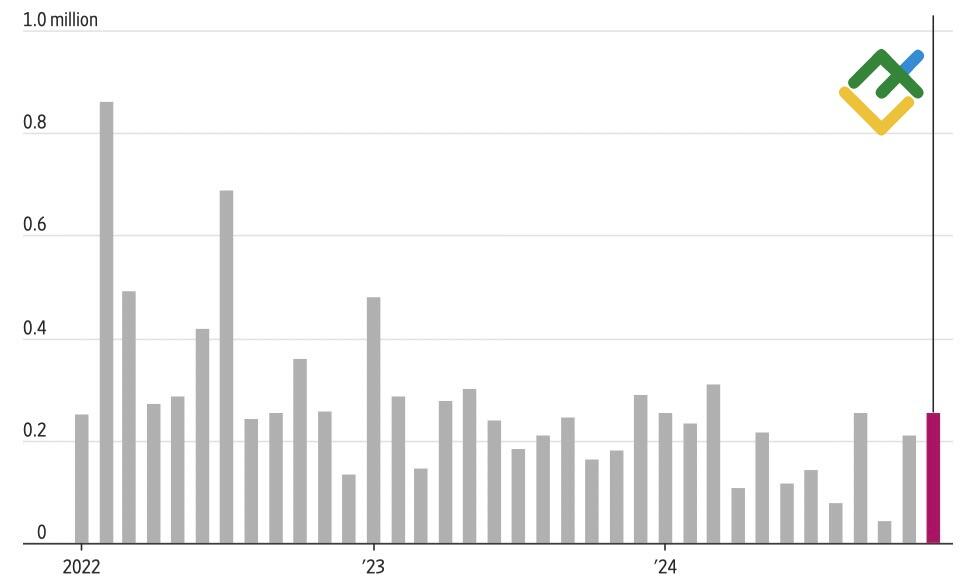

In December, US employment surged by 256,000, while unemployment dropped to 4.1%, exceeding Bloomberg’s expert forecasts. Notably, the job growth was 2.2 million in 2024, surpassing the initial expectations of experts by more than double. While there was a perception of a cooling US labor market in the fall, investors are now speculating about its potential heating.

US Employment Change

Source: Wall Street Journal.

Against this backdrop, the views of FOMC officials are changing. The policymakers who voted to raise the federal funds rate by 50 basis points in September 2024 are now discussing the possibility of a pause. The derivatives market anticipates the monetary expansion cycle to continue only in September 2025, giving a 20% probability of the second cut before the end of the year. Previously, the market had projected a rate reduction in June, with a 60% likelihood of borrowing costs falling to 4.5%.

Bank of America suggests that the Fed has completed its monetary policy loosening cycle, and if inflation in the US continues to rise, there could be discussions about tightening. Bloomberg experts predict that the consumer price growth rate will rise from 2.7% to 2.8% in December, with core inflation remaining at 3.3%.

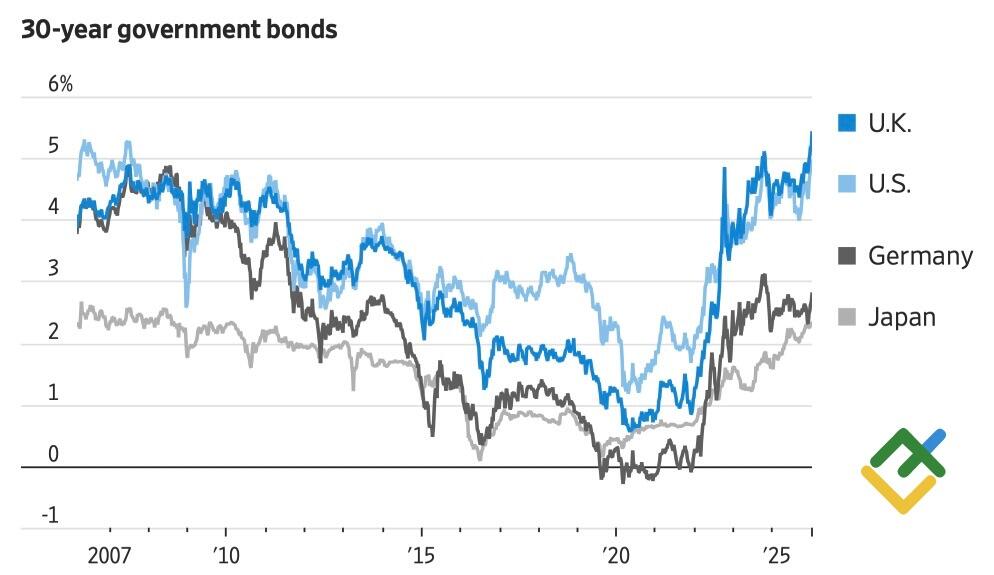

A robust economy, coupled with tariffs and fiscal stimulus from Donald Trump, is expected to fuel higher inflation, leading to higher bond yields. As a result, debt service costs will rise, with rates in the UK reaching their highest levels in 27 years and in France surpassing riskier Greek rates. In light of these developments, the pound and euro have been harmed significantly.

30-year Government Bond Yields

Source: Wall Street Journal.

According to ECB chief economist Philip Lane, the only viable solution to the current economic situation in Europe is further monetary policy easing. He anticipates that loosening will continue, as achieving the 2% inflation target will be challenging otherwise. The official’s perspective on the potential return of deflation in the currency bloc reflects a sense of urgency and concern.

Weekly EURUSD Trading Plan

The key factor contributing to the EURUSD pair’s downtrend is the divergence in monetary policy, with one central bank pausing or raising rates while the other cutting them. Monex anticipates that a robust US jobs report for December will push the major currency pair to parity faster than expected. Against this background, one should keep their short positions open with the targets of 1.012 and 1.000.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.