Despite the Fed’s interest rate reduction from 4.75% to 4.5%, the Bank of England will likely keep the rate unchanged at 4.75%. This has resulted in higher borrowing costs for Britain compared to other G10 countries. Will the pound appreciate in value? Let’s discuss this topic and make a trading plan for the GBPUSD pair.

The article covers the following subjects:

Major Takeaways

- The Bank of England intends to leave the repo rate at 4.75%.

- The BoE wants to support the economy, but inflation and wages are preventing it.

- The US economy is stronger than its UK counterpart.

- Short trades on the GBPUSD pair can be opened on a decline below 1.259 or a pullback from 1.264 and 1.27.

Weekly Fundamental Forecast for Pound Sterling

Bloomberg experts are unanimous in their expectation that the Bank of England will not take the same action as the Fed did just hours before its meeting. It is unlikely that rates will be cut in light of the accelerating inflation. The US regulator has determined that the cost of borrowing is excessive and has reduced it to 4.5%. However, the Bank of England is prepared to keep the rate at 4.75%. Meanwhile, the GBPUSD pair does not receive support from the central bank. The currency pair has reached both bearish targets of 1.267 and 1.259, prompting investors to turn their attention to the Bank of England as a catalyst for a potential reversal.

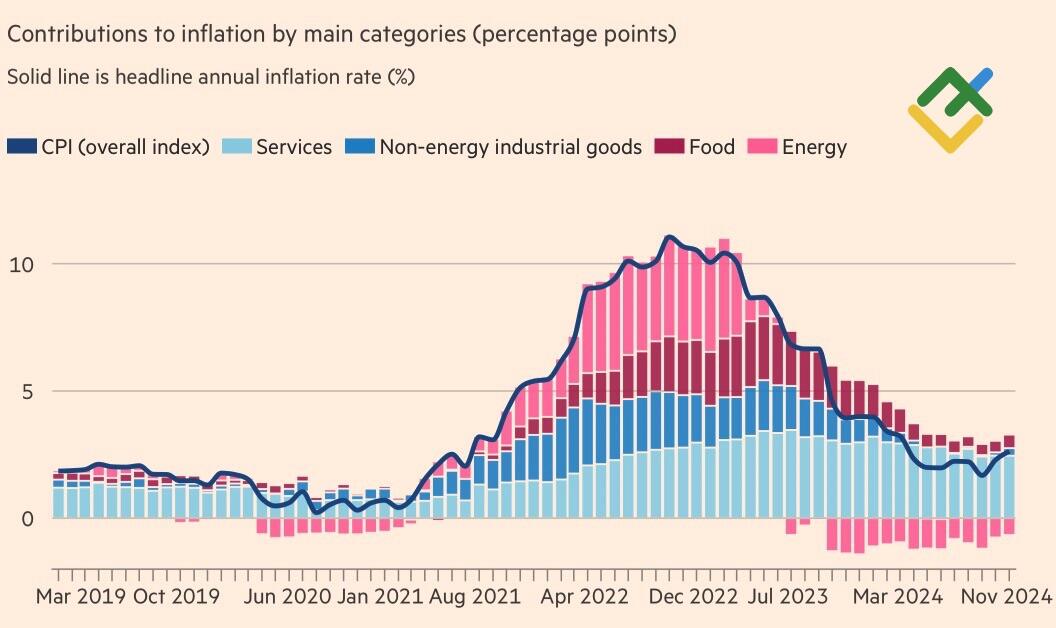

In contrast to the United States, the British economy is on the verge of stagflation. Following two consecutive months of GDP contraction, the PMI has slid below a critical point, and inflation has accelerated at a rapid pace. In November, consumer prices surged 2.6%, up from 2.3% in October. The core CPI rose from 3.3% to 3.5%, while services inflation remained at 5%.

UK Inflation Breakdown

Source: Financial Times.

Coupled with the first increase in wages in months from 4.9% to 5.2%, these figures prevent the Bank of England from reducing the repo rate by 25 bp in December. The derivatives market estimates that the Bank of England’s monetary expansion in 2025 will total 52 basis points, which is equivalent to two cuts. This figure contrasts with the recent statement by Andrew Bailey, who suggested that borrowing costs could fall by 100 bp next year. As a result, investors are cautious about the possibility of a dovish shift in the Bank of England’s stance.

BOE Rate Cut Expectations

Source: Bloomberg.

In contrast to the Fed’s hawkish cut, the Bank of England’s indications of an imminent repo rate cut will have a distinct impact on its currency. The US dollar soared in response to updated FOMC forecasts indicating the Fed’s reluctance to aggressively cut rates, while the pound will likely plummet deeper. There is a possibility that the Monetary Policy Committee will incline to more cuts than the markets are predicting. In addition, Andrew Bailey’s remarks on the temporary nature of accelerating inflation may influence market sentiment.

I do not think that this scenario will occur. The BoE must exercise caution to avoid inadvertently causing more turbulence. However, it is unlikely that the UK regulator will reverse the downtrend in the GBPUSD pair. The derivatives market expects two rate cuts by the Fed and Bank of England in 2025, each by 25 bps. However, the US economy is stronger than the British one. The latter is on the verge of stagflation, while the US is poised to accelerate thanks to fiscal stimulus from Donald Trump. The pound sterling is only able to compete with the euro. The single currency looks vulnerable due to the ECB’s monetary expansion cycle.

Weekly GBPUSD Trading Plan

Therefore, regardless of the results of the Bank of England meeting, the GBPUSD downtrend will gain momentum. Short positions can be opened if the pair declines below 1.259 or rebounds from the resistance levels of 1.264 and 1.27.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.