The actual CPI data was in line with forecasts, prompting the futures market to reassess the trajectory of the fed funds rate. However, the central bank’s rhetoric can hardly be called dovish, which supports the US dollar. Let’s discuss these topics and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- US inflation is heading in the right direction.

- The Fed is unlikely to pause in December.

- Donald Trump may not be as aggressive as expected.

- The EURUSD pair continues to slide toward 1.035.

Weekly US Dollar Fundamental Forecast

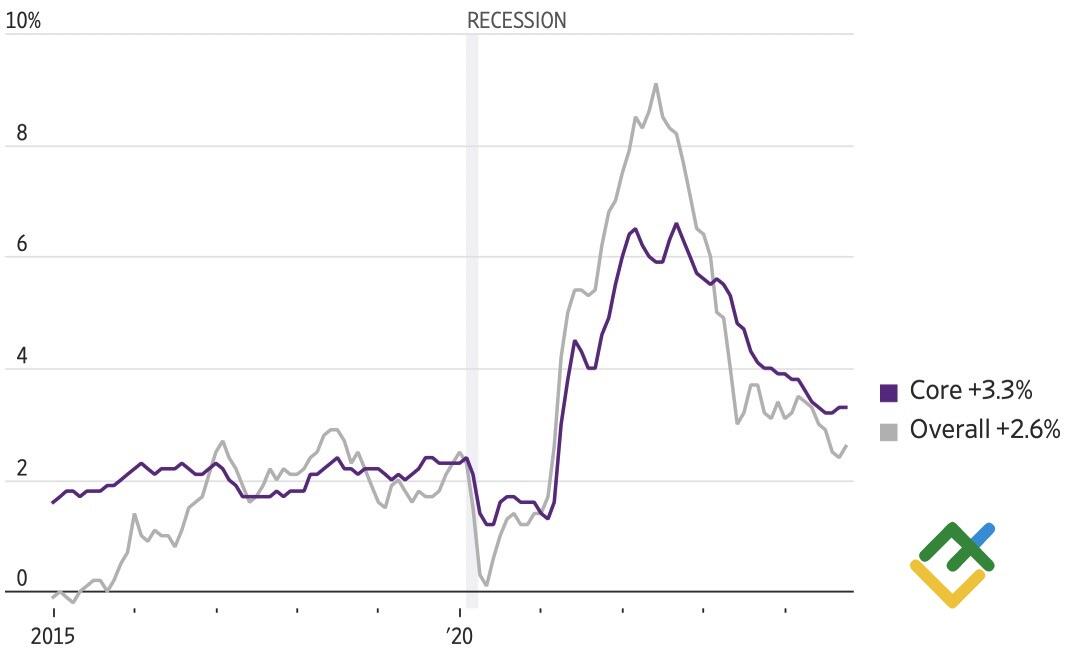

Investors were concerned that US inflation would accelerate beyond the 2.6% forecast in October. However, when it became clear that the actual data aligned with estimates, the futures market increased the odds of a December rate cut to 83% from 59%. The market believed that the latest CPI report was not enough for the Fed to pause its monetary expansion cycle. However, the US dollar’s temporary weakness did not prevent the EURUSD from a sell-off.

US Inflation Change

Source: Wall Street Journal.

Investors were scrutinizing Minneapolis Fed President Neel Kashkari’s comments. The official noted that the latest statistics showed that inflation was moving in the right direction. A day earlier, he claimed that surprises from consumer prices could set the stage for a pause in the Fed’s monetary expansion cycle.

The rhetoric of other FOMC officials confirms that the Fed is changing its stance from decisiveness to caution. According to St. Louis Fed President Alberto Musalem, the risks of accelerating inflation are increasing, and the risks of a cooling labor market are decreasing. The strength of the US economy will give the Fed room to gradually ease monetary policy with little urgency. Laurie Logan, head of the Dallas Fed, stressed that the central bank should not be in a hurry to bring interest rates down to the neutral range, as the neutral rate had likely risen in recent years.

Indeed, the market remembers Jerome Powell’s statement that one or two months of weak data will not change the trend. However, the shift in the rhetoric of FOMC officials from dovish to neutral is causing the futures market to lower the implied magnitude of monetary expansion. The market expects a 60 bps decrease by June, which implies a decline in the fed funds rate to around 4.25%, suggesting several pauses in the cycle, which supports EURUSD bears.

Market Expectations on Fed Rate Cuts

Source: Bloomberg.

The key question is how eagerly will Donald Trump begin to fulfill his campaign promises? Tariffs and fiscal stimulus may spur inflation. Does the Republican need that? Trump knows that the Democrats lost the election largely because of Americans’ dissatisfaction with elevated prices.

Suppose the president-elect implements a more dovish policy instead of an aggressive one. In that case, the disinflationary trend will allow the Fed to continue cutting interest rates, weakening the US dollar. However, does anyone believe that someone as eccentric as Donald Trump will abandon his plans? “After me, the deluge!” With this motto, he will rush to reshape the international trade system, facilitating the flight of capital into the US dollar.

Weekly EURUSD Trading Plan

Against this backdrop, one may keep selling the EURUSD pair with the target of 1.035.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.