Can a business exist without any assets? Actually, no. Today, all kinds of enterprises possess various assets and simply can’t function properly without having some. An asset is traditionally determined as a valuable item, controlled or owned by an entity, person, or government, and it is expected to provide assessable benefit in the future. However, it can also be something that doesn’t have a physical embodiment, e.g., a resource or a strategy. That’s why all assets are subdivided into two major categories: tangible and intangible.

Understanding the very essence of multiple kinds of assets can be a bit confusing, so here we are — ready to help you out. In this article, we will outline the major differences between tangible and intangible assets. We’ll also provide even more classifications that are vital to know if you want to keep your accounting processes nice and smooth.

The article covers the following subjects:

Major key takeaways

|

What are tangible and intangible assets? |

Tangible and intangible assets represent essential categories for evaluating a company’s value and play a significant role in shaping its overall capital structure. |

|

Tangible assets definition |

Tangible assets refer to physical items such as buildings, equipment, and inventories that have a material form and can be sold to generate cash. |

|

Intangible assets meaning |

Intangible assets do not have physical embodiment and include patents, trademarks, and goodwill, which are crucial for a company’s competitive edge. |

|

Tangible vs intangible assets |

Understanding the differences between tangible and intangible assets helps more accurately assess a company’s financial performance and optimiяe its accounting and management processes. |

What Is an Asset?

Simply put, an asset is a piece of property controlled or owned by a company or a private person. The respective company or individual should be able to meet all applicable laws, regulations, and obligations and is usually recognized as a valuable entity, no matter if it’s private or legal. Assets can also be owned by the government, but in any case, they are always expected to provide a significant economic impact or benefit.

Provided that a company can correctly identify and classify assets, half the battle is already won. The survival of any entity depends on many critical factors, but knowing your company’s assets is something that allows you to mitigate possible risks and ensure the solvency will be kept at the appropriate level.

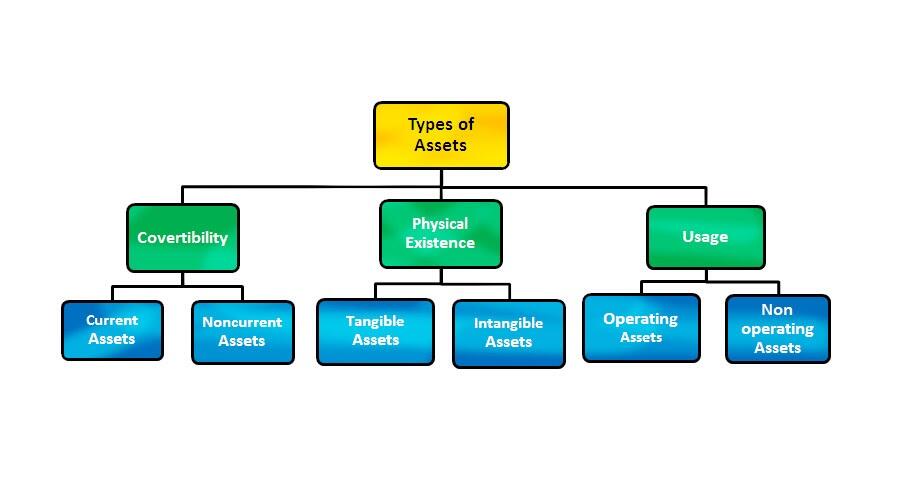

The universally accepted asset classification is based on the following features or qualities: convertibility, physical existence, and usage.

Convertibility

A high level of convertibility means that you can easily convert your assets into cash or cash equivalents. Assets, classified on their convertibility, can also be subdivided into two groups: current assets (also known as short-term assets) and non-current or fixed assets (also known as long-term assets). Let’s examine them more carefully.

Current Assets

Current assets are sometimes called short-term or liquid assets, as they are subject to conversion into cash or its equivalent within a short time period, e.g., one year. Here are a few examples of current assets:

-

Cash;

-

Various monetary equivalents;

-

Short-term financial investments;

-

Account receivables;

-

Professional inventory;

-

Marketable securities on public stock/bond exchanges.

Non-Current (Fixed) Assets

As the name implies, non-current assets are the exact opposite of current assets, meaning they can’t be converted into cash that easily. The conversion process of non-current assets can last for decades; hence, they are also known as “fixed assets” and “long-term assets.” However, the monetary value of such pieces of property is often higher than the price of a current asset that can be converted into cash equivalents here and now. Some examples of hard assets are given below:

-

Land properties;

-

Buildings (commercial or private);

-

Special equipment;

-

All kinds of patents;

-

Intellectual property;

-

Company trademarks.

Usage

This classification of assets is connected with their practical usage or purpose. Properties with such characteristics are termed either operating or non-operating assets.

Operating Assets

Operating assets play a significant role in the routine processes of any business, generating revenue from an entity’s core business activities. Operating assets can include:

-

Cash and cash equivalents;

-

Accounts receivable;

-

Facilities;

-

Inventory;

-

Various patents;

-

Copyrights;

-

A company’s buildings;

-

Sophisticated equipment;

-

A company’s reputation.

Essentially, operating assets are anything that a company uses in the course of business to raise cash and generate income. One important thing to note about operating assets is that they are typically reported on a company’s balance sheet (income statement) at their fair value. Fair value is the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date. Thus, it is important to keep in mind that the fair value of an operating asset can fluctuate over time based on market conditions.

Non-Operating Assets

Non-operating assets are also used to generate revenue, but businesses can continue to operate successfully even without them. They lack the effectiveness of operating assets and provide fewer benefits. Here is a list of the most common non-operating assets:

-

Short-term financial deposits;

-

Securities on public stock/bond exchanges;

-

Lands;

-

Interest from fixed deposits.

Physical Existence

One can also classify assets on the basis of their physical existence. Yes, we are finally talking about tangible and intangible assets.

Tangible Assets

Tangible assets can boast physical form, so one can actually touch or at least see them.

Intangible Assets

Intangible assets are non-physical assets that lack tangible embodiment but still have a certain value.

Read on for more information on these asset classes.

What Are Tangible Assets?

Assets are divisible into several types, in accordance with their origin, life-cycle, and physical presence. The latter characteristic allows us to break down all assets into two categories we have already mentioned above, tangible and intangible, so the chief distinction between these two terms is based purely either on their physical existence or their “immaterialism.”

Why is it imperative to catch on to the difference between various assets? Well, the answer is obvious: this knowledge comes in handy when business owners have to choose an accounting strategy or want to keep their income statement as accurate as possible.

As we have already mentioned above, tangible assets are physical pieces of property included in the balance sheet that influence the company’s market value. Here are some examples that can be considered tangible assets:

-

Land properties;

-

Corporate buildings;

-

Machinery, inventory, and equipment;

-

Cash and its equivalents;

-

Marketable securities on public stock/bond exchanges.

Tangible assets are typically depreciated. Depreciation is a term coined to determine the process when the cost of a tangible asset is allocated throughout its useful life. Assets tend to lose their value in a pretty short time period, usually a year. Based on their convertibility, tangible assets are subdivided into two categories:

Current Tangible Assets

Current tangible assets are liquid or short-term items converted into cash equivalents without a hitch (currency, inventory, accounts receivable, etc.). The conversion process of these tangible assets usually takes less than one year, which allows raising funds if needed.

Fixed Tangible Assets

Fixed or long-term tangible assets are, on the contrary, not so liquid assets; the conversion process lasts for more than one year. The most notable examples of long-term assets are corporate buildings, offices, land property, and specific equipment. Fixed assets allow businesses to operate without delays.

What Are Intangible Assets?

Just like the name “intangible” implies, this type of asset is the antithesis of the tangible one. These items lack physical existence, though they still bring value to their owners. So, what pieces of property should we consider intangible assets?

-

Goodwill (the company’s reputation);

-

Patents;

-

Brand equity;

-

Corporate intellectual property;

-

Trade secrets;

-

Copyrights;

-

Trademarks;

-

Licenses.

If you make up your mind to convert your intangible assets into cash, that’s not going to be fast or easy, as they lack liquidity typical for fixed assets. Determining the real value of any intangible asset is yet another daunting task due to its non-physical nature. The slogan of such a prominent company as Coca-Cola doesn’t have a price tag, but it still costs a lot, doesn’t it?

All intangible assets are subject to amortization, the process of allocating the cost of an intangible asset throughout its useful life.

Differences Between Tangible and Intangible Assets

Both intangible and tangible assets serve the same purpose: they help business owners drive efficient solutions and estimate the fair market value of their company. To discover their full potential and skillfully operate the inherent benefits, one should have a good understanding of their differences and essence.

|

Criteria |

Tangible Assets |

Intangible Assets |

|

Definition |

Tangible assets are items that possess a physical existence; therefore, they can be touched or felt. |

In stark contrast to tangible assets, intangibles don’t have a physical existence. They can’t be seen or touched. |

|

Type of value |

Monetary. The value is materially present. |

Economical. The value is present but abstract. |

|

Type of cost allocation |

Depreciation. |

Amortization. |

|

Form |

Physical form. |

Non-physical form. |

|

Disposal value |

Obsolete tangible assets are sold in scrap. |

Intangible assets have no disposal value. |

|

Risk |

Tangible assets are vulnerable to exogenous factors. Buildings can be demolished, and land properties can be damaged by fire or hurricanes. Such risks force business owners to buy insurance for their tangible assets. |

Intangible assets can’t be destroyed by natural disasters but are exposed to rash business decisions. |

|

Cost evaluation |

The cost of tangible assets is easy to evaluate. |

The cost of intangible assets is hard to determine. |

Conclusion

Companies record both tangible and intangible in their accounting books, and they do it for a good reason. While a company’s tangible assets are required to ensure the flawless operation of an entity, intangibles inconspicuously build its future worth. A successful company masterfully combines the benefits of tangible and intangible assets.

Today, surveys show that companies generate the better part of their value through the effective usage of intangible assets. Intangibles help companies create a recognizable brand name and overall greatly impact the business life of entities.

Tangible and Intangible Assets FAQs

Tangible assets are those that have a physical form and can be touched. They are listed on a company’s balance sheet and are recorded at their historical cost or fair market value, whichever is lower. Tangible assets play an important role in a company’s financial statements by providing security for its loans and by serving as collateral for its bonds.

Intangibles are assets that can’t be felt or touched. Though some may say they can touch a patent certificate, patents are recognized as intangible assets. Other examples include copyrights, goodwill, licenses, trademarks, intellectual properties, and so on.

Intangible assets are large in number and varied, so for convenience, they are grouped into five common types:

- Goodwill: the premium amount paid for such unmeasurable benefits as, for example, customer loyalty;

- Brand equity: this asset is formed by the consumer attitude to the brand;

- Intellectual property;

- Licenses;

- Customer bases.

Tangible assets form is physical, they can be touched and felt, meaning they have a physical embodiment. The most common examples of tangible assets include land properties, buildings, inventory, equipment, cash, and even some securities.

It certainly can! For instance, a brand logo can become more valuable over time if the brand rises to prominence and joins the league of big market players.

Intangible company’s assets are determined by their non-physical existence. If you can’t touch an asset, but it still substantially contributes to your company’s value, then it’s definitely intangible.

Tangible assets possess a physical form. Therefore, you can touch or feel them. One of their distinctive features is that external natural forces or malefactors can damage them.

Tangible assets are subdivided into two classes: current and fixed. Regardless of the classification, all tangible assets have a monetary, materially present value, while intangibles are abstract. It’s also tough to determine the cost of an intangible asset, so if you can easily name the price of your property, then it’s most likely to be a tangible asset.

A decrease in tangible assets generally refers to a decrease in the physical assets that a company owns. This could mean that the company has sold more tangible assets than it has purchased, or that the fair value of its tangible asset has fallen down. Either way, this can have a negative impact on a company’s financial statements. In general, companies with more tangible assets are considered to be more financially stable than those with fewer tangible assets.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.