Despite the optimism on Wall Street regarding gold, the precious metal will unlikely repeat its last year’s outstanding performance. The previous drivers are waning, and Trump’s policies are creating uncertainty. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The consensus forecast for gold for 2025 is $2,795 per ounce.

- Trump’s trade policy keeps the precious metal under pressure.

- A slowdown in the Fed’s monetary expansion cycle is a negative factor for the XAUUSD.

- Strong data on the US labor market will allow traders to open short trades.

Weekly Fundamental Forecast for Gold

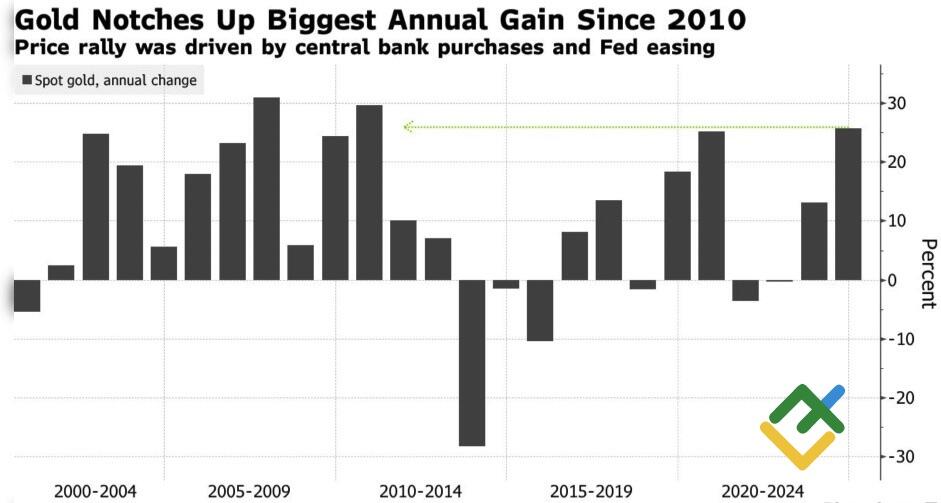

Despite facing strong headwinds in 2024, the price of gold remained resilient. Meanwhile, Wall Street experts project that the precious metal will continue growing in 2025, anticipating a price of $2,795 per ounce by the end of the year, representing a 5.7% increase. This figure reflects a more modest outlook than the 27% gain posted in 2024, which was the most significant yearly increase since 2010. However, financial institutions and investment firms forecast that gold’s fundamental drivers persist despite their waning influence on the XAUUSD.

Gold’s Yearly Performance

Source: Bloomberg.

Among these factors are central bank buying, Fed monetary policy easing, and geopolitical risks, as well as the uncertainty surrounding Donald Trump’s policies. Meanwhile, it remains uncertain how the latter could impact XAUUSD quotes.

According to DWS Group, tariffs will negatively impact US stock indices, making gold appealing as a tool to diversify investment portfolios. In my view, this point is not viable. The recent pullbacks in the S&P 500 resulted in a significant decline in the gold price as capital flowed into equities to maintain margin requirements.

Frontier Commodities anticipates that the adoption of protectionist policies by the Trump administration will prompt central banks to pursue more aggressive rate cuts to support their economies, potentially weakening fiat currencies and thereby strengthening the XAUUSD. Such a scenario would likely result in a strengthening of the US dollar, which could pose challenges for gold.

The precious metal’s reaction to the Washington Post’s insider report on tariffs on critical imports, followed by a rebuttal from Donald Trump, suggests that the gold market lacks clarity regarding the president-elect’s policies. XAUUSD quotes initially surged, then collapsed to lower levels before rallying again, indicating that investors are carefully considering the implications of the new administration’s policies.

Meanwhile, major financial institutions like Goldman Sachs, Bank of America, and JP Morgan have adjusted their forecasts, with Goldman Sachs lowering its gold forecast for the end of 2025 from $3,000 to $2,910 per ounce, representing the most bullish outlook for gold. On the other hand, Barclays and Macquarie were bearish on the gold price, anticipating it to reach $2,500.

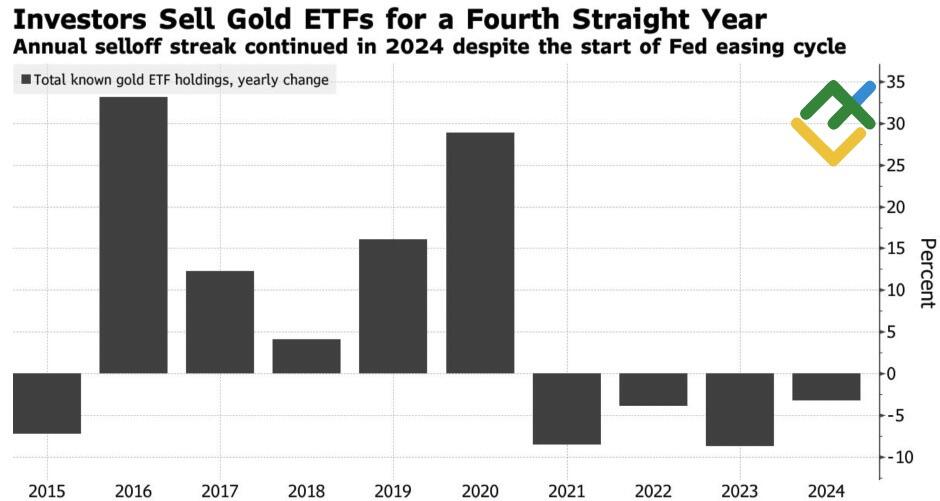

Capital Flows into Gold ETF

Source: Bloomberg.

Goldman Sachs suggests that investors may shift away from ETFs due to the Fed’s monetary expansion cycle slowdown. This shift is evidenced by the fourth consecutive annual outflow of capital from ETFs in 2024. However, if central banks continue to purchase 39 tons of gold on a monthly basis, this trend will be negated.

Weekly Trading Plan for Gold

The majority of gold’s drivers no longer influence the market, while the Fed’s pause in monetary expansion will likely exert pressure on gold quotes. Therefore, robust US labor market statistics for December will create an opportunity to open more short positions, adding them to the ones formed at $2,715.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.