The return of Donald Trump to the White House has introduced uncertainty for the USDJPY. The currency pair declined before September. However, the outlook shifted as the likelihood of Trump’s victory increased. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Major Takeaways

- Divergence in monetary policy should strengthen the yen.

- The Japanese currency lost its advantages due to a red wave in the US.

- The BoJ is going to take its time.

- The USDJPY pair is more likely to rise to 160 than fall to 130.

Weekly fundamental forecast for yen

A new challenge is emerging in Japan. The outcome of the US presidential election has offered nothing but uncertainty for the USDJPY pair. Should Donald Trump implement his ambitious plans, the US economy will experience accelerated growth, and the US dollar will strengthen. However, there is also the possibility that this will not occur. What if the Fed continues to cut interest rates, as projected in the September FOMC report, and the Bank of Japan follows a path of normalization? Hedge funds that have accumulated the largest net short position on the Japanese yen since July are fearing that the Trump factor will fail to affect the currency market as they expect.

Despite the 11% rally in the USDJPY pair from September lows, it always takes two to tango. Mizuho anticipates that the US dollar will decline to 130 due to the Bank of Japan’s continued increase in the overnight rate every six months. This will narrow the yield differential in comparison to the Fed’s loosening monetary policy. Nomura Securities and Saxo Markets anticipate that the pair will reach a peak of 140, given that the Fed is expected to cut rates even under the Trump administration. In addition, trade tariffs are likely to bolster the yen as a safe-haven currency.

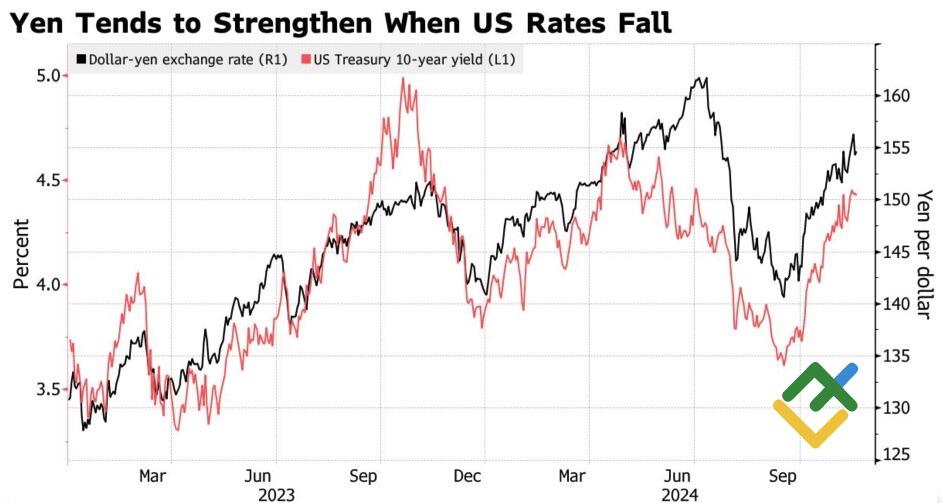

Unfortunately, the rapid increase in US Treasury yields is undermining USDJPY bears. The anticipation of fiscal stimulus and deregulation from the Republican Party is driving risk appetite and causing debt market rates to rise due to the expectation of robust economic growth. The concept of American exceptionalism is a significant factor in the US dollar’s appreciation.

USDJPY Performance and US Treasury 10-Year Bond Yield

Source: Bloomberg.

The futures market does not see the Fed cutting the federal funds rate 6 times in 2025 and predicts a smaller scale of monetary expansion. Meanwhile, Kazuo Ueda is not inclined to signal an immediate continuation of the normalization cycle. The BoJ head stated that the central bank’s decisions would depend on the data. Indeed, the stronger growth of the Japanese economy in the third quarter, along with expectations of hints of an overnight rate hike, have increased the likelihood of monetary tightening in December to 53% from 44%. This prompted a retreat in the USDJPY pair and made hedge funds more cautious.

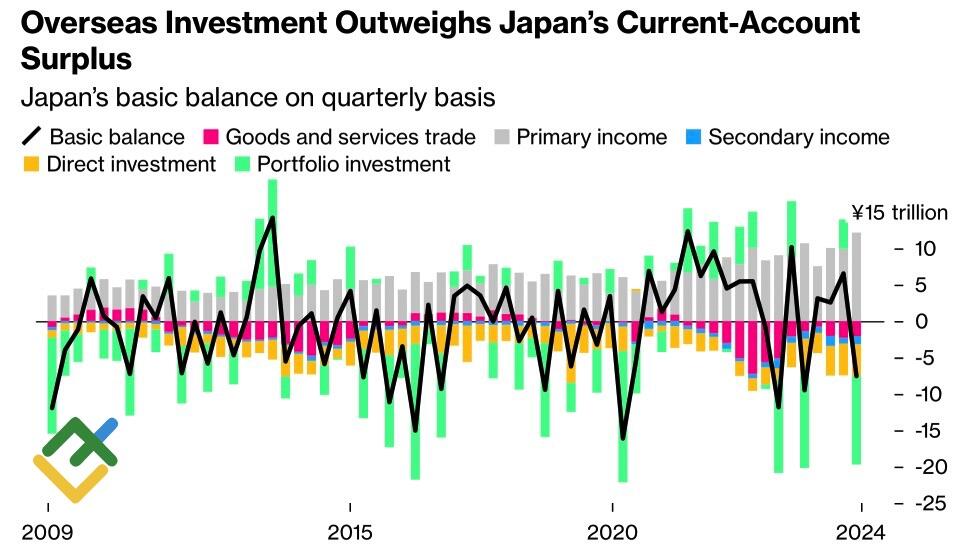

The initial optimism of bears was short-lived. Capital outflows from Japan exceeded its current account surplus of $57.5 billion. Furthermore, there is a likelihood of continued capital flows from Asia to North America, given that the yield on US Treasuries, taking into account the hedging of currency risks on the yen, has turned positive for the first time in two years.

Investments and Japan’s Basic Balance

Source: Bloomberg.

Therefore, it would be premature to conclude that the factor of Donald Trump’s policies has been eliminated.

Weekly USDJPY Trading Plan

The Japanese yen has the potential to become the top performer in the Forex market in 2025 or 2026. However, it will continue to be overshadowed by the US dollar until the end of 2024. The pullback in the USDJPY pair after reaching the first of two earlier targets at 156.4 and 160 presents an opportunity to open more long positions.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.