The previous trade war slowed China’s GDP growth. This time, the country’s economy is already fragile, and tariffs could weaken it even more. How to navigate this challenging environment? Let’s discuss this topic and make a trading plan for the USDCNH pair.

The article covers the following subjects:

Major Takeaways

- China’s GDP lost 0.65pp during the 2018–2019 trade war.

- The introduction of 60% tariffs on imports will put more pressure.

- Devaluation can save the yuan.

- The USDCNH pair may soar to 7.35 and 7.45.

Monthly Yuan Fundamental Forecast

It is a universally acknowledged fact that feeling cheated is one of the most unpleasant experiences a person can have. In 2020, Donald Trump attributed the global spread of the novel coronavirus to China. As of the end of 2021, China has only purchased 58% of the $200 billion worth of US products it agreed to buy by the end of the year. China has disappointed the new US president twice, providing him a reason for retaliatory action. Against this backdrop, buying the USDCNH pair may be a promising opportunity.

Most likely, Donald Trump considers “a tariff” the best word in the dictionary. He employed it actively during his previous tenure as head of state. The Republican administration has no intention of abandoning import duties at this time. However, Trump’s second administration will be markedly different from the first one. In 2017, the US economy was not as robust as it is today, while China was the primary driver of global economic growth. The rhetoric of the 45th US president’s predecessors was cautious and measured. The current administration is adopting a more hawkish stance while the Chinese economy faces challenges.

The GDP slowdown has been influenced not only by the pandemic but also by trade wars. According to Goldman Sachs estimates China’s gross domestic product missed 0.65pp due to higher import duties in 2018. If Washington increases them to 60%, the losses will rise to 2pp. The consensus forecast of 19 Bloomberg experts assumes a slump of 1% for the year.

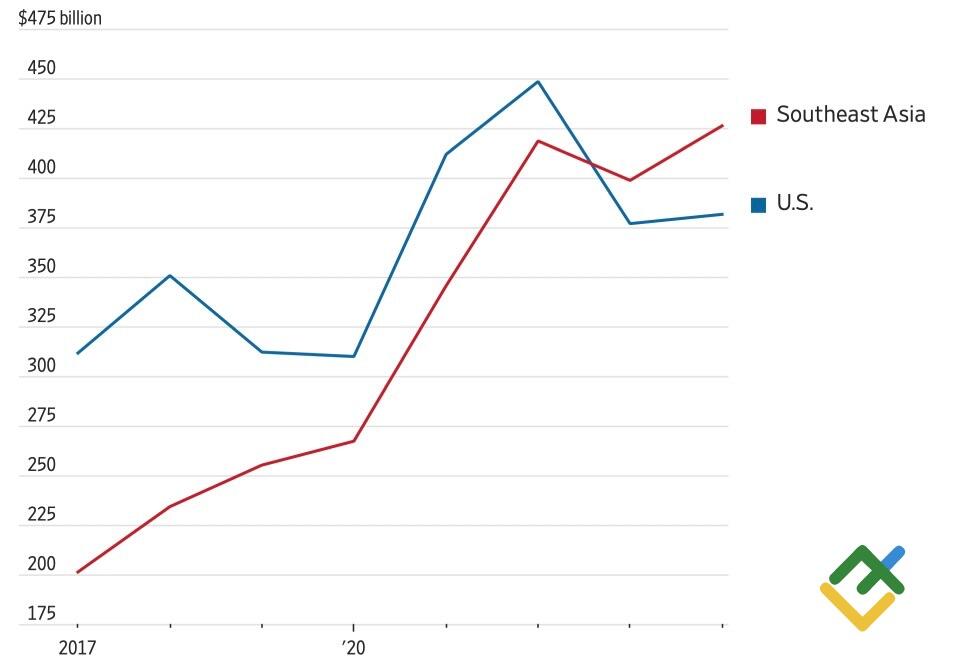

China’s Exports

Source: Wall Street Journal.

Beijing has gained valuable insights from the previous trade war. The proportion of exports to the United States declined from 19% in 2017 to 15%. Since that time, exports have increased by 22%, while shipments to Southeast Asia and Mexico have doubled over the same period. China uses these regions as a provisional measure to circumvent the tariffs imposed by Donald Trump on imported goods.

This time, it is likely that the current US administration will be closely monitoring the situation. The 200% tariff on Mexican imports with a Chinese footprint that Donald Trump has promised to impose is a significant economic incentive. The Chinese economy will face significant headwinds, and in addition to further stimulus and production support, it will be forced to devalue the yuan.

Repetition is an essential component of the learning process. Between January 2018 and December 2019, the USDCNH currency pair appreciated by approximately 10%. According to Morgan Stanley, the devaluation offset approximately two-thirds of the negative impact of US import duties.

Considering the gravity of Donald Trump’s threats, the yuan should have weakened more considerably. Since the US general election, the currency has shed 2% against the US dollar. It has lost approximately 3.7% from its September highs. JP Morgan anticipates that the USDCNH pair will reach 7.4 if Trump fulfills his election pledges. UBS estimates that the pair will hit the 7.6 mark.

Monthly USDCNH Trading Plan

The potential for a disaster remains until Donald Trump adopts a more conciliatory approach. Meanwhile, one can buy the USDCNH pair on pullbacks with targets of 7.35 and 7.45.

Price chart of USDCNH in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.