The Reserve Bank hesitates to take action due to Donald Trump’s threats. It is attempting to maintain a positive front in a difficult situation, fully aware of the potential damage trade wars could cause to the AUDUSD. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Australia would like to see the results of Trump’s promises.

- Trade wars don’t bode well for the “Aussie.”

- Unlike its peers, the RBA is in no rush to start monetary expansion.

- AUDUSD is at risk of falling to 0.635 and 0.615.

Weekly Fundamental Forecast for Australian Dollar

While the Reserve Bank of Australia argues that it is too early to estimate the impact of Donald Trump’s tariffs on the economy, AUDUSD is collapsing. Mixed Australian jobs statistics and positive news from China have failed to stop the attack of the bears, driving the pair to its lowest since Black Monday on August 5. Then, the mass closing of carry trades left no chance for the “Aussie.”

Michele Bullock noted that policymakers’ steps are driven by what they know: economies cool, but disinflationary trends remain in play. It makes no sense to take Donald Trump’s tariffs into account since it is unclear which of his ideas will be implemented and which will not. Although the US protectionist policy will not benefit Australia, the final impact of import duties should be assessed based on other countries’ responses.

Treasurer Jim Chalmers was more frank, saying that trade wars would slow the Australian economy and accelerate inflation. The timing and scale of these processes will depend on China’s response to the US.

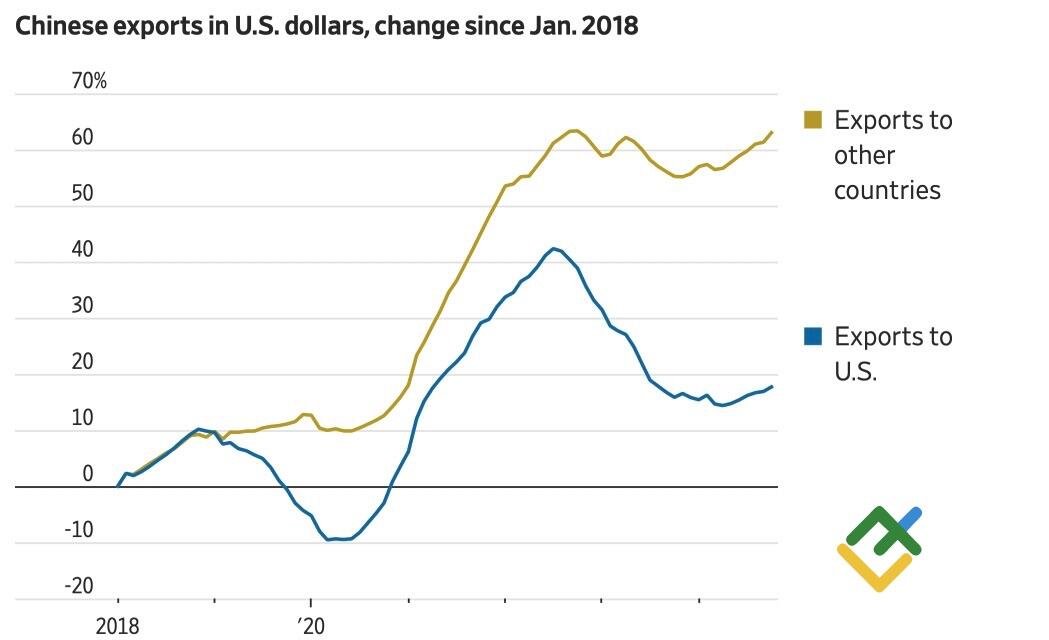

Donald Trump promised to impose a 60% tariff on imports from China, pushing Beijing to further “redirect” sales worth $430 billion to other countries. However, cheap Chinese goods will unlikely be welcome there. Trade war risks will increase, negatively impacting the Australian dollar.

China’s Export Dynamics

Source: Wall Street Journal.

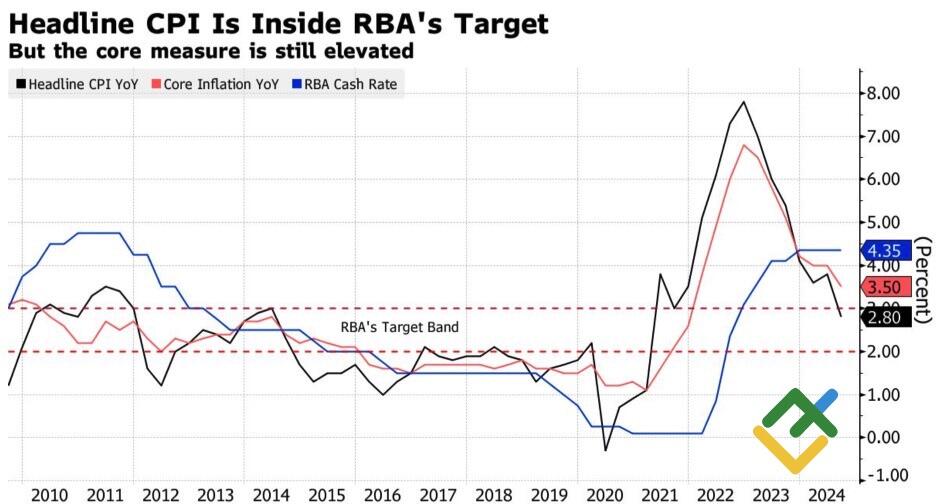

Without the Trump trade factor, the future of AUDUSD would not look so gloomy. Despite lower-than-expected employment growth in October, unemployment in Australia remained at a level of 4.1%, close to record lows. Put this together with a slowdown in wage growth from 4.1% to 3.5% in the third quarter, and a slow cooling of the labor market and inflation will suggest itself. Derivatives give a 72% probability of monetary easing in May.

RBA Inflation and Key Rate Trends

Source: Bloomberg.

The Reserve Bank of Australia is in no hurry to join the global cycle of monetary expansion, which should support the “Aussie .”The Australian dollar cannot resist its American counterpart because of the Trump trade. Which of his promises will the 47th President of the United States implement? And how will China respond? It is unlikely that American manufacturers and the US Congress will support 60% tariffs on all Chinese imports. Moreover, Donald Trump often used a carrot-and-stick policy during his previous term in the White House to secure concessions.

Weekly Trading Plan for AUDUSD

Does history repeat itself? Probably. The AUDUSD has not touched the bottom yet, so hold short positions opened from 0.662 and ramp them up on pullbacks. The initial targets are at 0.635 and 0.615.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.