The Japanese government is preparing the foreign exchange market for currency interventions, but the effectiveness of these measures is unclear. Only the Fed managed to help the Japanese regulator reverse the USDJPY pair’s uptrend. How will the market respond this time? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Japan intensifies verbal interventions in the Forex market.

- Currency interventions cost Tokyo $36.2 billion in the third quarter.

- The Trump trade pressures the Japanese yen.

- The USDJPY pair may return to 160.

Weekly Fundamental Forecast for Yen

While investors are wondering which of Donald Trump’s campaign promises will be implemented, Japanese officials are making verbal interventions, stating that they are closely monitoring the foreign exchange market with a high level of urgency and that they are prepared to take exceptional measures against any excessive volatility in the USDJPY pair. Nevertheless, the pair continues to demonstrate a consistent upward trajectory.

In the third quarter, Japan made two interventions in the foreign exchange market, spending a total of ¥5.54 trillion, equivalent to $36.2 billion. The USDJPY currency pair traded above 160 in July, and market analysts believe that its return above this level will prompt the Ministry of Finance to resume currency interventions. However, for the time being, traders can proceed with confidence, capitalizing on the Trump trade to generate profits. In the days leading up to the US presidential election, hedge funds increased their net short position on the yen to the highest levels seen since August.

Speculative position on Yen

Source: Bloomberg.

It is essential that both parties contribute to achieving the desired outcome. The USDJPY uptrend was broken in the summer due to several factors, including Tokyo’s currency interventions and signals from the Fed about the imminent start of the monetary policy easing cycle, which contributed to the bearish sentiment. It is unlikely that the Japanese Ministry of Finance will succeed on Forex if it decides to enter the market. Investors are anticipating an increase in US Treasury bond yields in light of the Trump trade and a potential pause in the Fed’s monetary expansion cycle, which may occur as early as January or even December. Against this backdrop, it is becoming increasingly unclear whether FX market interventions will prove effective.

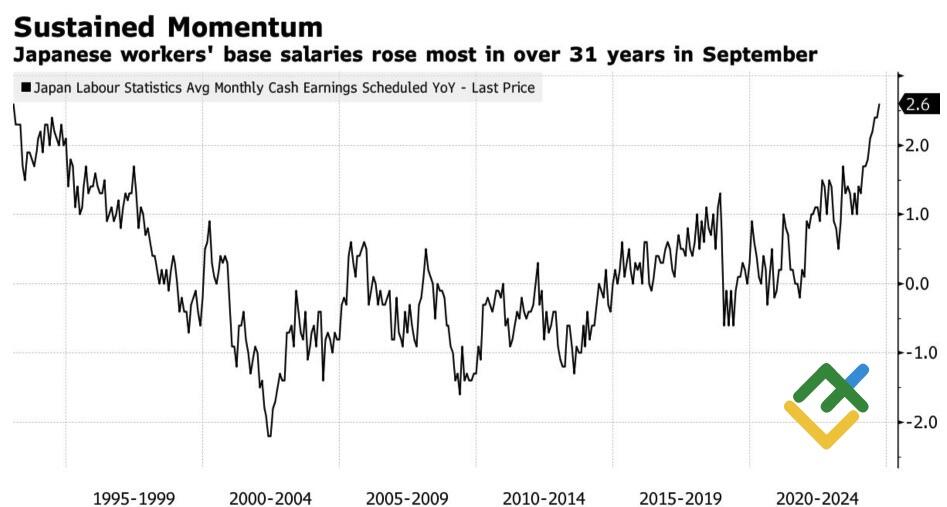

An overnight rate hike by the BoJ would undoubtedly support the Japanese economy. The Bank of Japan is concerned about the potential impact of a weakening yen on import costs. Furthermore, there is a strong case for Kazuo Ueda and his colleagues to continue the cycle of monetary policy normalization. For instance, the growth of Japanese workers’ base salaries at the fastest pace in three decades confirms that inflation is likely to accelerate.

Japanese Worker’s Base Salaries

Source: Bloomberg.

The Bank of Japan has made it clear that it is not in a hurry to take action regarding the USDJPY pair. In October, the regulator stated that it would monitor the US economy’s performance, including after the presidential election. According to a recent Bloomberg survey, approximately 80% of experts believe that the overnight rate will rise in January. However, the BoJ has not yet indicated that this will occur. If the central bank maintains its current stance, the yen may continue to weaken against the US dollar.

Weekly USDJPY Trading Plan

The Bank of Japan’s cautious approach to monetary expansion and the growth of US Treasury yields due to the Trump trade may fuel the USDJPY pair’s rally. One may open more long trades on pullbacks while keeping the existing long positions open. The target of 155.5 should be shifted to 156.5 and 160.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.