Despite the political upheaval in France and Jerome Powell’s relatively hawkish comments, the EURUSD exchange rate has remained stable. In light of this, it is worth considering why traders are buying the euro in the face of negative news. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The government’s resignation in France was expected.

- Jerome Powell gave no hint of a pause.

- The Fed will act faster without tariffs.

- The EURUSD pair may show a false breakout of 1.054.

Weekly Euro Fundamental Forecast

In France, the National Assembly has voted for a motion of no confidence, causing the government’s fall for the first time since 1962. This is unlikely positive news for the euro. France is entering a period of prolonged political unrest, during which dissolving parliament is not a viable option, appointing a new prime minister carries significant risk, and the president is reluctant to step down. Nonetheless, a vote of no confidence in Michel Barnier’s government was anticipated. Meanwhile, the EURUSD exchange rate did not collapse.

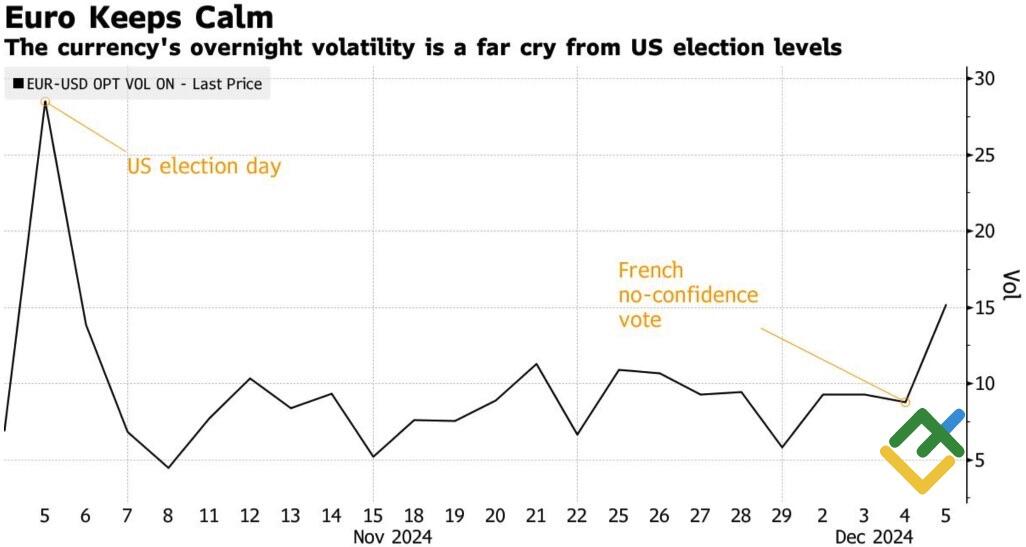

Despite the ongoing political crisis and the rapid rise of the French and German bond yield differentials to their highest levels since 2012, the euro’s volatility remained at a level far below that seen during the US presidential election. Investors are not engaging in speculation about Frexit or the breakup of the eurozone. They are adopting a wait-and-see approach.

Euro Volatility Change

Source: Bloomberg.

The Fed has the capacity to implement a similar strategy for the benefit of the US economy. In a recent statement, Jerome Powell highlighted this as positive news. The markets were awaiting guidance from the Fed chairman on the potential for a pause in the cycle of monetary expansion, a sentiment echoed by Alberto Musalem, the head of the St. Louis Fed. San Francisco Fed President Mary Daly also noted that the central bank had no sense of urgency to cut rates. At some point, something went wrong, and a buy the rumor and sell the news tactic proved effective, boosting the EURUSD exchange rate significantly.

Jerome Powell stated that the US economy was in a stronger position than it was when the Fed initiated the monetary policy easing cycle. At that time, the objective of the regulator was to provide support to the labor market in the event of a continued cooling. In fact, that has not occurred. Are there any indications that the current pace may be slowing? The futures market does not anticipate this outcome. The probability of the federal funds rate remaining at 4.75% in December has decreased from 44% to 28% over the past week. Against this backdrop, the EURUSD pair has seen a positive shift.

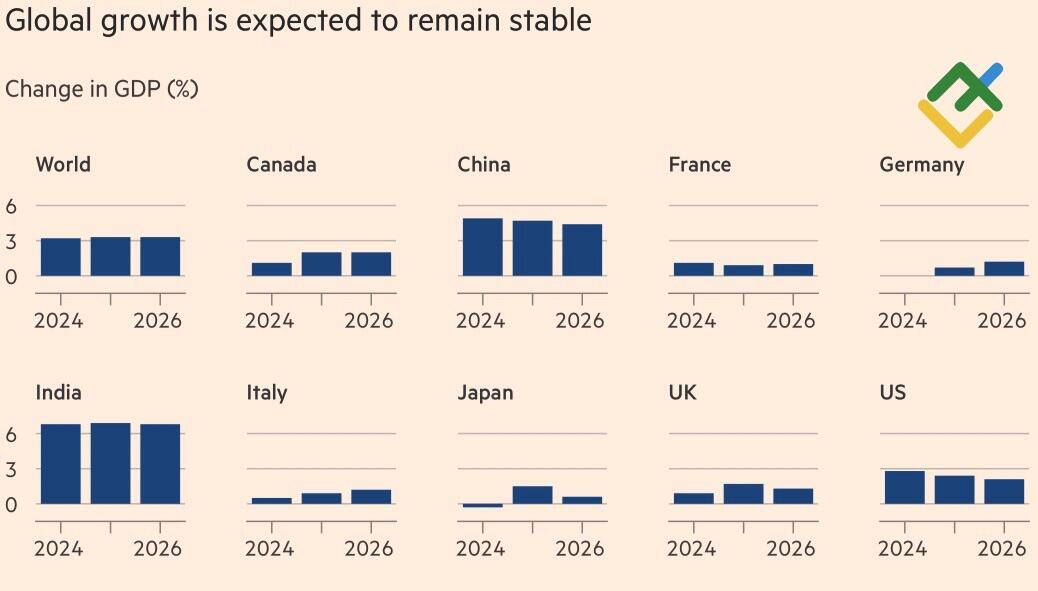

The OECD forecasts that the Fed will reduce borrowing costs to 3.25% by the first quarter of 2026, a figure that is considerably lower than the 3.75-4% anticipated by the derivatives market. In contrast, the ECB will cut rates to 2% rather than the 1.5-1.75% projected by investors. Along with the upward revision in the global GDP growth forecast for 2025 from 3.2% to 3.3%, this news supported the EURUSD currency pair.

Global GDP Growth Expectations

Source: Financial Times.

However, the OECD does not factor in Donald Trump’s tariffs in its assessments, only noting that protectionism will slow economic growth. As long as the US does not spark a trade war, the euro could appreciate, particularly given that December is a seasonally weak month for the US dollar.

Weekly EURUSD Trading Plan

The EURUSD rally will likely be triggered by disappointing US employment statistics for November. Alternatively, profit-taking on short positions will occur in the context of moderate data, as was the case with the resignation of the French government and Jerome Powell’s speech. It would be prudent to refrain from opening trades at this time. However, the euro may rally earlier once the 1,054 level is broken through.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.