The gradual decrease in the Bank of England’s repo rate and its substantial value bolster the appeal of UK assets, foster capital inflows, and restrain the extent of the GBPUSD correction. Let’s discuss this topic and make a trading plan.

Weekly fundamental forecast for pound sterling

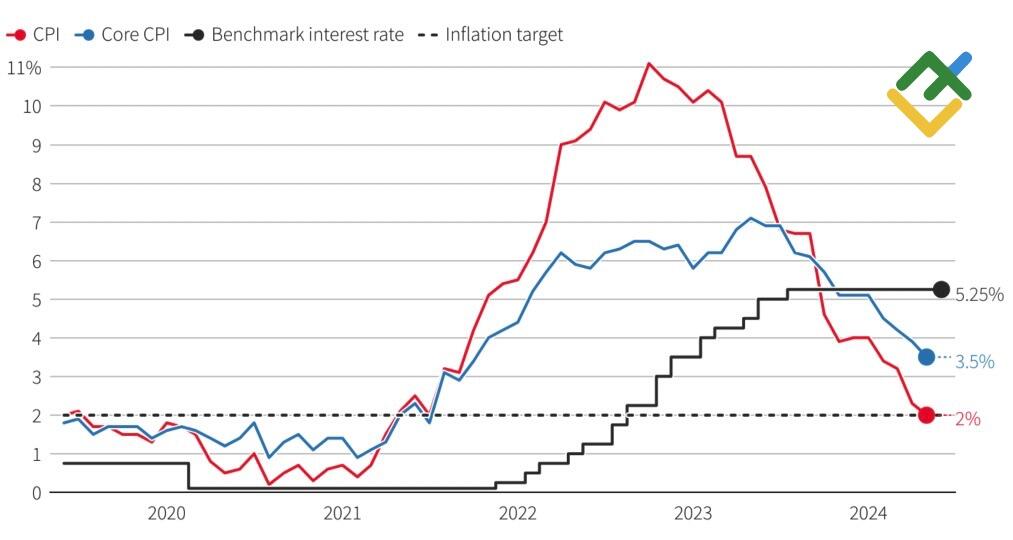

The Bank of England’s decision to maintain the repo rate at 5.25% can be viewed as a dovish move. While there were no alterations to the monetary policy, the BoE described its decision as finely balanced and observed that the latest data did not significantly alter the disinflation trajectory. Andrew Bailey expressed contentment with the CPI decline to 2%, and the financial markets interpreted the central bank’s rhetoric as a sign of an impending monetary policy easing, increasing the likelihood of an August rate hike from 32% to 50%. This development led to a decrease in GBPUSD quotes.

UK repo rate and inflation

Source: Bloomberg.

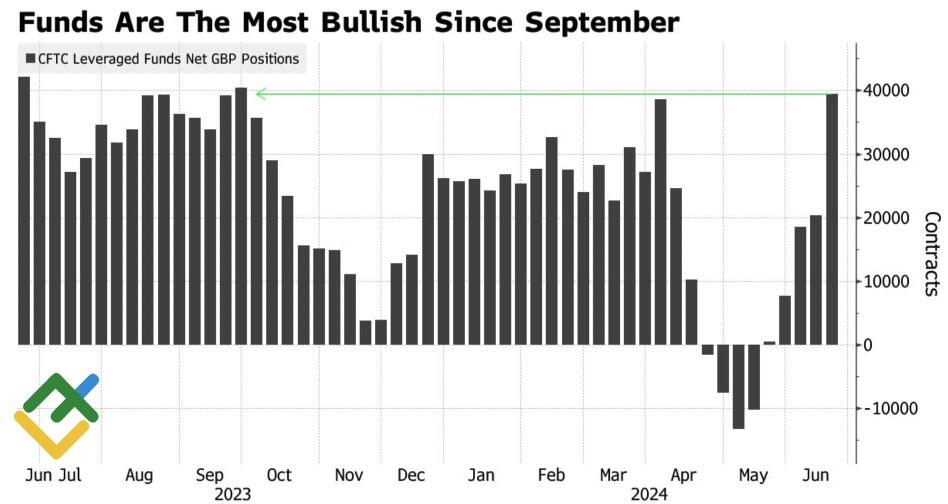

The pound has performed poorly this month, but speculators continue to favor the currency. Asset managers and hedge funds have held the maximum amount of long trades on the pound sterling since the end of September. The British currency tries to outpace the US dollar and become a leader among G10 currencies as the Fed and the Bank of England will cut rates from a high baseline. Washington will reduce rates from 5.5%, and London will trim them from 5.25%. Moreover, both regulators intend to do it extremely slowly, maintaining the high attractiveness of US and British assets and promoting capital inflows.

GBP speculative net positions

Source: Bloomberg.

The political background supports the British pound. Unlike the National Rally or the New People’s Front in France, the Labour Party, leading in the pre-election polls, does not intend to change anything drastically. Their policy is seen as the exact opposite of Liz Truss’ policy, which crashed GBPUSD almost to parity.

In fact, everything is not as good as it may seem at first glance. The Labour Party’s ambitious plans to bring GDP growth to 2.5% seem disconnected from reality. According to Bloomberg, UK GBP will reach 2% at best. At the same time, the planned increase in budget spending will require at least £20 billion.

Thus, the high chances of Labour’s victory in the general elections on July 4 provide support for the British pound. However, events may not unfold in line with investors’ expectations. The main driver of the pound’s growth against global currencies is the high repo rate base and slow easing of monetary policy by the Bank of England. The fact that Andrew Bailey and his colleagues are likely to start the monetary expansion cycle ahead of the Fed pushes GBPUSD quotes down.

Overall, the pound, along with its US counterpart, is in a balanced state. While short trades initiated at 1.2715 with targets at 1.264 and 1.259, as per the previously discussed strategy, have yielded profits, it’s crucial to remember that a substantial decline in the pair may not occur until the US presidential election becomes the primary focus of investors’ attention.

Weekly trading plan for GBPUSD

The GBPUSD pair is likely to reach the support levels near 1.259, 1.2545 and 1.25. A rebound from these levels may serve as a buy signal with a subsequent transition to consolidation. Long trades on GBPJPY look attractive after the Bank of Japan’s intervention. In addition, long trades on GBPCHF also look promising after the political risks in France diminish.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.