The EURUSD pair is showing a similar pattern seen in 2016 when Donald Trump first took office. However, the pair surged in 2017. Will the history repeat itself? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The robust US economy allows the Fed to take its time.

- The euro is falling amid the Trump trade as it did in 2016.

- Next year, the US dollar’s allure may disappear.

- Short trades on the EURUSD pair toward 1.035 remain relevant.

Weekly US Dollar Fundamental Forecast

When new data showing the strength of the US economy is added to the Trump trade, the US dollar’s counterparts are weakening. The EURUSD pair saw a 6% decline from its September highs to a yearly low following the acceleration of US inflation and indications from Jerome Powell that the Fed would not be in a hurry to reduce the federal funds rate.

Will the US economy remain robust during Donald Trump’s second term in office? This is a key question for investors. Many assets reacted to Trump’s victory as they did in 2016. However, the USD index fell by 10% by 2020, mainly due to the impact of the global pandemic, which led to a recession. The EURUSD pair saw a similar decline eight years ago after the election but recovered by 5.6% a year later.

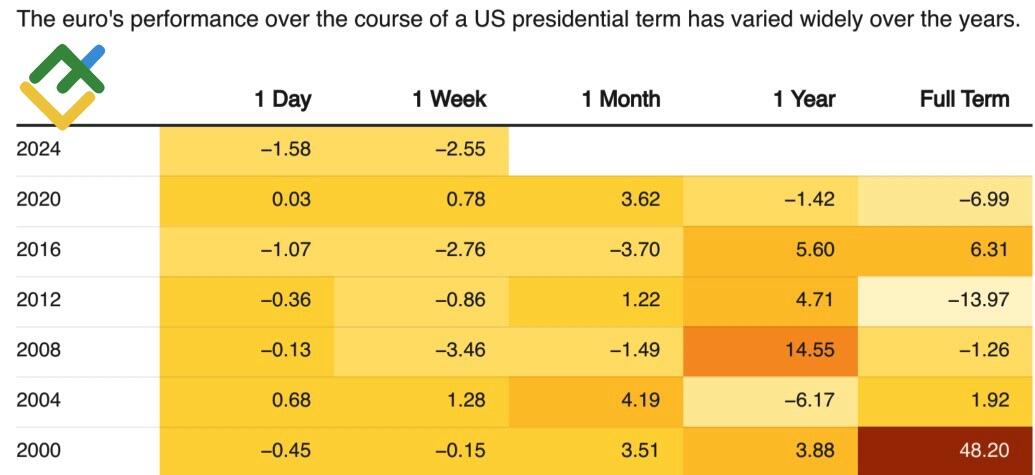

EURUSD Performance Over US Presidential Terms

Source: Reuters.

The “America First” slogan is effective as long as the US economy is experiencing robust growth. For example, the current situation is a case in point, with jobless claims reaching their lowest levels since May and consumer and producer price indexes accelerating in October.

Based on current trends, the personal consumption expenditure index, which is the Fed’s preferred measure of inflation, is expected to reach 2.7-2.8%. Such an outcome would negate the Fed’s progress in addressing high prices since May and raise questions about the likelihood of the PCE reaching 2.6% by year-end. This is the rate that the central bank has identified as the target.

Indeed, the Fed should proceed with caution and avoid any hasty actions to loosen monetary policy. Jerome Powell noted that the current economic indicators did not suggest any urgency for the Fed to act. The strength of the economy allows the US regulator to make careful decisions regarding interest rate cuts. If the data indicates that the central bank should proceed with caution, it should do so. This seems to be a reasonable approach.

The recent comments from Jerome Powell have led to a significant shift in the futures market forecasts. Following the CPI data release, the futures market lowered expectations for the December federal funds rate to remain at 4.75% from 41% to 17%. However, just a day later, the odds rebounded to 41%. This has been a notable boost to the US dollar during the Trump trade. Currently, the greenback is rising in tandem with stock indices, reflecting the ongoing strength of American exceptionalism.

US Dollar Rate and S&P 500 vs. MSCI World

Source: Bloomberg.

As long as the United States maintains its current position, the Trump trade will persist. However, recessions are not solely the result of pandemics. The Fed’s overly tight monetary policy is the main reason for economic downturns. Nevertheless, the US economy may encounter headwinds due to interest rates that are excessively elevated.

Weekly EURUSD Trading Plan

However, this scenario is out of consideration now. Meanwhile, the EURUSD pair has reached the bearish target of 1.05, and traders may sell the euro against the US dollar with the new target of 1.035, keeping their short positions open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.