The tariffs will hurt the economies of Mexico and Canada, but the US will also suffer from accelerating inflation. Donald Trump’s victory was largely driven by voter dissatisfaction with high prices. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Import duties will accelerate US consumer prices.

- The Fed will be forced to stop cutting rates.

- The maximum pressure policy increases uncertainty.

- The EURUSD pair may quickly return to 1.04.

Weekly US Dollar Fundamental Forecast

There is often a discrepancy between promises made and the reality of a situation. Donald Trump was elected President of the United States due to voter dissatisfaction with high inflation. However, it is unlikely that any party will emerge as a clear winner in the trade war initiated by the Republicans. Implementing tariffs on imports from Canada, Mexico, and China will freeze the economies of these countries while simultaneously raising prices in the US. You reap what you sow. Every country has the government it deserves.

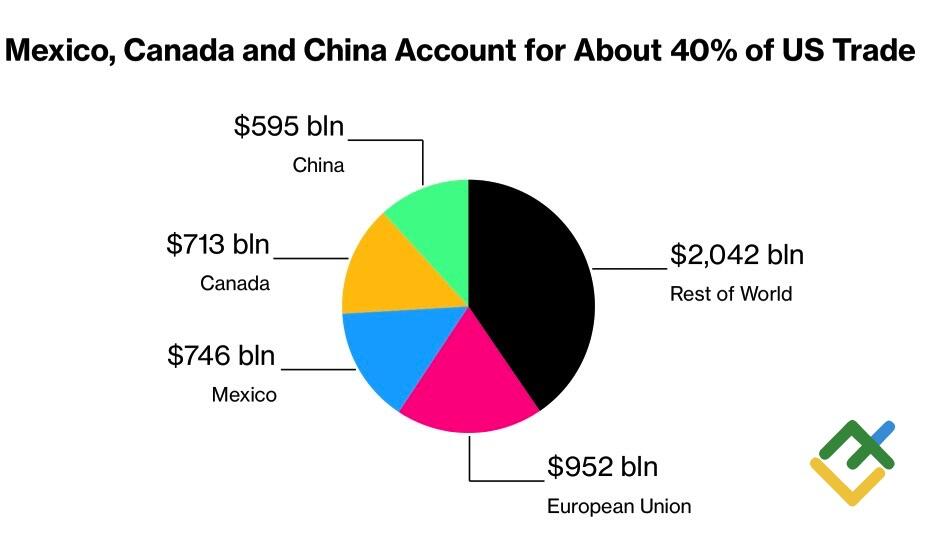

According to Budget Lab research, import duties of 25% on Canada and Mexico and 10% on China would raise the US CPI by 0.75 pp if those countries retaliate. Should Americans switch to buying domestic goods, the price increase would be more modest at +0.65 pp. Ottawa has warned that Donald Trump’s announced tariffs will raise the cost of gasoline in the US. Despite being a net exporter of energy commodities, the US still buys 8.3 million b/d of crude oil and refined products, 70% of which comes from Canada and Mexico.

US Trading Partners

Source: Bloomberg.

The acceleration of inflation will prompt the Fed to pause the monetary expansion cycle. The minutes of the October FOMC meeting indicate that the Committee may temporarily halt its monetary easing policy if inflationary pressures persist but may resume it if economic activity shows signs of slowing. Based on the expectation that the PCE will accelerate to 2.4% in October, it appears that the former process is underway. The futures market estimates that the Fed’s monetary expansion is set to reach 75 bps, which is two points less than the ECB’s estimate. This indicates that the current downtrend in the EURUSD pair is likely to continue.

It is possible that Donald Trump’s threats are merely a tactic to exert maximum pressure. Similarly, in 2019, he pledged to impose a 5% tariff on imports from Mexico if the flow of migrants from that country did not cease. Mexico City fulfilled the request and the tariff was never implemented. However, the unpredictability of the President-elect brings uncertainty to the market, which is another argument in favor of strengthening the US dollar. Deutsche Bank anticipates that the EURUSD exchange rate will reach parity by mid-2025.

Notably, the euro demonstrated resilience in response to Donald Trump’s tariff announcement, potentially due to its omission of Europe. When coupled with the EURUSD pair’s seasonal strength in December, driven by the rebalancing of investment portfolios at the end of the year, this provides a favorable outlook for bulls on the major currency pair.

Euro’s Seasonal Performance

Source: Bloomberg.

Weekly EURUSD Trading Plan

While short-term consolidation and upward pullback risks exist, the EURUSD pair’s downtrend remains robust. Divergence in economic growth, different speeds of monetary expansion, and uncertainty are compelling reasons to sell the euro. The acceleration of PCE in October and robust US GDP statistics for the third quarter will create an opportunity for selling the main currency pair with a target of 1.04.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.