KUALA LUMPUR (Reuters) – Malaysia said on Thursday any attempt by the incoming Trump administration to impose tariffs on BRICS countries for trying to create a new currency or use alternatives to the dollar could cause global semiconductor supply chain disruptions.

The BRIC grouping of major emerging economies initially included Brazil, Russia, India and China, and has since expanded to take in other countries.

Malaysia has applied to be part of the bloc, which aims to challenge a world order dominated by Western economies, but has not yet been officially accepted as a member.

Trade minister Tengku Zafrul Aziz said Malaysia was closely monitoring developments after U.S. President-elect Donald Trump said BRICS members would face 100% tariffs unless they committed to not creating a new currency or supporting another currency that would replace the United States dollar.

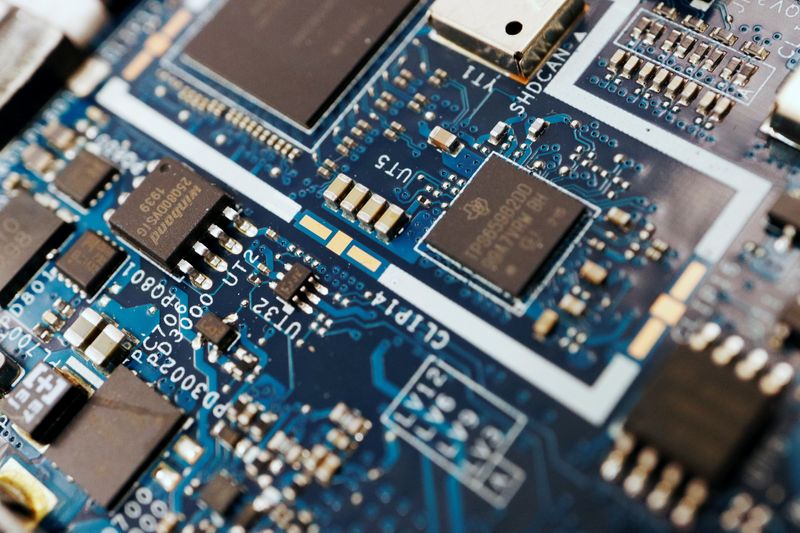

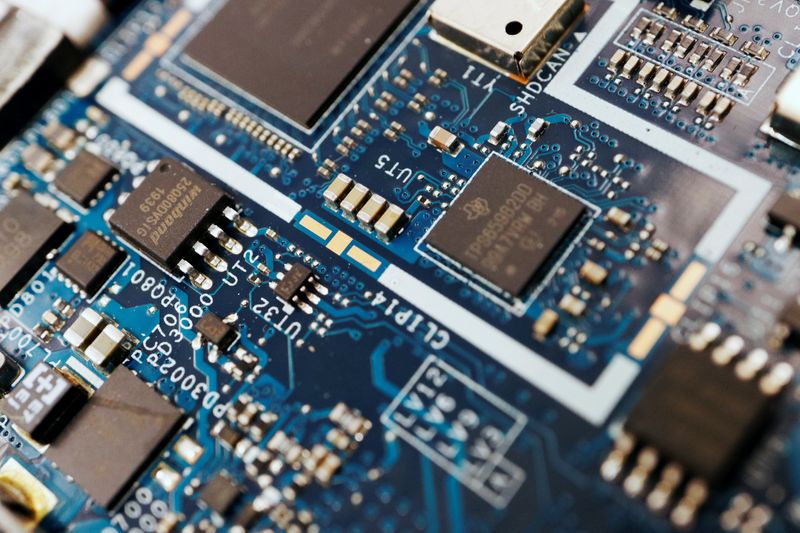

Tengku Zafrul noted the United States was Malaysia’s third-biggest trade partner and U.S. firms were the main investors in its semiconductor sector. Malaysia is a major hub which accounts for about 13% of global chip testing and packaging.

“As such, any move to impose a 100% tariff will only harm both parties which are depending on each other for efforts to prevent disruptions in the global supply chain,” he said in a parliamentary reply.

He added that while BRICS countries have discussed reducing reliance on traditional trade currencies such as the U.S. dollar, there has been no official decision made on de-dollarisation efforts.

The grouping does not have a common currency, but long-running discussions on the subject have gained some momentum after the West imposed sanctions on Russia over the war in Ukraine.

On Monday, Russia said any U.S. attempt to compel countries to use the dollar would backfire, and only strengthen efforts among countries to switch to national currencies in trade.

This post is originally published on INVESTING.