In addition to reducing interest rates, the European Central Bank has indicated that it plans to maintain this course of action at upcoming meetings. In contrast, investors anticipate that the US Federal Reserve will pause its rate hikes in early 2025. What implications will this have for the EURUSD currency pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The ECB plans to cut rates at its next meetings.

- A December cut of 50bp was discussed.

- Data is pushing the Fed to pause in early 2025.

- The EURUSD pair will continue to slide if it settles below 1.047.

Weekly Euro Fundamental Forecast

The euro is suffering from political crises in Germany and France. Now the ECB has decided to add to the collapse. Despite the European Central Bank’s best efforts to present a positive outlook, investors remained vigilant and were not deceived. The EURUSD pair declined in response to signals regarding the continuation of the monetary policy easing cycle and a Bloomberg insider report. According to sources within the Governing Council, the cut made in December is unlikely to be the culmination of the cycle. It is reasonable to anticipate that at least two more adjustments will be made at upcoming meetings.

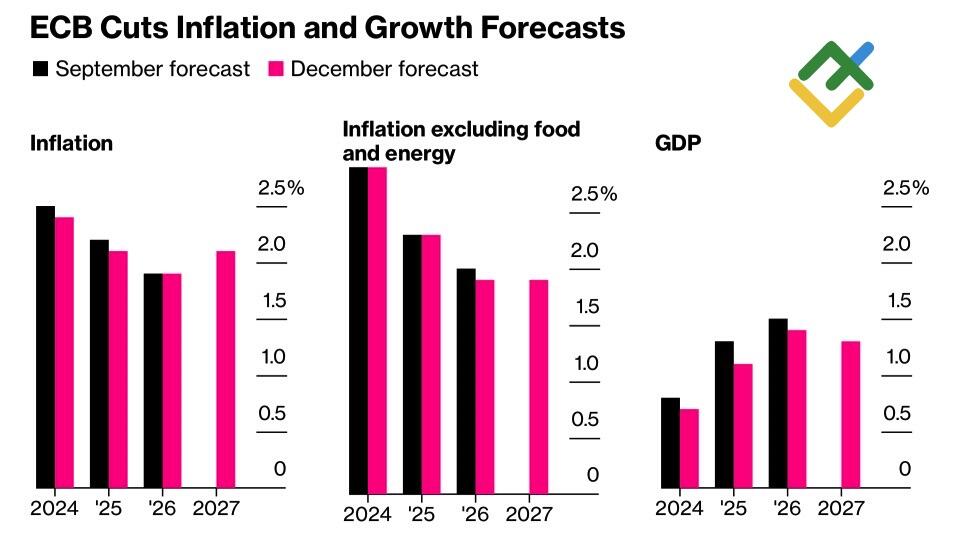

The ECB has shifted its stance on maintaining rates that limit economic activity for an extended period. The absence of this phrase in the accompanying statement, coupled with the reduction in inflation and GDP forecasts and Christine Lagarde’s assertion that a proposal to cut rates by 50 bp was under consideration, was interpreted by the market as a dovish shift in stance.

ECB Inflation and Euro Area GDP Forecasts

Source: Bloomberg.

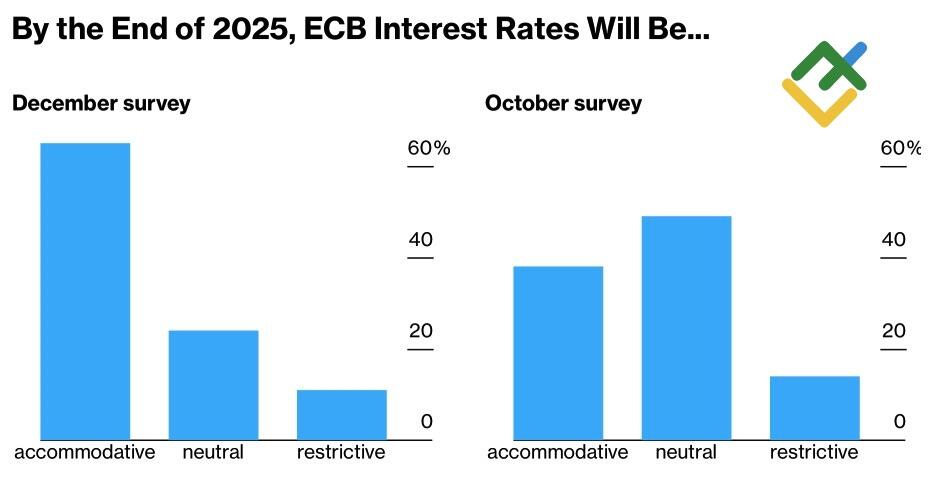

The derivatives market is increasingly confident that borrowing costs will reach 1.75% by the end of the monetary expansion cycle. In addition, Bloomberg experts are more optimistic that by the end of 2025, the ECB’s monetary policy will be stimulative rather than neutral. The European Central Bank is poised to make faster rate cuts than the Fed, reinforcing the EURUSD pair’s downtrend.

Economists’ Forecasts on ECB Monetary Policy

Source: Bloomberg.

The euro’s decline could have been more pronounced had bears not been constrained by the macroeconomic data in the United States. Unemployment claims reached a two-month high, and the acceleration of producer prices to 0.4% was misleading. Some components of the index saw significant increases, with Bank of America anticipating a deceleration in PCE, the Federal Reserve’s primary inflation metric, to 0.1% m/m in November, based on Consumer Price Index (CPI) and Producer Price Index (PPI) data, the slowest pace seen in six months.

The decision to cut the federal funds rate at the end of 2024 is almost finalized. However, it would be a mistake to assume that the Fed will pursue a similar course of monetary expansion in the first quarter of 2025 as it did between September and December. Given that GDP growth is approaching 3% and core inflation has anchored above 3%, there is no rationale for loosening monetary policy even without taking into account the pro-inflation factors from Donald Trump: fiscal stimulus and trade tariffs.

The US Fed has publicly stated that it does not factor in potential moves by the White House when making monetary policy decisions. However, publicly available data suggests that the central bank may have grounds to slow the pace of monetary expansion in early 2025. Given the ECB’s intention to maintain its current approach, this could create an opportunity for selling the major currency pair.

Weekly EURUSD Trading Plan

If bears manage to maintain EURUSD quotes below the pivotal level of 1.047, the downtrend will continue in 2024. In this case, short trades formed at 1.0615 and 1.047 can be kept open.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.