The Bank of England’s slower pace of rate cuts compared to the Federal Reserve gives the pound an advantage over the US dollar. However, the GBPUSD pair is falling significantly. What factors are influencing this movement? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- UK inflation accelerated in October.

- The odds of the BoE monetary policy easing have fallen.

- The weak economy may force the BoE to accelerate the monetary expansion cycle.

- The GBPUSD pair may collapse to 1.25 and 1.23.

Weekly Fundamental Forecast for Pound Sterling

At first glance, the foundation beneath the British pound is so solid that it can still compete for the title of the best-performing G10 currency. However, external factors could severely harm the UK economy. As anticipated, the GBPUSD exchange rate has continued to decline despite the release of robust economic data.

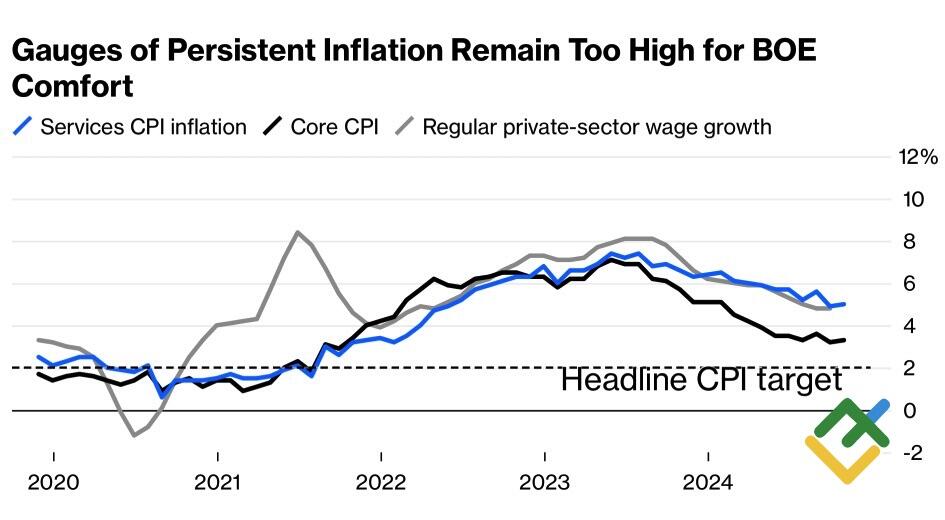

In the UK, consumer prices accelerated from 1.7% to 2.3% in October, the biggest gain in two years. Core inflation accelerated from 3.2% to 3.3%, while services prices accelerated from 4.9% to 5%. The Bank of England’s hawkish forecast of CPI accelerating to 2.7% in 2025 and inflation returning to the target only in 2027 is starting to come true.

UK Inflation Change

Source: Bloomberg.

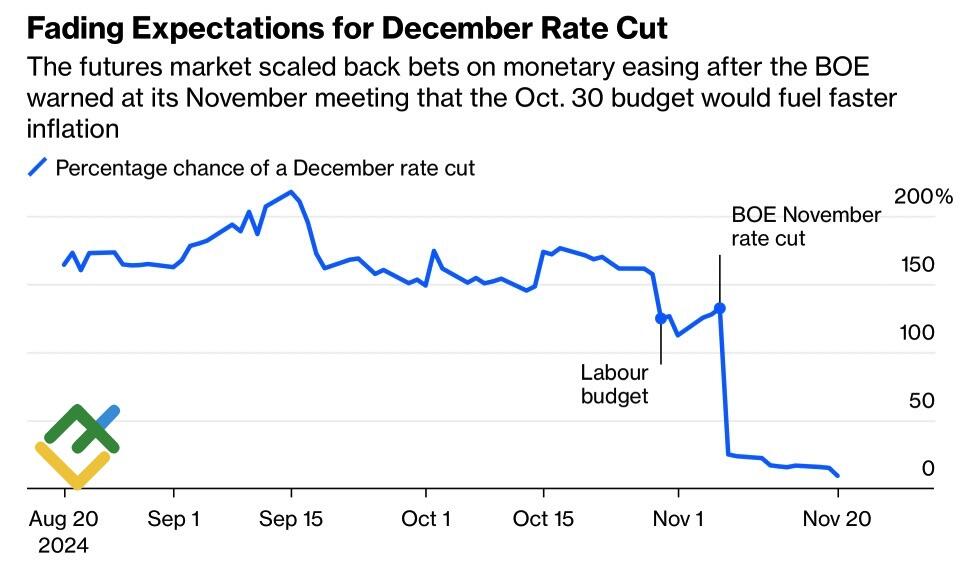

The release of the October CPI data prompted a reduction in the odds of a repo rate cut at the December BoE meeting, with the odds dropping from 20% to 17%. The derivatives market adjusted its estimates of the extent of monetary easing in 2025 from 65 bp to 60 bp, implying two acts of monetary expansion with a low probability of a third. The Fed is expected to cut the federal funds rate by another 25 bp in 2024 and 75 bp in 2025.

Expectations on BoE Rate

Source: Bloomberg.

In theory, the Bank of England’s slower pace should support the GBPUSD pair. In practice, the pair is plummeting, and it is not clear what can really help bulls.

The statements made by BoE officials provide insight into the current situation. Deputy Governor for Markets and Banking of the Bank of England Dave Ramsden supports a gradual normalization of monetary policy but is prepared to accelerate it should new signs of disinflationary developments emerge. New MPC member Alan Taylor anticipates that monetary easing will occur at a faster pace than expected by the futures market if the economy continues to lose steam.

The UK economy grew at a slower rate in the third quarter, with GDP slowing from 0.5% to 0.1%. Moreover, the situation may become worse once President-elect Donald Trump takes office. The press is speculating that the country may be compelled to choose between the United States and Europe in the event of a trade war. However, Prime Minister Keir Starmer is actively refuting these claims.

While the UK’s economy may be less susceptible to new import duties than the eurozone due to its services-oriented economy and trade deficit with the US, it will still suffer losses. Global trends will not bypass the UK and the pound sterling.

Weekly GBPUSD Trading Plan

The GBPUSD pair is not solely influenced by the Trump trade. The potential for an economic slowdown is increasing the likelihood of the Bank of England implementing a more expansive monetary policy. The futures market is underestimating the extent of this approach and may face harsh reality. The pound’s move to 1.27 has provided an opportunity to open more short positions. The strategy remains the same: short trades can be opened with the targets at 1.25 and 1.23.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.